What Does Separate Legal Entity In Business Mean

Distinct legal entity separate from its owner. Business entity simply refers to the form of incorporation for a business.

A separate entity is a business that is separate legally and financially from its owner or owners.

What does separate legal entity in business mean. In this example we use a company as a separate legal entity. According to the business entity concept also known as the separate entity or economic entity concept financial transactions that happen in a business should be kept separate from those of the businesss owners or any other business. In many jurisdictions artificial personality allows that entity to be considered under law separately from its individual members for example in a company limited by shares its shareholders.

Juridical personhood allows one or more natural persons universitas personarum to act as a single entity body corporate for legal purposes. The concept is most critical in regard to a sole proprietorship since this is the situation in which the affairs of the owner and the business are most likely to be intermingled. If the business is to be conducted under a name it is necessary to file an assumed name certificate sometimes referred to as a dba in any county in which the business is.

As you develop your business you may decide to change entity types depending on your plans for growth. Each entity in the joint venture which could be individuals groups of individuals companies or corporations keeps its separate legal status. Legal entities are the various structures under which you may create a corporation.

Incorporation is the legal process by which a business entity is formed. They may be related entities in practice but when it. A company is a separate legal entity as distinct from its members therefore it is separate at law from its shareholders directors promoters etc and as such is conferred with.

A joint venture may be set up by a contract that outlines the resources such as money properties and other assets each entity. In terms of day-to-day business a separate entity runs separately from the owner with a separate bank account and transactions buying and selling products or services or both and receiving and paying out its own money. Difference between Sole Proprietors and Companies.

Separate business entity refers to the accounting concept that all business-related entities should be accounted for separately. When a business incorporates the law recognizes the business as a distinct legal entity which can enter contracts and acquire property among other rights and privileges. That require different variations of legal entity documents.

The separate entity concept states that we should always separately record the transactions of a business and its owners. From S corporations and C corporations to limited liability companies sole proprietorships trusts nonprofits and so on. This idea may also be known as the economic entity assumption and it posits that all businesses other related businesses and business owners should be accounted for separately.

Definition and meaning In the world of business and finance an entity is an individual company partnership association club cooperative that has a legal and separately identifiable existence. This is usually done by forming a limited liability company or a corporation so that the companys actions may be legally declared as separate from those of an individual person the companys shareholders or another company. It does not refer to what that business does the product or service it sells or its industry.

Separate legal entity means any entity created by interlocal agreement the membership of which is limited to two or more special districts municipalities or counties of the state but which entity is legally separate and apart from any of its member governments. All three are separate legal entities and they are solely responsible for their own contracts. Limited liability companies and corporations are common types of legal entities.

Separate Legal Entities Advantages Benefits in Business Different Types of Companies. Is a partnership a separate legal entity. There are around 15 types of business legal entities in the US.

A business entity refers to a type of business or the legal structure of that company. A corporation is a separate legal entity from its owners. These use the suffix CIC.

As a result the owner is liable for all of the debts and liabilities of the business but has total control of the business. Sample 1 Sample 2 Sample 3.

