How To Report Deferred Income Payment From 1099 On Tax Return

Scroll down to Less Common Income 3. Enter the Date acquired Date sold and Cost basis.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Individual Income Tax Return Form 1040-SR US.

How to report deferred income payment from 1099 on tax return. Check the box Not a Form 1099-B1099-S transaction. Any information shown in this section as Deferred Income is shown therefore as informational only to assist account holders in any reconciliation of their income received during the year. Typically you receive deferred compensation after retiring or leaving employment.

Because of this complexity there are few resources available that succinctly describe the proper federal tax reporting Form W-2 and Form 1099-MISC of contributions to and payments. This appears to be Other reportable income since it is not reported to the IRS on any tax form. If so were does it go in TurboTax.

Although tax-advantaged retirement plans such as 401k accounts are technically deferred compensation plans the term deferred compensation in general use refers to nonqualified plans. To report your 1099-K income on this form simply enter your gross 1099-K income on line 1 of Schedule C. If your taxable interest income is more than 1500 be sure to include that income on Schedule B Form 1040 Interest and Ordinary.

Scroll down to Other Reportable Income 7. To enter or review information from Form 1099-MISC Miscellaneous Income Box 14 Nonqualified deferred compensation. Scroll down to Miscellaneous Income 5.

The reporting of nonqualified deferred compensation plans is complex and depends on several factors including contributions vesting and payments as well as the different rules that apply for income tax and employment taxes FICAFUTA. Since in the US. Nonresident Alien Income Tax Return.

If you have deferred income it may be shown in this section but reportable and taxable in the following Tax Year on 1099-DIV. Scroll down to the Schedule D section. Federal Income Tax Withheld Any backup withholding taken from payments reported on the 1099-MISC will be reported in Line 4 of this section.

If payments are incorrectly reported on a 1099 then generally no taxes are withheld and the government must wait for the person to not only file an income tax return but to pay the taxes due. Put the total amount on the gross receipts line. For additional information on how to report pension or annuity payments on your federal income tax return be sure to review the instructions on the back of Copies B C and 2 of the Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click Federal. How to Report 1099-MISC Box 3 Income. If you have not already entered the applicable Schedule C Form 1040 Profit or Loss From Business information.

Does deferred income payment not reported to the IRS get reported on the current years tax return. Provide this tax reporting until mid-March you may receive a Corrected Consolidated Form 1099 in late March. If you dont consider yourself self-employed how you report this income on your personal tax return depends on where it is located on the 1099-NEC form.

To report the loss on Form 8949. Related Topics Foreclosure Repossession Quitclaim Short. Deferred compensation refers to money received in one year for work performed in a previous year often many years earlier.

If its included on a 1099 youll need to include it and then list a credit to offset it and attach an explanation. Click the Details button. You dont need to mention where these smaller amounts came from -only the total is important.

Click Income Expenses at the top of the page. Here is where you can enter the description and amount. Either way report taxable benefits on your tax return the same way you would your regular wageson the line marked for wages salaries tips etc.

Only qualified dividends return of capital long-term capital gains and tax-exempt interest payments are eligible to receive a gross-up payment. Depending on the facts when the payments are made and when the person files such taxes may be delayed for nearly two years. July 10 2018.

Any smaller payments should be added to money that was already reported on a Form 1099. Lieu of a scheduled dividend payment. Check the box Personal loss.

You should consider waiting for this Corrected Consolidated Form 1099 before filing your taxes We have prepared a guidebook to assist you in reporting income from these products on your federal income tax return. If youre self-employed or an independent contractor youll report your 1099-K income on Schedule C of form 1040. Go to the Input Return tab.

Tax Return for Seniors or Form 1040-NR US. Incentive payments and other types of income that appear in Box 3 are reported on Line 8 of Schedule 1 thats submitted with the 2020 Form 1040. That you received and the Instructions for Forms 1040 and 1040-SR lines 5a and 5b and the.

If you received more than one 1099 form you need to add them together and report the total amount of money you made. If the income is reported in Box 3 Other Income include the information on this 1099-MISC on Line 7a Other Income. You pay taxes based upon what you have actually recieved in the tax year youll wait until 2019 to report it.

Report interest income from an installment sale payment on Form 1040 US. When it comes to reporting miscellaneous income your deadline is April 15. On the left navigation menu select Income Schedule D4797etc.

You might receive a separate W-2 specifically for your taxable benefits or those benefits might be included on the same W-2 as your wage or salary income. You would then enter the total amount of other income as calculated on Schedule 1 on Line 8 of Form 1040.

