How To Create A K1 For An Llc

Information about Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc including recent updates related forms and instructions on how to file. The LLC is a hybrid form that combines corporation-style limited liability with partnership-style flexibility.

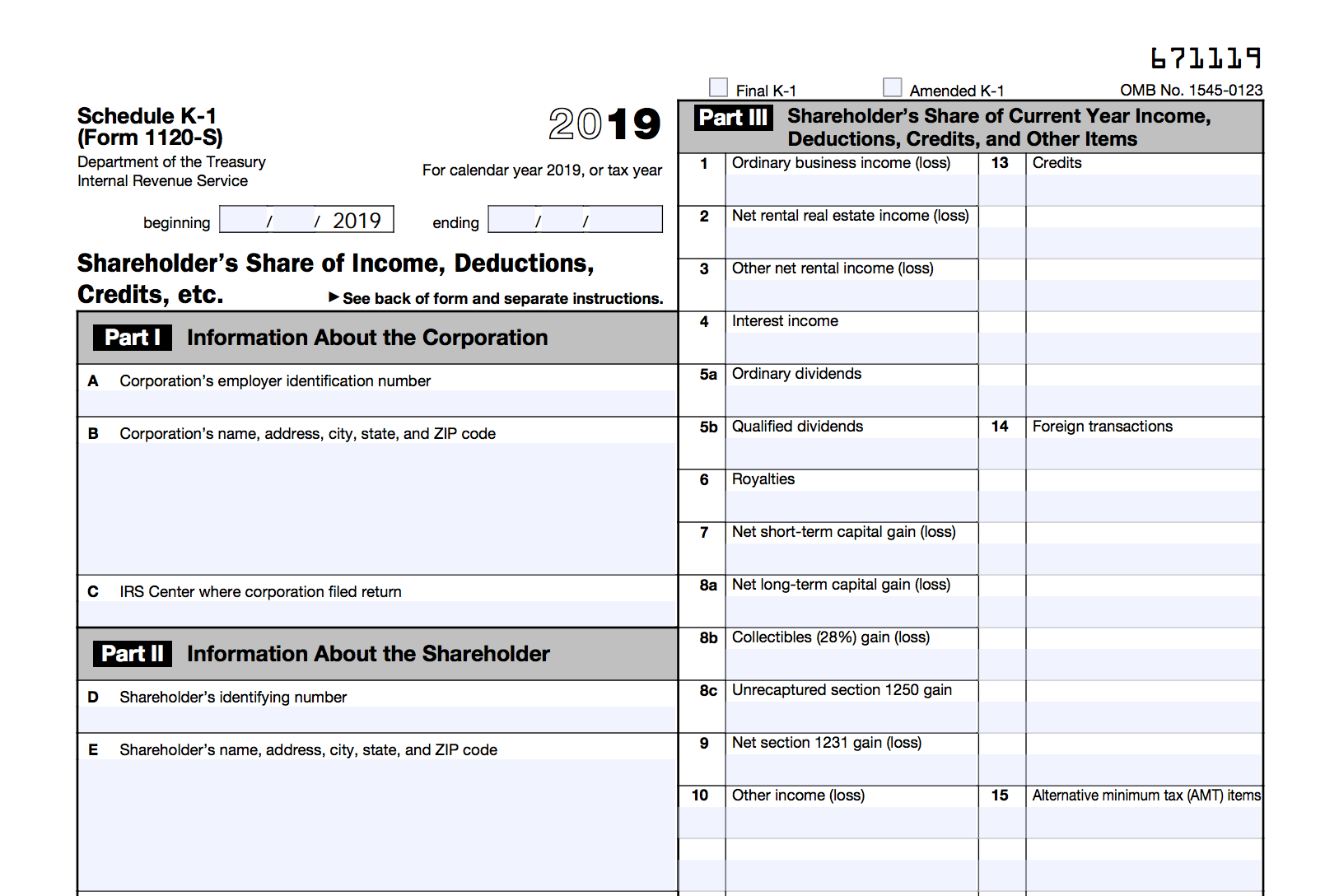

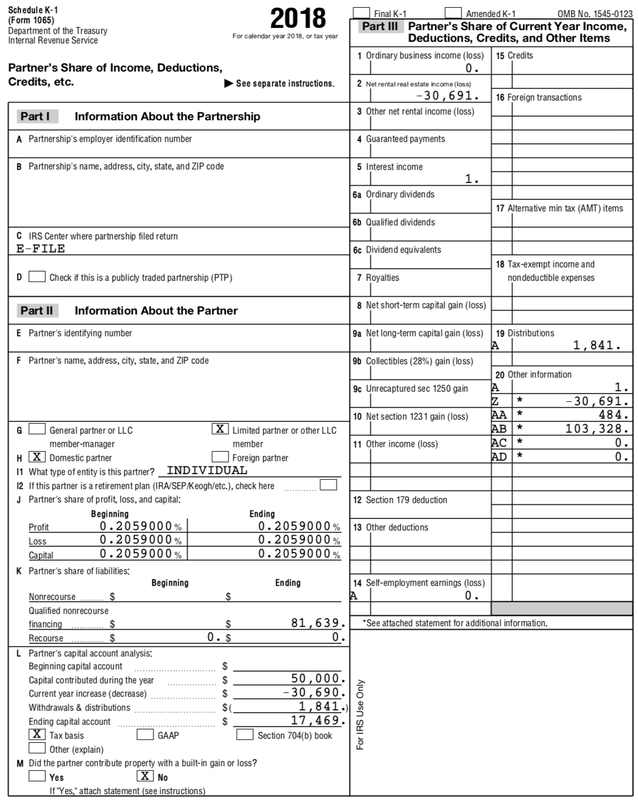

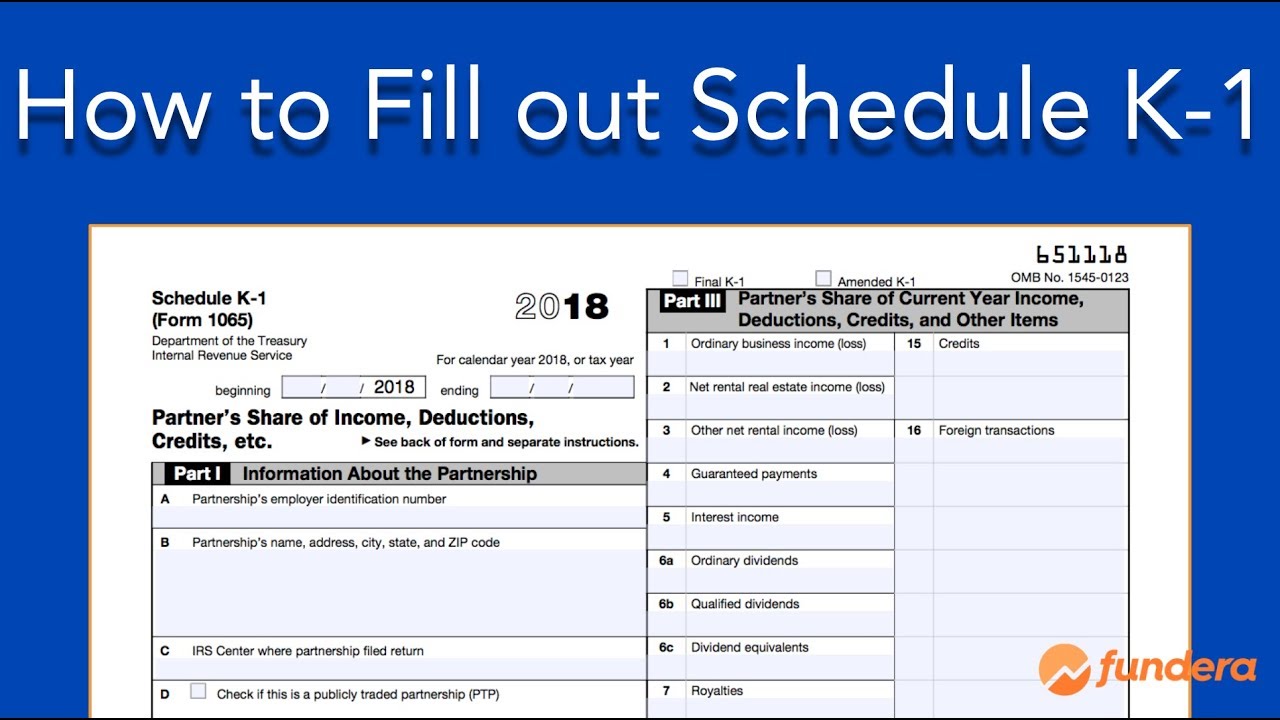

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income.

