How To File 1099 R Electronically

However taxpayers should keep records of these attachments with a copy of their tax return. You need to file Form 4419 Application for Filing Information Returns Electronically to obtain a Transmitter Control Code TCC.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

You will receive IRS acknowledgement of your eFile by email within 3 - 7 business days.

How to file 1099 r electronically. 1099-R eFile Service Pricing. You are required to submit your W-2 information electronically through the W-2 Upload Feature on the Ohio Business Gateway. Specific Instructions for Form 1099-R File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from profit-sharing or retirement.

This allows the IRS and Technical Services Operation to approve and verify your electronic filing. IncomeStatementsEWTtaxstateohus or by calling. Electronically-filed 1099-R forms are directly transmitted to the IRS from Tax1099.

1099 Upload Frequently Asked Questions Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. FOR TAX YEAR 2019. INSTRUCTIONS FOR FILING 1099-Rs.

1099Gs are available to view and print online through our Individual Online Services. Online filing is now available for Ohio W-2s and 1099-Rs Please review the 1099-R Upload Specifications on ODTs website. If this is the first time you are filing electronically then you can easily obtain a TCC code by submitting Form 4419 to the IRS.

There are three steps you need to take to send 1099 electronically to the IRS. Taxpayer Identification Number TIN Matching TIN Matching is part of a suite of internet based pre-filing e-services that allow authorized payers the opportunity to match 1099 payee. E-Filing 1099 Forms With the IRS You can submit all 1099 forms including Form 1099-NEC to the IRS by mail or online using the Filing Information Returns Electronically FIRE system.

Those who issue 250 or more W-2 forms must submit this information to ODT using the approved. You must register with the FIRE system by filing an online application. The Benefits of Filing Online.

If you filed with the IRS electronically before then you should already have a T code. Ohio IT 3 Transmittal of W-2 Statements Instructions 1. The app will select the correct tax forms for you and help you fill them out.

How to E-File 1099-R Forms Using W2 Mate Note. Those who issue 250 or more W-2s. The requirement to attach Forms W-2 W-2G W-2GU and Form 1099-R has been eliminated for electronically filed returns.

All Revisions for Form 1099-R and Instructions. 1099- R Tax Year 2019 V 1. You will need a TCC code to electronically file regardless of the software.

Publication 1220 PDF Specifications for Filing Forms 10971098 1099 3921 3922 5498 8935and W2-G Electronically PDF Additional Publications You May Find Useful. Additionally it will calculate the math and enter your. Online Ordering for Information Returns and Employer Returns.

Filing Information Returns Electronically FIRE FIRE is dedicated exclusively to the electronic filing of Forms 1042-S 1098 1099 5498 8027 and W-2G. For easysecure and irs approved 1099 R Filing. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

You can elect to be removed from the next years mailing by signing up for email notification. Efore you can file electronically with the IRS you need to obtain a T code Transmitter ontrol ode. Deadline for filing 1099 R Form 2020 with the IRS is March 1 2021 for paper filings and March 31st for electronic filings.

File separate Forms 1099-R using Code 8 or P to indicate the year the amount is taxable. If a qualified plan loan offset occurs in a designated Roth account Codes M and B or a loan is treated as a deemed distribution under section 72p Codes L and B and a numeric code is needed to indicate whether the recipient is subject to the 10 tax under section 72t omit Code M or Code L as applicable. The Ohio Department of Taxation follows the 1099-R specifications as required by the Internal Revenue Service and accepts CD-ROM as described below.

If you filed with the IRS electronically before then you should already have a TCC code. The Ohio IT 3 must be filed by January 31st or within 60 days after discontinuation of business.

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

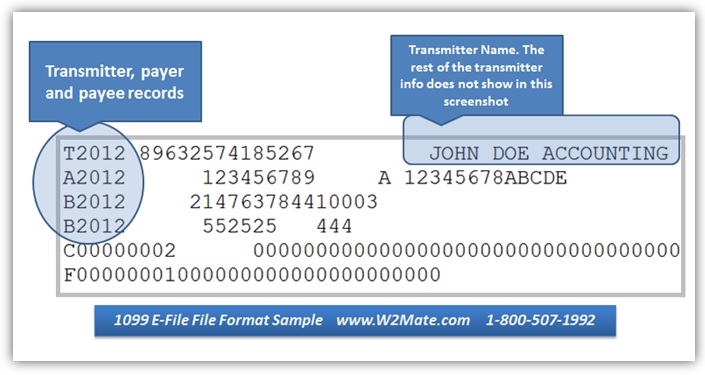

1099 E File Format Specification File Layout

1099 E File Format Specification File Layout

Report Year End Information On 1099s Returns

Report Year End Information On 1099s Returns

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Irs Form 1099 R Software 79 Print 289 Efile 1099 R Software

Irs Form 1099 R Software 79 Print 289 Efile 1099 R Software

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

![]() How To File Quickbooks 1099 Forms Electronically On Vimeo

How To File Quickbooks 1099 Forms Electronically On Vimeo

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Https Portal Ct Gov Media Drs Publications Pubsip 2019 Ip 2019 12 Pdf La En Hash Bf4940bd5400a296cf1e8caed4c1d53a 20 20guidance 20unclear 20as 20to 20threshold

1098 T User Interface Tuition Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Student Informatio Irs Forms Form Example Irs

1098 T User Interface Tuition Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Student Informatio Irs Forms Form Example Irs

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

1099 Electronic Filing Software 289 To Efile

1099 Electronic Filing Software 289 To Efile

How To File Quickbooks 1099 Forms Electronically On Vimeo

How To File Quickbooks 1099 Forms Electronically On Vimeo

1099 Nec Software To Create Print E File Irs Form 1099 Nec

1099 Nec Software To Create Print E File Irs Form 1099 Nec

1099 Misc Electronic Filing New Video Illustrates How To E File 1099 Misc Forms With The Irs

1099 Misc Electronic Filing New Video Illustrates How To E File 1099 Misc Forms With The Irs

Tf8621 2020 Continuous 1099 R 4 Part Carbonless Dated Electronic Filing 8 X 5 1 2

Tf8621 2020 Continuous 1099 R 4 Part Carbonless Dated Electronic Filing 8 X 5 1 2

Performing 1099 Year End Reporting

Performing 1099 Year End Reporting

Irs Form 1099 R Software 79 Print 289 Efile 1099 R Software

Irs Form 1099 R Software 79 Print 289 Efile 1099 R Software