How Much Can You Claim On Work Related Car Expenses Without Receipts

Jun 27 2019 There was no such thing as a standard tax deduction. While people could claim 300 for general work-related expenses 150 for work-related laundry and up to 5000 kilometres travelled for work without a receipt she said taxpayers still need to have incurred the expense and be able to substantiate it.

Do You Have A Home Based Business Did You Know That You Can Deduct Car Expenses Home Base Successful Home Business Internet Business Home Based Business

Do You Have A Home Based Business Did You Know That You Can Deduct Car Expenses Home Base Successful Home Business Internet Business Home Based Business

Jun 27 2019 Your claim is based on a set rate of 68c since 1 July 2018 for each business kilometre travelled.

How much can you claim on work related car expenses without receipts. You can claim a maximum of 5000 business kilometres per car. You may need to keep a travel diary if you travel for six or more nights in a row as substantiation for your travel expenses. Here are 10 of the most under-claimed but legitimate tax deductions.

You can then also claim any additional days you worked at home in 2020 due to the COVID-19 pandemic. Vehicle Expenses You do not have to keep a log of business-related vehicle expenses. May 15 2017 Firstly its important to understand the ATOs threshold for work-related expenses without a receipt.

Travel expenses If youre self-employed and use your private vehicle for work-related activities such as traveling between job sites or offices dont worry you wont need to hoard all your fuel receipts. Chances are you are eligible to claim more than 300 which can boost your tax refund considerably. Jun 19 2017 People can claim work-related deductions totalling up to 300 without receipts but assistant commissioner Kath Anderson said some taxpayers incorrectly believed they could make this standard 300 claim even if they didnt spend it.

Your claim by this method is based on a set rate for each business kilometre you travel. If you itemize deductions and you know you have to pay for work-related expenses you should start saving those receipts. You are required to provide written evidence to claim a tax deduction if your total expense claims exceed 300.

The base amount of 1000 began in 2007 and has increased slightly each year as it was indexed for inflation. To support the amount you can deduct keep a record of both the total kilometres you drove and the kilometres you drove to. Dec 02 2020 The maximum amount of the credit for the 2020 tax year is 1245.

This method can only be used for the 2020 tax year. 2 You can use a Logbook to record work related travel. As long as your employment earnings equal more than the value of the credit you can claim the full amount.

Under this method you are eligible to claim up to a maximum of 5000 kilometres per year per vehicle. 66 cents per kilometre for the 201718 201617 and 201516. If you travel in excess of 5000 kilometres this method of claim is not appropriate to you and you will need to use the alternate method of a logbook to claim.

The maximum amount that can be claimed is 400 per individual. You can only claim a maximum of 5000 kilometres per car This method is best suited for those who only use their car for work purposes on an ad-hoc basis. If you were unable to acquire written documentation eg.

May 13 2015 Evidence recorded by you without a receipt is only acceptable for. If you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic you can claim 2 for each day you worked from home during that period. To care for him or herself.

How much of that you can claim depends on the following. So remember you cant add these expenses on top of the cents per kilometre rate when working out your deduction. This is known as substantiation of your travel expenses.

72 cents per kilometre from 1 July 2020. For tax years prior to 2018 the IRS allows you to deduct unreimbursed work expenses including the. May 16 2018 In fact you can claim up to 300 for these expenses.

This means at the Car Expenses item on her tax return Julie can claim a car expenses deduction about of 241920. If you carry tools instruments or other items in your car to and from work you can deduct only the additional cost of transporting the items such as the rent of a trailer to carry them. This method includes all expenses including insurance registration annual repairs maintenance and fuel costs.

Without receipts for your expenses you can only claim a maximum of 300 worth of work related expenses. What can I claim on tax without receipts. Instead the IRS offers a standard per-mile deduction that is 555 cents starting April 17 2012.

If your total expense claims total less than 300 the provision of receipts is not required at all. Small business expenses of 10 or less as long as the total of these expenses does not exceed 200. Keep a log of.

You cannot deduct commuting expenses for transportation between your home and your regular place of work. 68 cents per kilometre for 201819 and 201920. The ATO generally says that if you have no receipts at all but you did buy work-related items then you can claim them up to a maximum value of 300.

