Limited Company Mileage Claim Hmrc

Being a Contractor many places of work are temporary as a result of contract lengths and conditions. Very simply HMRC mileage allowance lets you claim a reduction of your taxable income to partially offset what youve spent on certain travel costs for business trips and not had reimbursed by an employer.

How To Write Off Car Payments As A Business Expense Mileiq Uk

How To Write Off Car Payments As A Business Expense Mileiq Uk

The basic rule being that mileage can be claimed back when you are travelling to and from a temporary place of work.

Limited company mileage claim hmrc. As a limited company director you can claim back mileage from HMRC if you use your personal vehicle for business trips and youve paid for the costs of fuel. Claim 40ppm for the first 10000 business miles and 25ppm thereafter. You can also claim passenger payments of 5p per mile where your passenger is also on a business journey for example in a family company a director giving a.

Only payments specifically for carrying passengers count and. Trips taken to complete work ie deliveries. To find your tax-deductible business mileage costs youd multiply 9000 miles by 35p which would give you 3150.

5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them. The mileage allowance is also paid free of NICs. If you dont pay them business mileage or you pay them less than the HMRC approved mileage rates they can make a claim to HMRC at the end of the tax year for the difference.

Its usually best to claim back your mileage using the HMRC approved mileage allowance payments AMAP rates on Govuk. How much can be claimed as business mileage. 45p for cars and vans for the first 10000 miles.

The AMAP rates include the general running costs of. Whats more according to research by Barclaycard as many as 60 of people dont claim expenses properly or at all. What are other travel expenses that are tax deductible.

Youre allowed to pay your employee a certain amount of MAPs each year without. HMRCs current AMAP rates are. The Mileage Allowance Relief is based on HMRCs approved mileage rates.

If your limited company owns the vehicle you will only be able to claim Advisory Fuel Rates AFR set by HMRC and the company will take on the expenses of vehicle maintenance and other travel expenses. A workplace is temporary as long as contractor spends no more than 40 of their time there. In a recent YouGov survey surprisingly 56 of company car drivers were found to be unaware of HMRC rules on reclaiming business mileage.

Basically its anything that is solely and exclusively for the purpose of. HMRC has some general guidance on what expenses you can claim with a limited company. Bear in mind that HMRC can and do spot check mileage claims for visits as easily as anyone else with route planning software or the AA or RAC on-line route finders.

The 24-month and 40 rules. One of the most popular and utilised expenses that Contractors running Limited Companies claim for is mileage. This is all money that can be saved and reinvested into your limited company to help you improve your cash flow and grow your business.

If the contractor exceeds the 40 rule then as long as they dont expect to work at that location for more than two years then. Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys. According to HMRC these trips are defined as journeys you make wholly and exclusively for business purposes.

The mileage allowance is designed to cover the cars running costs and the fuel costs. If you also drive your vehicle for private purposes. It is not only important for any business to understand these rules but also to be aware that penalties for the inaccurate recording of business v private mileage enforced by HMRC can be significant.

The current rates are. Since your employer has already reimbursed you at a rate of 10p per mile you can only claim 45p less 10p so 35p per mile. HMRC publish a fixed rate for mileage which you can claim without having to pay tax for a car this is 45p per mile for the first 10000 miles per year and 25p per mile after this.

Every year 962m in expenses are left unclaimed from HMRC. To qualify as a temporary workplace so that a contractor can claim travel expenses the location must satisfy HMRCs 40 and 24-month rules.

Company Car Or Car Allowance Aaron Wallis Sales Recruitment

Company Car Or Car Allowance Aaron Wallis Sales Recruitment

Company Car Taxes The Hmrc Implications Of This Perk

Company Car Taxes The Hmrc Implications Of This Perk

Umbrella Company Vs Paye Which Should You Choose

Umbrella Company Vs Paye Which Should You Choose

Update To Company Car Mileage Rates Finerva

Update To Company Car Mileage Rates Finerva

8 Facts About Per Diem Rates In Uk And Hmrc Guidelines For Companies

8 Facts About Per Diem Rates In Uk And Hmrc Guidelines For Companies

Uk Fines Mt Global 32 Million For Money Laundering Breaches

Uk Fines Mt Global 32 Million For Money Laundering Breaches

The Ultimate Guide To Company Car Tax Osv

The Ultimate Guide To Company Car Tax Osv

Company Car Tax Guide Recent Changes You Need To Know

Company Car Tax Guide Recent Changes You Need To Know

Car Allowance Vs Mileage Allowance What To Know

Car Allowance Vs Mileage Allowance What To Know

Self Assessment 6 Most Common Errors You Need To Avoid

Self Assessment 6 Most Common Errors You Need To Avoid

How Hmrc Advisory Fuel Rates Work For Uk Businesses

How Hmrc Advisory Fuel Rates Work For Uk Businesses

Free Mileage Log Template Download Ionos

19 Ltd Companies Director S Expenses You Should Claim 2020

19 Ltd Companies Director S Expenses You Should Claim 2020

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

A Guide To Allowable Expenses For A Limited Company

A Guide To Allowable Expenses For A Limited Company

Functional Requirements Specification Template Ms Word Templates Forms Checklists For Ms Office And Apple Iwork Document Templates Word Template Software Requirements Specification