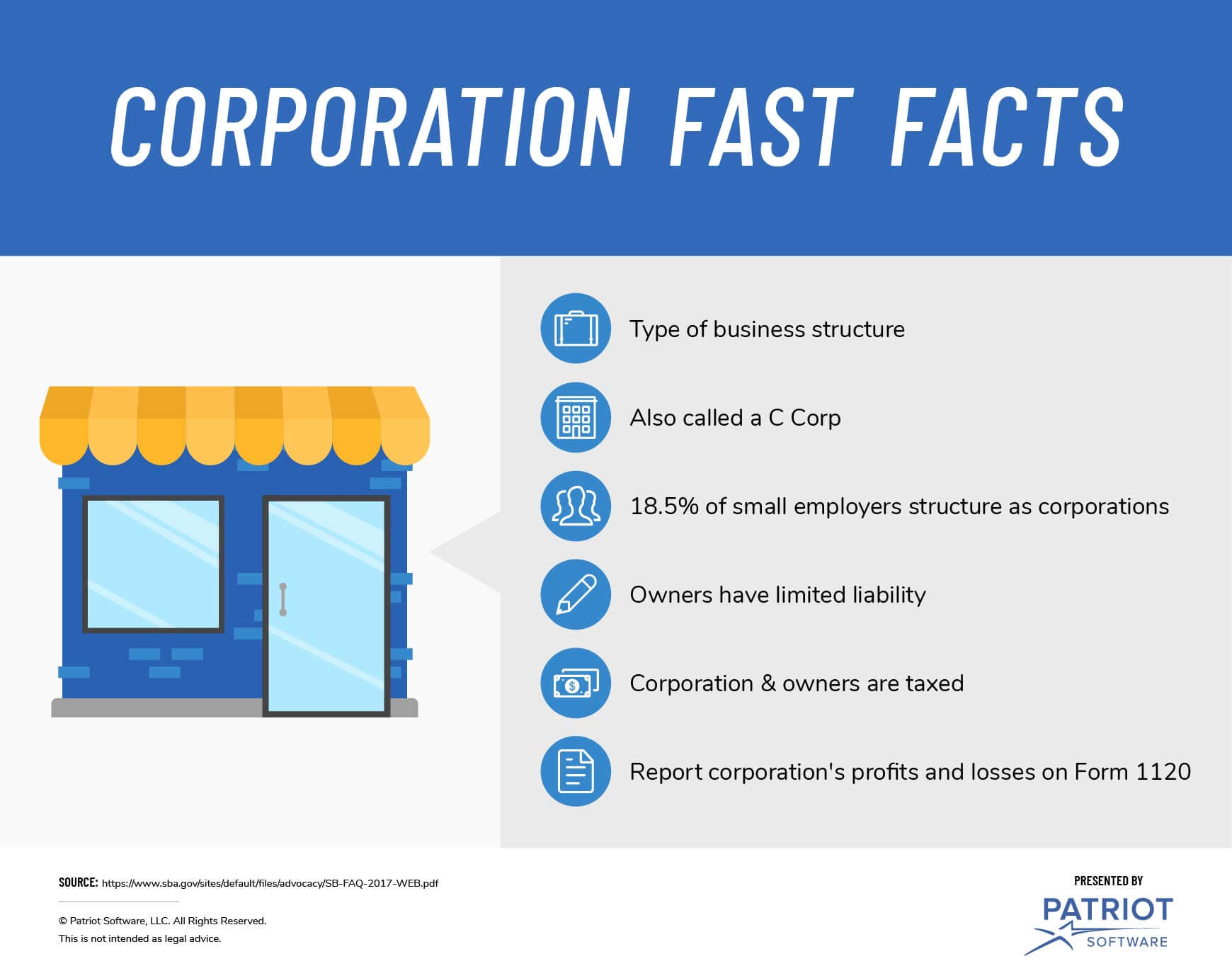

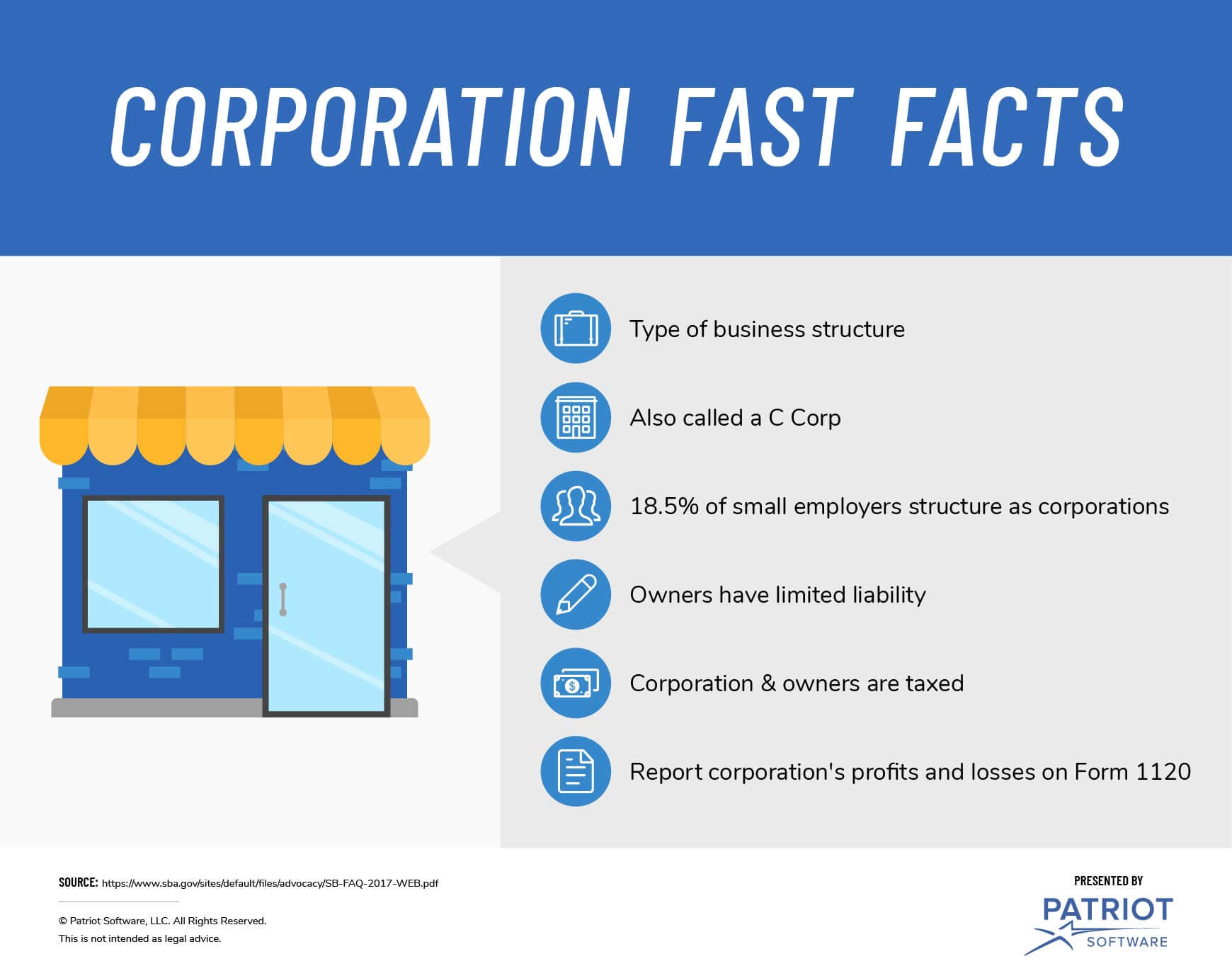

What Is A Corporation Structure For Small Business

What Is A Corporation Structure For Small Business

Separate Legal Entity Formation Of A Company Class 11 Business Studies Youtube

Separate Legal Entity Formation Of A Company Class 11 Business Studies Youtube

Sole Proprietorship Bookkeeping Business Sole Proprietorship Accounting

Sole Proprietorship Bookkeeping Business Sole Proprietorship Accounting

Advantages And Disadvantages Of Limited Liability Company Limited Liability Company Liability Raising Capital

Advantages And Disadvantages Of Limited Liability Company Limited Liability Company Liability Raising Capital

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Limited Liability Company Meaning Features Pros Cons Bookkeeping Business Limited Liability Company Business Tax

Limited Liability Company Meaning Features Pros Cons Bookkeeping Business Limited Liability Company Business Tax

A Private Limited Company Is The Separate Legal Entity Which Carries On Business For Making The Private Limited Company Public Limited Company Limited Company

A Private Limited Company Is The Separate Legal Entity Which Carries On Business For Making The Private Limited Company Public Limited Company Limited Company

What Is An Llc Limited Liability Company How To Find Out About Me Blog

What Is An Llc Limited Liability Company How To Find Out About Me Blog

Corporation Law Firm Small Business Law Texas Law

Corporation Law Firm Small Business Law Texas Law

