How To Get Your 1099-g Form Online

You may owe Uncle Sam if you didnt withhold taxes. Form 1099-G for New Jersey Income Tax refunds is only accessible online.

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

These forms are available online from the NC DES or in the mail.

How to get your 1099-g form online. 1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. You can elect to be removed from the next years mailing by signing up for email notification. By providing your information below you consent to receive your 1099G information electronically.

If you get a file. Your Form 1099-G information can be accessed on-line using the Departments Taxpayer Service Center TSC. You can access your Form 1099G information in your UI Online SM account.

To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the IRS or contact your tax professional. How to Get Your 1099-G online. This will help save taxpayer dollars and allow you to do a small part in saving the environment.

From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G button. Why is the amount in box one of my 1099G form different from the actual benefit amount I received. If your responses are verified you will be able to view your 1099-G form.

Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. 1099Gs are available to view and print online through our Individual Online Services. The Department is now providing 1099-G information online over a secure server that is available anytime.

Where to find your 1099G info Your 1099G tax form will be mailed to you by Jan. Look up your 1099G1099INT. Select the appropriate year and click View 1099G.

You must first log in to your secure account. Answer the security questions. The Internal Revenue Service IRS requires government agencies to report certain payments made during the year because these payments or refunds may be considered taxable income for the recipients.

For Pandemic Unemployment Assistance PUA claimants the forms will also be available online in. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

Taxpayers and practitioners can access an electronic version of Forms 1099-G via the Personal Income Tax e-Services Center. To access this form please follow these instructions. Pacific time except on state holidays.

It will be available to view in early February on the Online Claims System in the tab titled 1099G Tax forms toward the bottom of the page. This 1099-G does not include any information on unemployment benefits received last year. These forms will be mailed to the address that DES has on file for you.

To view your 1099 from any year even if you exhausted your benefits you must register to access the MyBenefits portal. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. Welcome to the Missouri Department of Revenue 1099-G inquiry service.

To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. To view and print your statement login below.

Look for the 1099-G form youll be getting online or in the mail. We do not mail these forms. The Department of Revenues 1099-G only applies to individuals who itemize their deductions on their.

To access a Form 1099-G electronically a taxpayer must first register for an e-signature account by establishing a User ID and Password. The form will be mailed to the address we have on file for you. The Form 1099G is a report of the income you received from the Virginia Department of Taxation.

We will mail you a paper Form 1099G if you do. Form 1099-G reports the amount of refunds credits and other offsets of state income tax during the previous year. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security.

You can view or print your forms for the past seven years. What is the IRS Form 1099-G for unemployment benefits. 1099-G forms are delivered by email or mail and are also available through a claimants DES online.

Follow this link to go directly to the TSC to view and print your Form 1099-G information prior years available in most cases Visit the Form 1099-G Informational Page for tips on using the TSC to access your Form 1099-G information. A 1099-G is a tax form from the IRS showing the amount of refund credit or interest issued to you in the calendar year filing from your individual income tax returns. If you do not have an online account with NYSDOL you may call.