How to create a k1 for an llc. But one-member LLCs must report as if they were a sole proprietorship using Schedule C. This tax return can be prepared using Turbo Tax Business. A partnership does not pay income taxes the partners receive a form K-1 which is created as part of the form 1065.

You must fill out a separate K-1 for each shareholder. You can also file the form by mail. Credit partner 1 equity for 50.

Partners in an LLC can take their earnings as draws much like a single-member LLC. Even though the partnership itself does not pay income taxes it. The IRS treats this type of LLC as a partnership.

FULL DISCLAIMER We are not attorneys at law and do not practice law of any sort. Credit partner 2 equity for 50. When an LLC has more than one member the IRS considers it as a partnership.

Schedule K-1 is also known as Form 1065 US. In these businesses income tax returns are prepared by the business and then the profit or. Please consult with a licensed attorney f.

By default the IRS treats every multi-member LLC as a partnership. How members of a multi-member LLC get paid depends on whether its a partnership or a corporation. We are simply giving advice.

How to pay yourself from a multi-member LLC. The limited liability company LLC has in recent years become the most popular legal structure for small businesses seeking personal liability protection and flexibility. Schedule K-1 Form 1065 is used for reporting the distributive share of a partnership income credits etc.

Then you do a journal entry to distribute net profit to the partners. Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities. How do I create a K-1 1065 for an LLC partnership Youll need to use TurboTax Business to prepare Form 1065 for the partnership and issue K-1 1065 forms for the partners.

This means that the LLCs income and expenses are distributed to the members using a Form K-1. Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company. Choose a Registered Agent.

A multi-member LLC must file their own tax return. How to Start an LLC in 5 Steps. Preparing a K-1 For Shareholders.

File the Articles of Organization. Return of Partnership Income. The exact requirements vary slightly from state to state but setting up an LLC is a relatively simple process that can usually be done in one to four hours depending on the complexity of your organizational structure.

Paying yourself with a partnership LLC. To file your taxes you must submit Form 1065 and Schedule K-1. Filed with Form 1065.

You can file your Schedule K-1 form when you submit your Form 1065 or 1120S to the IRS. You can truncate the shareholders tax identification or Social Security number in the K-1 you send to that shareholder by using asterisks or Xs for the first 5 digits. Most states require you to include as part of your companys name the letters LLC LLC or Limited Liability Company Even after you create your companys name do not omit these identifying letters on marketing materials advertisements or business transactions.

In Part II enter that shareholders name address and tax identification or Social Security number. You will include the Schedule K-1 in your personal tax return. The Limited Liability Company Law governs the formation and operation of an LLC.

S corporations partnerships and LLCs are considered pass-through business types because the businesss income passes through to the owners on their personal tax returns. A Limited Liability Company LLC is a business structure allowed by state statute. Create an Operating Agreement.

The tax form reports the participation of each member in the business income deductions and tax credit items. While a K-1 form is easy if youre just the recipient needing to record income or losses the process is a bit more detailed for owners of an S-corp LLC or partnership who are responsible for distributing the K-1 forms to members. The foreign partner of an US LLC will be deemed to be engaged in a US trade or business and the LLC must withhold 35 of its profits for taxes paid and filed on a quarterly basis to the IRS.

Debit RE for the full amount in the account. Because partnerships are so-called pass-through entitiesthey let the profits or losses of a business. Owners of an LLC are called members.

Once your own K-1 is ready you can use TurboTax to prepare your personal tax return 1040. The easiest thing to do is to submit the form electronically by using IRS Free File or tax prep software. Enter information about the shareholder.

When an LLC has more than one member the IRS automatically treats it as a partnership for tax purposes. A Schedule K-1 form is used to report individual partner or shareholder share of income for a partnership or S corporation. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS.

Include LLC or some variation in your name. In this instance the LLC must issue K-1s to all the members reporting all income credits and deductions based on the members share of ownership. An LLC may organize for any lawful business purpose or purposes.

Heres where to send the different K-1 forms.

How To Complete 2020 Form 1065 Schedule K 1 Part 1 Youtube

How To Complete 2020 Form 1065 Schedule K 1 Part 1 Youtube

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

Dissecting And Understanding A Schedule K 1

Dissecting And Understanding A Schedule K 1

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

What Is A K 1 And Does My Llc Need To Issue One

What Is A K 1 And Does My Llc Need To Issue One

2020 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 Ways To Fill Out And File A Schedule K 1 Wikihow

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto