Irs Form 1040 Business Mileage

This rate is adjusted from time to time to account for changes in the costs of operating a car and rates are different for different purposes. Complete Schedule SE to determine the exact amount of your FICA tax deduction.

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

Enter either the actual expenses or the standard mileage for your cars business purposes.

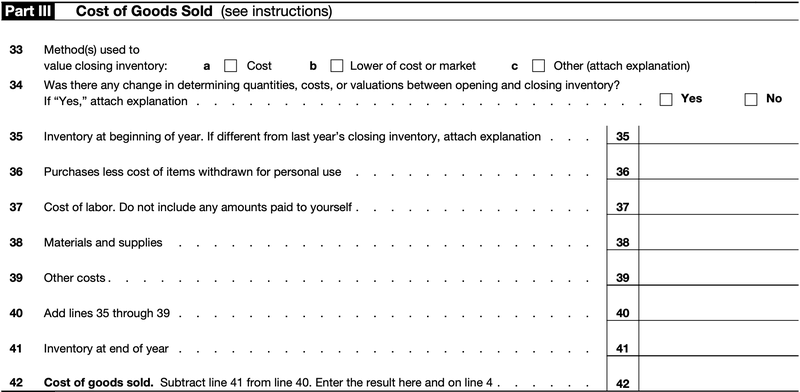

Irs form 1040 business mileage. IRS regulations and guidance provide that to qualify for the mileage deduction you are required to have a record of four facts when you drive your car for business. Information about Schedule C Form 1040 or 1040-SR Profit or Loss from Business Sole Proprietorship including recent updates related forms and instructions on how to file. For the standard mileage rate take the total number of miles driven for business purposes and multiply that by the standard mileage rate which is 51 cents for 2011.

Individual Income Tax Return which lets the IRS know whether you owe more taxes or should be reimbursed. You would also enter your commuting and other mileage on Part IV of Schedule C Form 1040. The standard mileage rate for the 2011 tax year for business-related miles was 51 cents per mile.

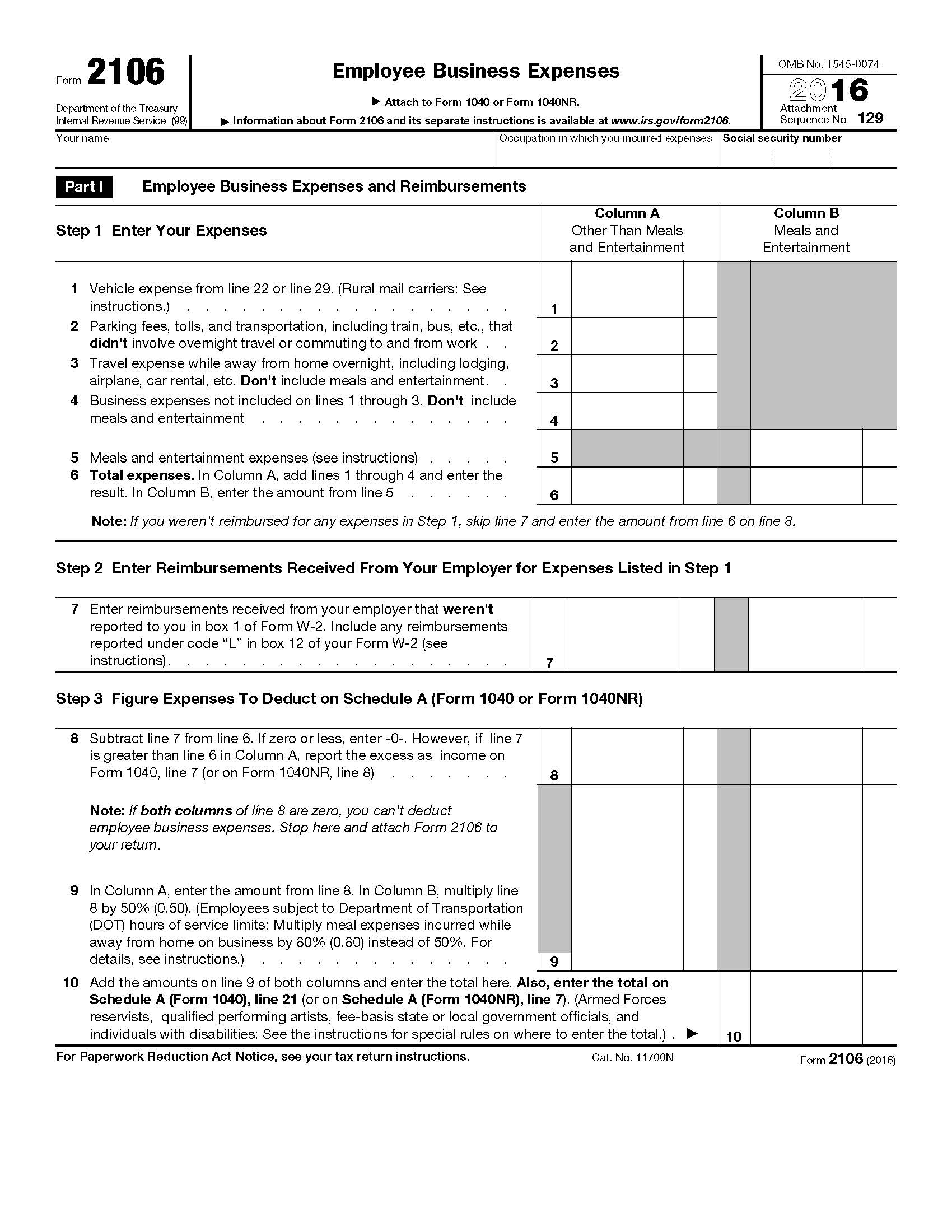

Complete Part II Line 9 on Schedule C. Standard Deduction on Form 1040 Tax Return January 7 2021 0. If youre an Armed Forces reservist a qualified performing artist or a fee-basis state or local government official complete Form 2106 Employee Business Expenses to figure the deductions for.

This will avoid EF Message 5843. Those miles could be racked up from meetings with clients travel to. Enter any other applicable Expenses optional if taking mileage.

Schedule C Form 1040 or 1040-SR is used to report income or loss from a business operated or a profession practiced as a sole proprietor. Prior year mileage data can be entered in the bottom left portion of the AUTO screen. For the expenses that occurred in 2021 the business mileage rate will be used Read More.

Form 1040 is your US. Use Schedule C to claim business mileage expenses as a sole proprietor. The standard mileage rate.

Enter the amount you are deducting on line 9. If you have business mileage to deduct enter your business mileage on Schedule C Form 1040 Part IV- Information on your vehicle. Time and date of the drive The total distance of the drive Destination of the drive and.

14 rows The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. IRS Business Mileage Rate is updated by the Internal Revenue Service. File 1099 Online Free.

Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or Schedule F Form 1040 Profit or Loss From Farming if youre a farmer. Under the IRS tax code if you are an employee who travels for business you can deduct any unreimbursed mileage expense that exceeds 2 percent of your adjusted. Claim the mileage deduction on Schedule C of Form 1040.

If you dont have a business office at home driving from home to your work location for your business is commuting. For 2020 tax filings the self-employed can claim a 575 cent deduction per business mile driven. Business miles are required whether the taxpayer elects to use mileage or actual expenses for the vehicle.

You can deduct a portion of the FICA tax as a business expense on Schedule 1 of Form 1040. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and 14 cents per mile driven in service of charitable organizations.

Https Singlefamily Fanniemae Com Media Document Pdf Glance Selling Guide Updates Related Tax Cuts And Jobs Act

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

What Is An Irs Schedule C Form And What You Need To Know About It

What Is An Irs Schedule C Form And What You Need To Know About It

Irs Schedule C What It Is And When To Use It Rethority Real Estate Guides News And More

Irs Schedule C What It Is And When To Use It Rethority Real Estate Guides News And More

10 Common Tax Deductions For Your Photography Business Photoshelter Blog

10 Common Tax Deductions For Your Photography Business Photoshelter Blog

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Step By Step Instructions To Fill Out Schedule C For 2020

Step By Step Instructions To Fill Out Schedule C For 2020

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Everything Old Is New Again As Irs Releases Draft Form 1040 For 2019 S J Gorowitz Accounting Tax Services P C

Everything Old Is New Again As Irs Releases Draft Form 1040 For 2019 S J Gorowitz Accounting Tax Services P C

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Irs Schedule C Form 1040 Fill Out Printable Pdf Forms Online

Irs Schedule C Form 1040 Fill Out Printable Pdf Forms Online

Https Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Schedule C What It Is And When To Use It Rethority Real Estate Guides News And More

Irs Schedule C What It Is And When To Use It Rethority Real Estate Guides News And More

![]() Schedule C Instructions How To Fill Out Form 1040 Excel Capital

Schedule C Instructions How To Fill Out Form 1040 Excel Capital