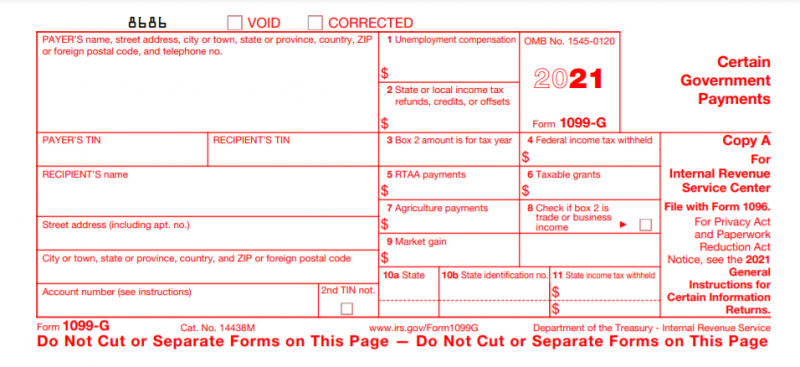

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

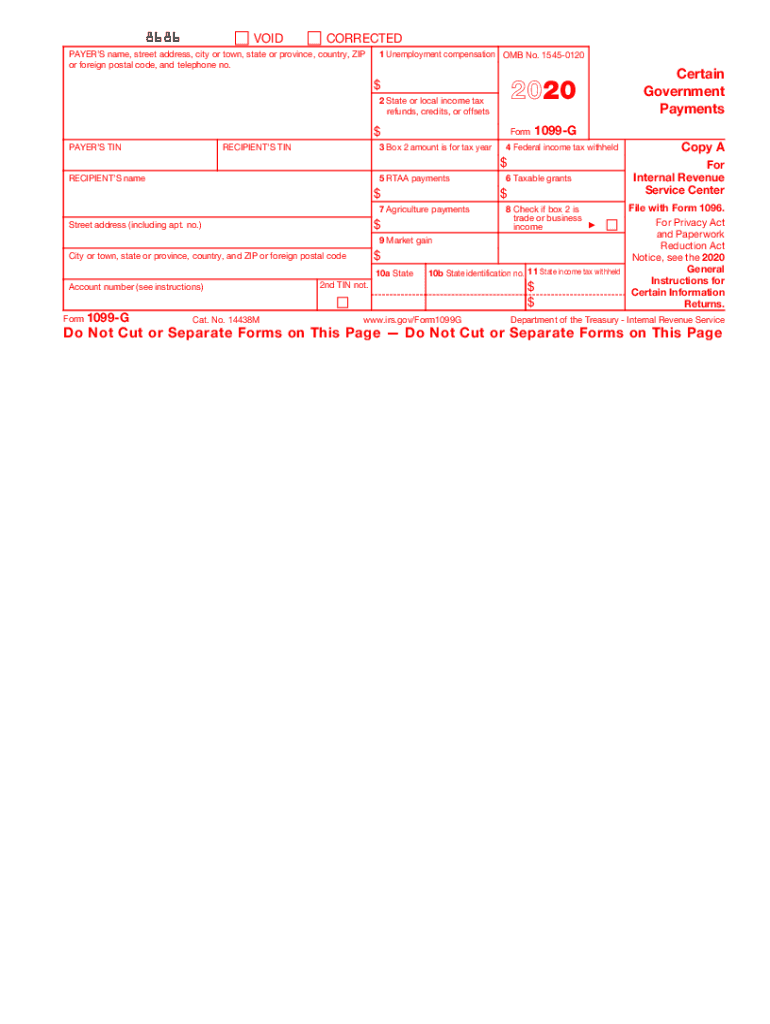

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Millions Of Americans Victimized By Unemployment Fraud Orbograph

Millions Of Americans Victimized By Unemployment Fraud Orbograph

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

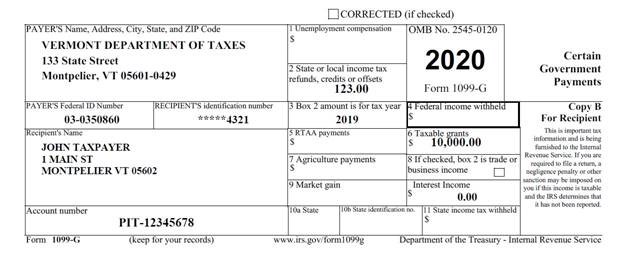

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G 2018 Public Documents 1099 Pro Wiki

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

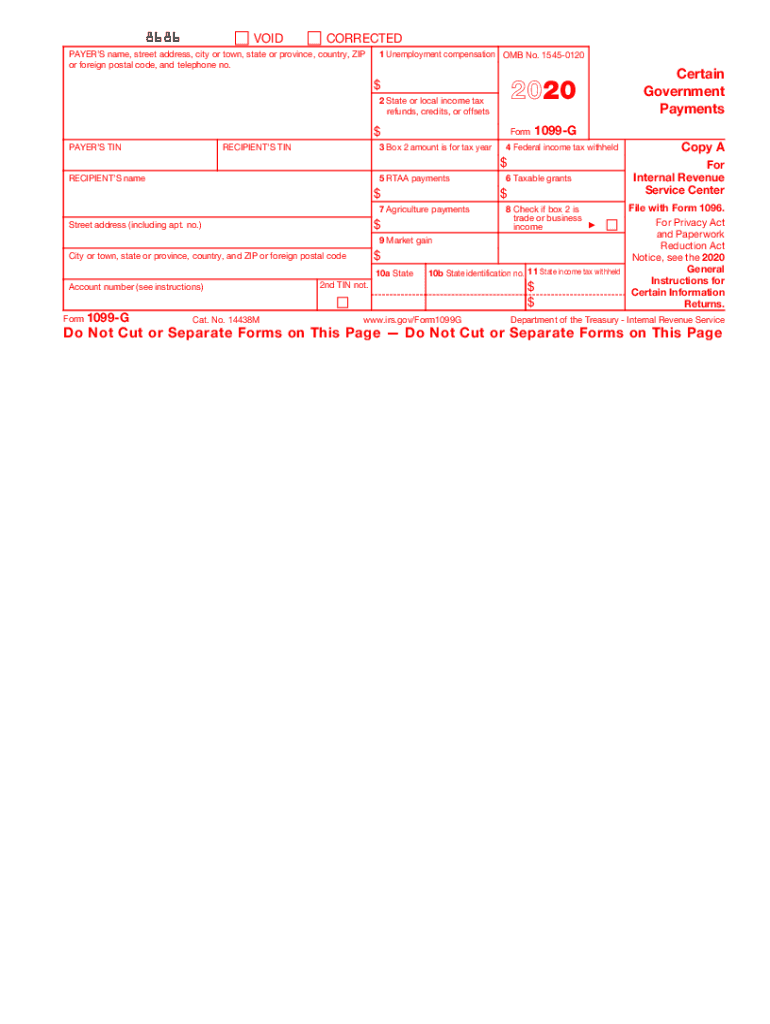

1099 G 2020 Public Documents 1099 Pro Wiki

1099 G 2020 Public Documents 1099 Pro Wiki

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

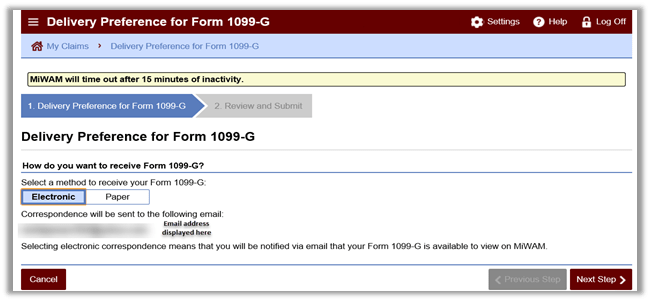

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G