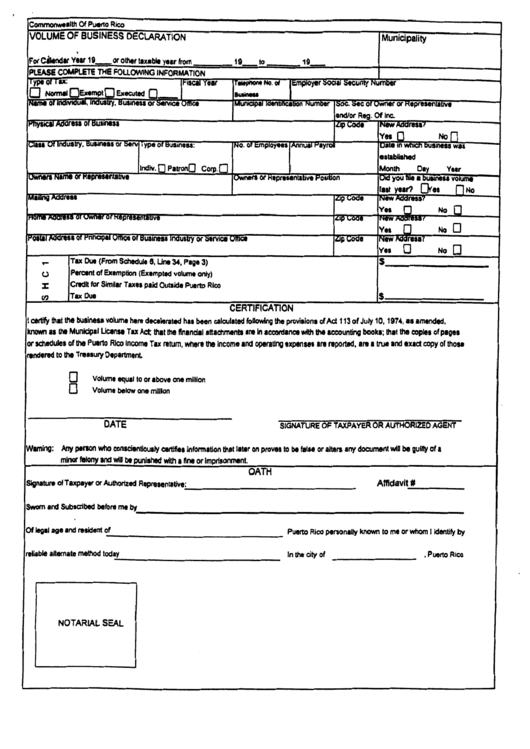

Commonwealth Of Puerto Rico Business Volume Declaration

In the event that the volume of business does not exceed USD 3 million a balance sheet prepared under Generally Accepted Accounting Principles GAAP by a person with a general. 005-2020 CL 05-20 providing that the deadline for filing the Volume of Business Declaration Declaration for fiscal year 2020-21 will be postponed to July 22 2020.

Https Www Navfac Navy Mil Niris Southeast Puerto Rico Na N40003 002350 Pdf

Commonwealth of Puerto Rico is subject to payment of Business Volume Tax unless otherwise established by law.

Commonwealth of puerto rico business volume declaration. By José Alvarado Vega on September 8 2020. The report must be signed by an authorized officer director or incorporator. The Department of State of the Commonwealth of Puerto Rico has the ministerial duty to manage multiple business records that are essential parts for the economic activity in Puerto Rico.

Service Support and Guidance. Ricardo Rosselló pledged to issue Puerto Rico government audited financial statements in a timely manner the administration of Gov. Net sales gross income from any service rendered and other gross receipts attributable to each municipality.

Commonwealth of Puerto Rico is subject to payment of Business Volume Tax unless otherwise established by law. The declaration must indicate the actual volume of business ie. The Puerto Rico Office of Management and Budget issued Circular Letter No.

Bush issued a memorandum to heads of executive departments and agencies establishing the current administrative relationship between the federal government and the Commonwealth of Puerto Rico. I the Electronic Registry of Corporations and Institutions on the basis of Law 164-2009 as amended. I am pleased to report to you that with the establishment of the Commonwealth of Puerto Rico on July 25 1952 the people of Puerto Rico have attained a full measure of self-government consistent with Puerto Ricos status as a territory of the United States.

Ii the Electronic Registry of Trademarks Trade Names and Related. Every corporation is required to file an annual volume-of-business declaration with each of the municipalities in which it establishes or conducts business operations during the year. On March 18 2020 the Puerto Rico Office of Management and Budget issued Circular Letter No.

PUERTO RICO Disaster Number PR-00034 Presidential Declaration. Share Tweet Share Share Share Share. Line 10 Indicate the aggregate business volume estimated or projected of all activities and locations at the end of the current calendar year.

This memorandum directs all federal departments agencies and officials to treat Puerto Rico administratively as if it were a state insofar as doing so would not disrupt. SAN JUAN Three years after then-Gov. Business volume means the gross sales of any business reduced by returns and the gross income received or derived from any service rendered or from any other commercial activity.

Depicts Bleak Fiscal State that Led to Bankruptcy Declaration under Promesa. If the volume of business is less than 3000000 a copy of the income tax return pages or schedules showing the income and expenses as filed with the Puerto Rico Department of the Treasury must be included with the. The establishment of the Commonwealth marks the culmination of a steady progression in the exercise of self-government initiated with the first organic act for Puerto Rico.

008-2021 to postpone the due date to file the 2021-2022 Volume of Business Declaration 21-22 VOB until May 24 2021. Puerto Rico business tax returns are due by the 15 th day of the 4 th month following the close of the tax year April 15 for calendar year filers. If the volume of business of a corporation equals exceeds USD3 million the balance sheet must be audited by a Certified Public Accountant CPA.

Any person or its authorized agent subject to the payment of Business Volume tax shall be required to give a Declaration of Business Volume by or before five 5 working days after 15 April of each taxable year. 2020-07962 ----- SMALL BUSINESS ADMINISTRATION Disaster Declaration 16253 and 16254. If you cannot file by this date you can get a Puerto Rico tax extension.

This postponement was allowed as a result of the PRTD announced postponements of the. SMALL BUSINESS ADMINISTRATION Federal Register Volume 85 Number 74 Thursday April 16 2020 Notices Page 21279 From the Federal Register Online via the Government Publishing Office wwwgpogov FR Doc No. March 24 2020.

A Puerto Rico business extension will give you 3 extra months to file which moves the filing deadline to July 15 for calendar year taxpayers. Commonwealth of Puerto Rico DEPARTMENT OF THE TREASURY 5. Volume of Business Declaration Filing Deadline Postponed Further to our Tax Alert of March 24 2020 on March 25 2020 the Puerto Rico Office of Management and Budget issued Circular Letter No.

Any request for extension to file a Declaration must also be filed on or before May 22 2020. Volume of business for the municipality where this location is established according to the V olume of Business Declaration for the payment of the Municipal License Tax prior to this application. 004-2020 CL 04-20 providing that because of the COVID-19 Emergency the new deadline for filing the Volume of Business Declaration for the Fiscal Year 2020-21 will be May 22 2020.

Any person or its authorized agent subject to the payment of Business Volume tax shall be required to give a Declaration of Business Volume by or before five 5 working days after 15 April of each taxable year. If the volume of business of the Corporation exceeds three million 3000000 the report should be audited by a Certified Public Accountant CPA licensed by the Commonwealth of Puerto Rico. In the case of for-profit corporations if the volume of business exceeds USD 3 million the annual report must be accompanied by a balance sheet certified by a certified public accountant CPA licensed in Puerto Rico.

Wanda Vázquez Garced released last week the commonwealths. Financial statements certified by a Certified Public Accountant CPA licensed in Puerto Rico must be attached to the declarations if the total volume of business is 3000000 or more. In 1992 President George H.

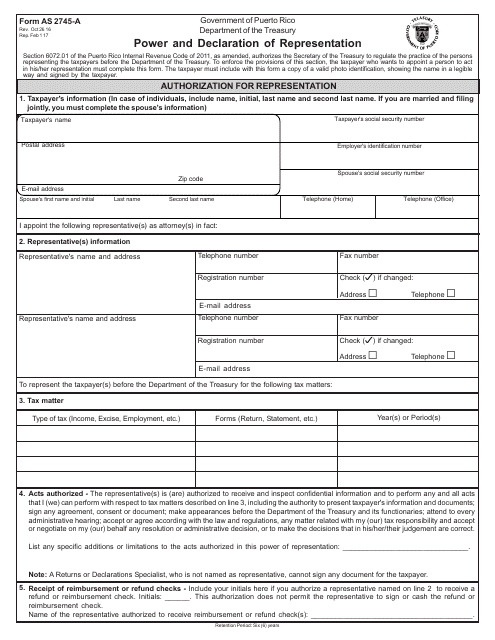

Puerto Rico Department Of Treasury Forms Pdf Templates Download Fill And Print For Free Templateroller

Puerto Rico Department Of Treasury Forms Pdf Templates Download Fill And Print For Free Templateroller