Functional Requirements Specification Template Ms Word Templates Forms Checklists For Ms Office And Apple Iwork Document Templates Word Template Software Requirements Specification

Fuel And Mileage Payments For Company Car Drivers Central Accountancy

Fuel And Mileage Payments For Company Car Drivers Central Accountancy

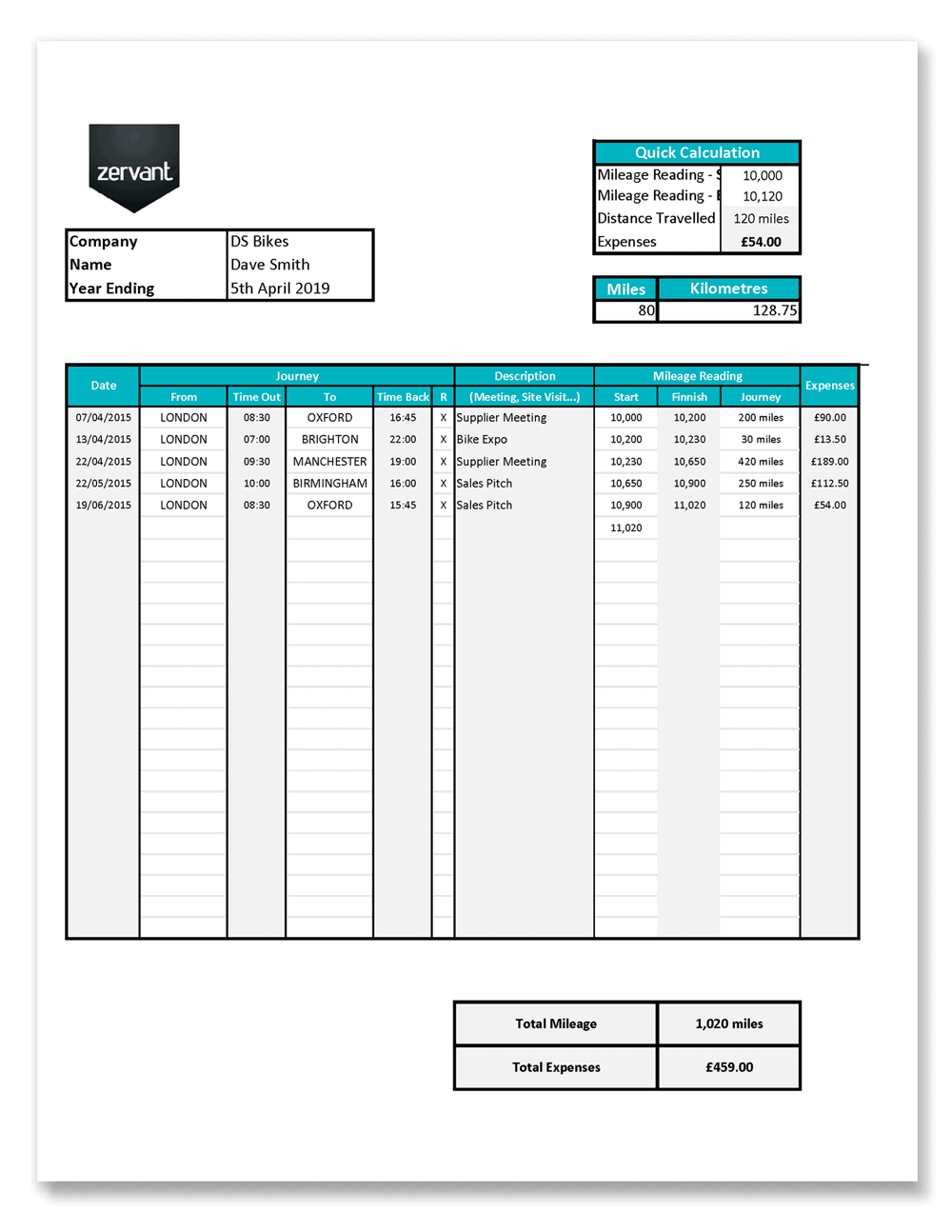

Free Uk Mileage Log Excel Zervant Blog

Free Uk Mileage Log Excel Zervant Blog

Company Expense Policy A Guide For Modern Businesses

Company Expense Policy A Guide For Modern Businesses