What counts as a work. Generally you need to get and keep written evidence such as receipts if you claim a deduction for work-related travel expenses. A child under the age of 13 who you claim as a dependent.

If you use a motor vehicle for both employment and personal use you can deduct only the percentage of expenses related to earning income.

This Simple Concept Works In Your Business And In Your Personal Life Learn How Putting Reminders In Your Calendars A Budgeting Tax Online Business Strategy

This Simple Concept Works In Your Business And In Your Personal Life Learn How Putting Reminders In Your Calendars A Budgeting Tax Online Business Strategy

Is Your Car A Tax Write Off Learn All About How To Make Your Car Expenses Tax Deductible Small Business Accounting Business Tax Deductions Business Tax

Is Your Car A Tax Write Off Learn All About How To Make Your Car Expenses Tax Deductible Small Business Accounting Business Tax Deductions Business Tax

Online Gas Mileage Reimbursement Form Use This Form For The Employee To Claim Work Related Travel Expenses In Emp Gas Mileage Mileage Travel Trailer Insurance

Online Gas Mileage Reimbursement Form Use This Form For The Employee To Claim Work Related Travel Expenses In Emp Gas Mileage Mileage Travel Trailer Insurance

.svg)

This Is What You Need To Know The First Year You File Business Taxes Business Tax Small Business Tax Tax Prep

This Is What You Need To Know The First Year You File Business Taxes Business Tax Small Business Tax Tax Prep

How To Organize Your Receipts And Records So You Aren T Buried In Paperwork Credit Card Statement Electronic Records Receipts

How To Organize Your Receipts And Records So You Aren T Buried In Paperwork Credit Card Statement Electronic Records Receipts

Tax Time Can Be A Time Of Dread For Many Truck Drivers Trying To Sift Through Boxes Of Receipts To Work Out What Deducti Truck Driver Truck Organization Trucks

Tax Time Can Be A Time Of Dread For Many Truck Drivers Trying To Sift Through Boxes Of Receipts To Work Out What Deducti Truck Driver Truck Organization Trucks

How To Prep For Your Self Employed Taxes A Survival Guide Bookkeeping Business Small Business Bookkeeping Small Business Tax

How To Prep For Your Self Employed Taxes A Survival Guide Bookkeeping Business Small Business Bookkeeping Small Business Tax

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Are Car Repairs Tax Deductible H R Block

Are Car Repairs Tax Deductible H R Block

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Business Tax Deductions Mileage Log Printable

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Business Tax Deductions Mileage Log Printable

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Deductions Small Business Tax Tax Prep Checklist

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Deductions Small Business Tax Tax Prep Checklist

How To Organize Your Receipts And Records So You Aren T Buried In Paperwork Credit Card Statement Electronic Records Receipts

How To Organize Your Receipts And Records So You Aren T Buried In Paperwork Credit Card Statement Electronic Records Receipts

Freelancer S Guide To Car Tax Deductions

Freelancer S Guide To Car Tax Deductions

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Tax Checklist For The Self Employed Military Spouse Nextgen Milspouse Tax Checklist Military Spouse Milspouse

Tax Checklist For The Self Employed Military Spouse Nextgen Milspouse Tax Checklist Military Spouse Milspouse

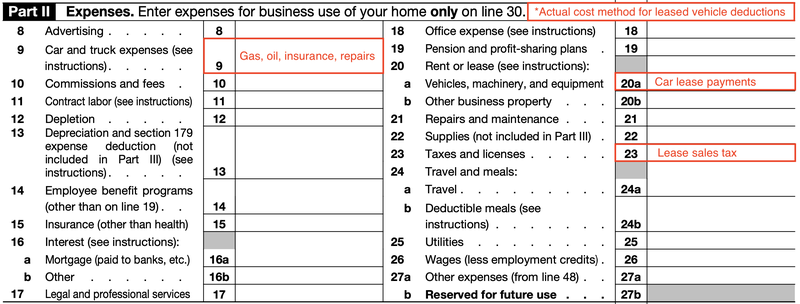

How To Write Off A Car Lease For Your Business In 2021 The Blueprint

How To Write Off A Car Lease For Your Business In 2021 The Blueprint

Business Use Of Vehicles Turbotax Tax Tips Videos

Business Use Of Vehicles Turbotax Tax Tips Videos