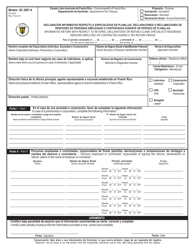

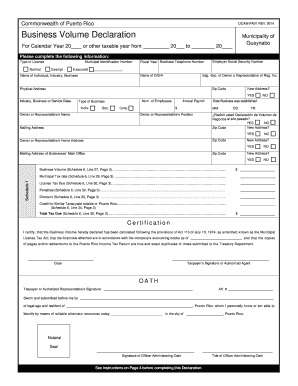

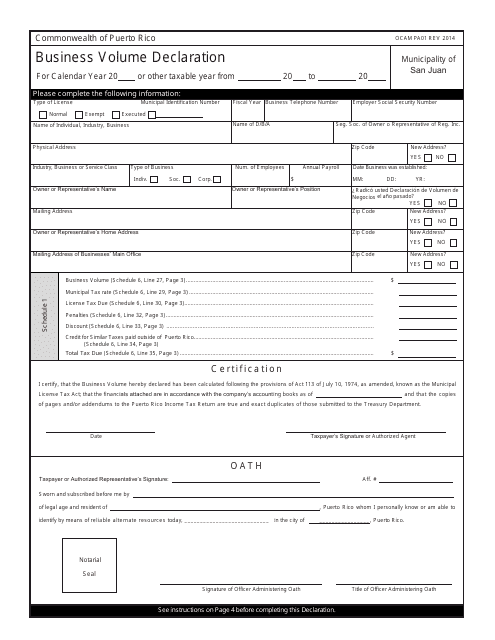

Form Ocam Pa01 Download Fillable Pdf Or Fill Online Business Volume Declaration Puerto Rico Templateroller

Form Ocam Pa01 Download Fillable Pdf Or Fill Online Business Volume Declaration Puerto Rico Templateroller

Https Www Fema Gov Sites Default Files 2020 04 Tribal Declaration Pilot Guidance Pdf

Business Declaration Form Page 4 Line 17qq Com

Business Declaration Form Page 4 Line 17qq Com

Https Www Navfac Navy Mil Niris Southeast Puerto Rico Na N40003 002350 Pdf

Business Declaration Form Page 4 Line 17qq Com

Business Declaration Form Page 4 Line 17qq Com

Form Ocam Pa01 Download Fillable Pdf Or Fill Online Business Volume Declaration Puerto Rico Templateroller

Form Ocam Pa01 Download Fillable Pdf Or Fill Online Business Volume Declaration Puerto Rico Templateroller

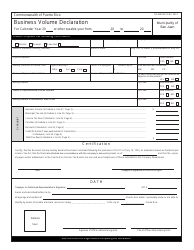

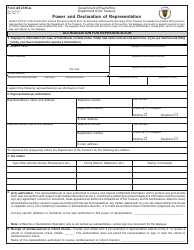

Volume Of Business Declaration Form Printable Pdf Download

Volume Of Business Declaration Form Printable Pdf Download

Business Declaration Form Page 4 Line 17qq Com

Business Declaration Form Page 4 Line 17qq Com

Business Declaration Form Page 4 Line 17qq Com

Business Declaration Form Page 4 Line 17qq Com

Volume Of Business Declaration Puerto Rico Fill And Sign Printable Template Online Us Legal Forms

Volume Of Business Declaration Puerto Rico Fill And Sign Printable Template Online Us Legal Forms

Puerto Rico Department Of Treasury Forms Pdf Templates Download Fill And Print For Free Templateroller

Puerto Rico Department Of Treasury Forms Pdf Templates Download Fill And Print For Free Templateroller

Pin By Lucy Cabo On Dinero Currency Design Money Notes Money Collection

Pin By Lucy Cabo On Dinero Currency Design Money Notes Money Collection

Business Declaration Form Page 4 Line 17qq Com

Business Declaration Form Page 4 Line 17qq Com

Volume Of Business Declaration Puerto Rico Fill Online Printable Fillable Blank Pdffiller

Volume Of Business Declaration Puerto Rico Fill Online Printable Fillable Blank Pdffiller

Https Www Guaynabocity Gov Pr Wp Content Uploads 2015 12 Business Volume Declaration Pdf

Puerto Rico Department Of Treasury Forms Pdf Templates Download Fill And Print For Free Templateroller

Puerto Rico Department Of Treasury Forms Pdf Templates Download Fill And Print For Free Templateroller

Volume Of Business Declaration Form Printable Pdf Download

Volume Of Business Declaration Form Printable Pdf Download

Form Ocam Pa01 Download Fillable Pdf Or Fill Online Business Volume Declaration Puerto Rico Templateroller

Form Ocam Pa01 Download Fillable Pdf Or Fill Online Business Volume Declaration Puerto Rico Templateroller