Declaration Eligible Business Participant

So long as you satisfy the conditions outlined here you will be able to click next at the bottom of this page to proceed with your application. This will allow you to change your eligibility and provide the Tier information.

Essential Guide To Jobkeeper 2 0 For Sole Traders Airtax Help Centre

Essential Guide To Jobkeeper 2 0 For Sole Traders Airtax Help Centre

When you enrol your business and nominate an eligible participant the government will be adding and extra 1500 per fortnight to the Jobkeeper payment.

Declaration eligible business participant. Accordingly in order to provide a benefit to such business participants payments can also be made to an entity in respect of what is referred to as an eligible business participant ie generally controlling individuals who are not employees of their business. The eligible business entity must also qualify in the same way as an eligible employer ie. 8 April 2020 edited April 2020.

Do not include Business Participants here. Change the JobKeeper status for the eligible business participant if they become ineligible. Confirm your current and projected income - youll need use the GST turnover method to do so which you can read about here.

Let us know if you have any further questions. The eligible business participant other than a sole trader must agree to be nominated and can do so using the ATOs nomination notice for eligible business participants. To determine if you qualify as an ECP please review each category on Table A below and complete the declaration on page 1 with category applicable for you.

You will then be taken to a screen with a lot of information about the eligibility for this program. Qualification Requirements for Eligible Contract Participants. An Eligible Business Particpant is not an employee and is not be paid through the payroll.

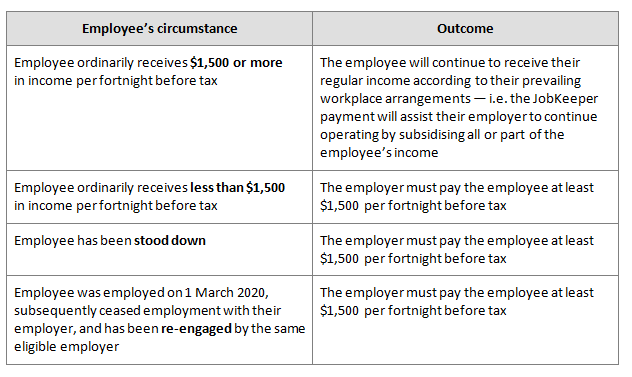

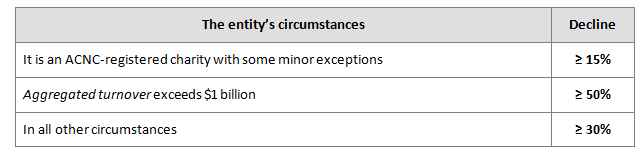

It must meet the relevant decline in turnover tests and not be an excluded entity. In your business monthly declaration form. Eligible business participant Your non-employee individual is an eligible business participant of your entity for the fortnight if they meet all of the following.

This section is where you will declare yourself as an eligible business participant. Were actively engaged in the business for 80 hours or more during your reference period and have provided it with a written declaration confirming this. They are an individual not employed by your entity.

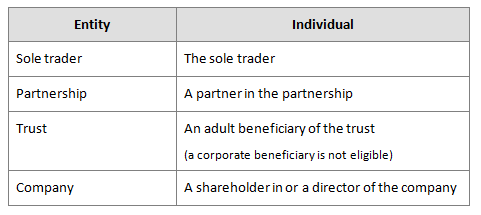

Sole traders one partner in a partnership one beneficiary of a trust and one director or shareholder of a company may be regarded as an eligible business participant. An eligible business entity will be entitled to the tier 1 rate for you from 28 September 2020 if you. You will need number of eligible employees for each JobKeeper fortnight 30 March to 12 April and 13 April to 26 April If your business does not have any employees but does have business participants enter as 0 here Are you intending to register as an eligible business participant.

The business entity is only entitled to receive the JobKeeper payment in relation to one eligible business participant. The Court will determine whether Bidder is eligible to receive the small business preference based on information provided in the Small Business Declaration. That is where you make the claim as you can only claim for one.

I declare that the eligible business participant if applicable was actively engaged in the business for 80 hours or more Tier 1 or less than 80 hours Tier 2 in February 2020 I acknowledge that if the ATO determine that I am not eligible for all or part of the. The business participant has made a declaration in the approved form to the entity or the Commissioner if the business participant is a sole trader that their total hours of active engagement are 80 hours or more for the applicable reference period. An employer or Eligible Business Participant.

They are actively engaged in the business carried on by your entity at 1 March 2020 and for the fortnight you are claiming. An Eligible Contract Participant ECP as defined in the Act and the CFTC rule 17 CFR 13. Payments upto the 27th September are JK 1 and the same process for monthly claim applies as previous months.

If Bidder submits incomplete or inaccurate information it will not receive the. You may or may not choose to ensure the employee tier allocation is done at this time. Complete business monthly declarations - what you need to do to continue receiving the payments is outlined here.

Must make a monthly declaration to the Commissioner which is also the Submission of the Claim for JobKeeper. You will be able to edit the business participant as part of your October declaration. Complete the Small Business Declaration.

A limit applies of one JobKeeper payment per fortnight for one eligible business participant. You can add an eligible business participant to claim JobKeeper payments for them if you did not identify one in Step 2. When you enrol for JobKeeper in the ATO business portal it will ask you whether you would like to claim for eligible business participant.

The Court may but is not obligated to verify or seek clarification of any information set forth in the Small Business Declaration. You can refer to this JobKeeper guide for sole traders which walks you through the steps of enrolling identifying as an eligible business participant and making a business monthly declaration. Confirm yourself as the eligible business participant - see instructions to do so here.

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Declaration Of Honour European Commission It How To Manual Confluence

Declaration Of Honour European Commission It How To Manual Confluence

Jobkeeper Key Dates Payroll Cycles

Jobkeeper Key Dates Payroll Cycles

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

Jobkeeper Extension What You Need To Know Hrd Australia

Jobkeeper Extension What You Need To Know Hrd Australia

Https Www Cpaaustralia Com Au Media Corporate Allfiles Document Covid 19 Business Advice Jobkeeper Extension Webinar Questions September 28 2020 Pdf La En Rev Bbb3c829d1f546af9f20ef34977f197a

Check Actual Decline In Turnover Australian Taxation Office

Check Actual Decline In Turnover Australian Taxation Office

Jobkeeper Key Dates Payroll Cycles

Jobkeeper Key Dates Payroll Cycles

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 3 Make A Business Monthly Declaration Australian Taxation Office

Step 3 Make A Business Monthly Declaration Australian Taxation Office

Managing The Jobkeeper Payment Payroll Support Au

Managing The Jobkeeper Payment Payroll Support Au

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Jobkeeper Employee Nomination Notice Pdf Templates Jotform

Jobkeeper Employee Nomination Notice Pdf Templates Jotform

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Https Www Ato Gov Au Assets 0 104 300 362 B503971b E760 4264 89be 28ed292fd889 Pdf

Insurance Waiver Template Pdf Templates Jotform

Insurance Waiver Template Pdf Templates Jotform