What Does A Dba Do Exit Promise Legal Separation How To Apply Business Planning

What Does A Dba Do Exit Promise Legal Separation How To Apply Business Planning

Definition Of Corporation Firm That Meets Certain Legal Requirements To Be Recognized As Having A Legal Existence Business Universities Definitions Corporate

Definition Of Corporation Firm That Meets Certain Legal Requirements To Be Recognized As Having A Legal Existence Business Universities Definitions Corporate

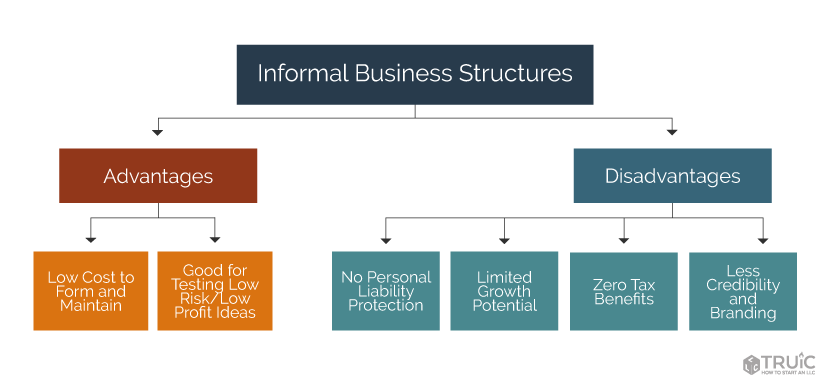

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

What Is A Company Company Company Definition Private Limited Company

What Is A Company Company Company Definition Private Limited Company

Company Registration In India Private Limited Company Limited Company Business Advisor

Company Registration In India Private Limited Company Limited Company Business Advisor

Separate Legal Existence The Most Important Feature Of A Company

Separate Legal Existence The Most Important Feature Of A Company

C Corporation Bookkeeping Business Business Notes C Corporation

C Corporation Bookkeeping Business Business Notes C Corporation

Articles Of Incorporation Business Investment Accounting And Finance Finance Investing

Articles Of Incorporation Business Investment Accounting And Finance Finance Investing

Business Ownership And It S Different Types

Business Ownership And It S Different Types

C Corporation Vs S Corporation S Corporation C Corporation Bookkeeping Business

C Corporation Vs S Corporation S Corporation C Corporation Bookkeeping Business