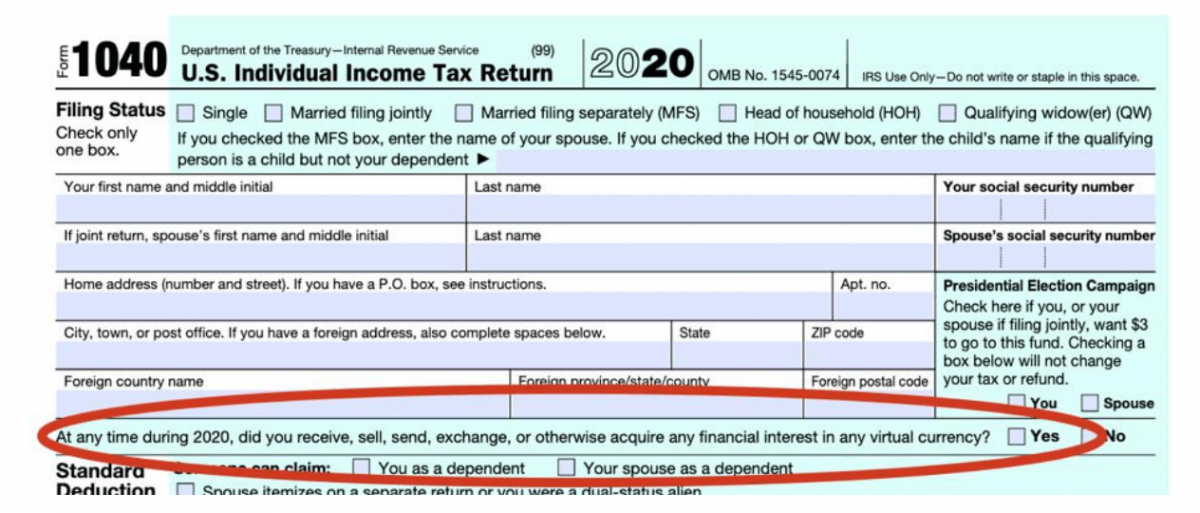

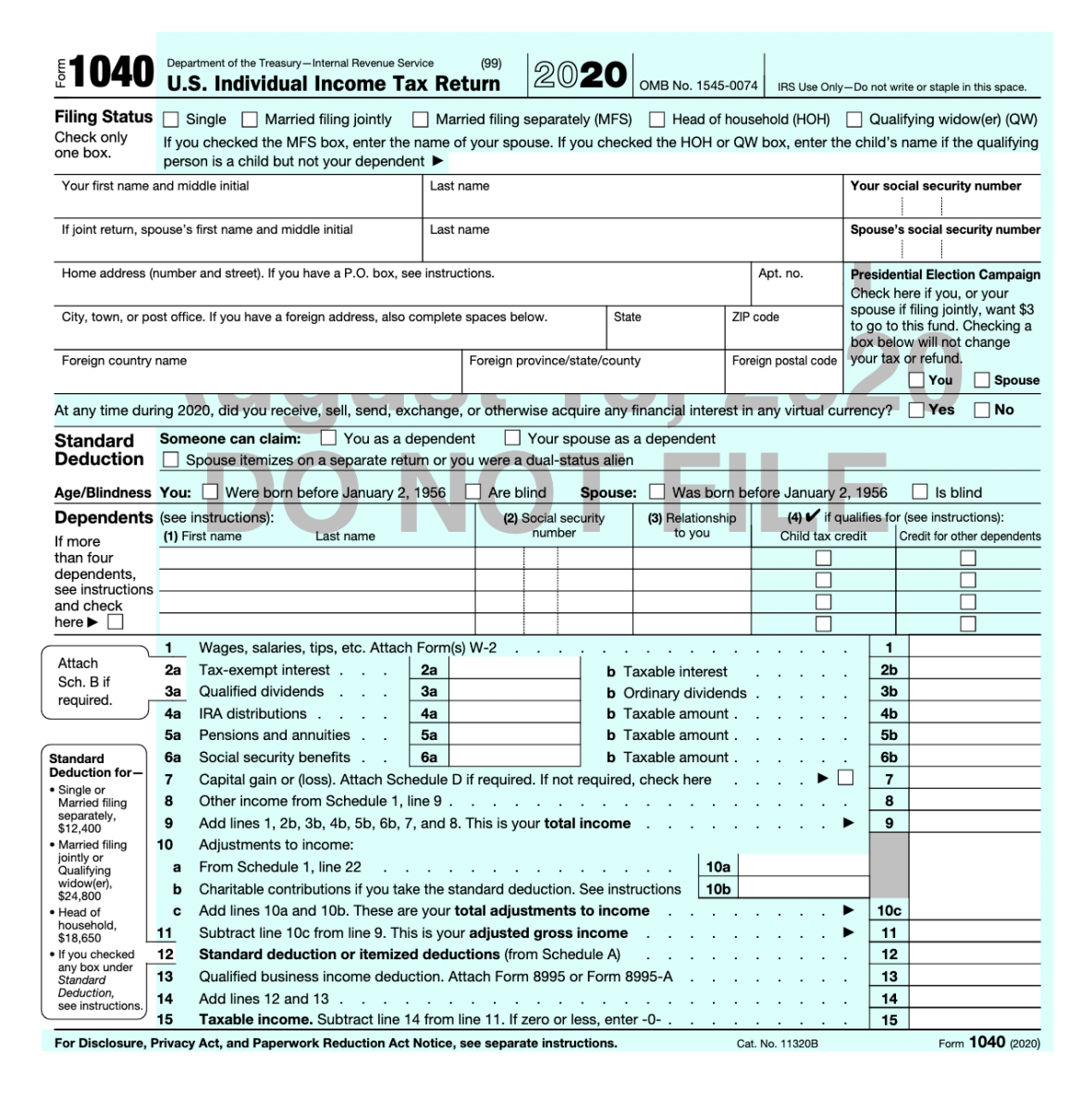

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

1099 Misc Form 2021 Futufan Futufan 1099forms Money Irs Finance Tax 1099 Misc Form 2021

1099 Misc Form 2021 Futufan Futufan 1099forms Money Irs Finance Tax 1099 Misc Form 2021

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Pin By Ossanak Momeni On Tax 1099 Tax Form Tax Forms Irs Forms

Pin By Ossanak Momeni On Tax 1099 Tax Form Tax Forms Irs Forms

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg) Form 1040 Sr U S Tax Return For Seniors Definition

Form 1040 Sr U S Tax Return For Seniors Definition

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Know Your Tax Forms Janus Henderson Investors

Know Your Tax Forms Janus Henderson Investors

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition