How To Amend A Business Activity Statement

The IRD may ask to see them later. The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period.

Service Level Agreement Template Functional Photos Outsourcing Marevinho Service Level Agreement Virtual Assistant Services Agreement

Service Level Agreement Template Functional Photos Outsourcing Marevinho Service Level Agreement Virtual Assistant Services Agreement

An exempt organization must report name address and structural and operational changes to the IRS.

How to amend a business activity statement. 31 Mar 2021 QC 43304 Footer. You do this by completing a business activity statement BAS. Information you will need Youll need a record of how much GST you collected on sales and how much was paid on purchases.

Lodging an activity statement through the business portal. Click on the three dots to. Goods and services tax GST pay as you go PAYG instalments.

View - View the Business Activity Statement. Xero compiles 3 reports - a GST Calculation Worksheet a Business Activity Statement and a GST Audit Report. Once you lodge online your BAS will be sent electronically.

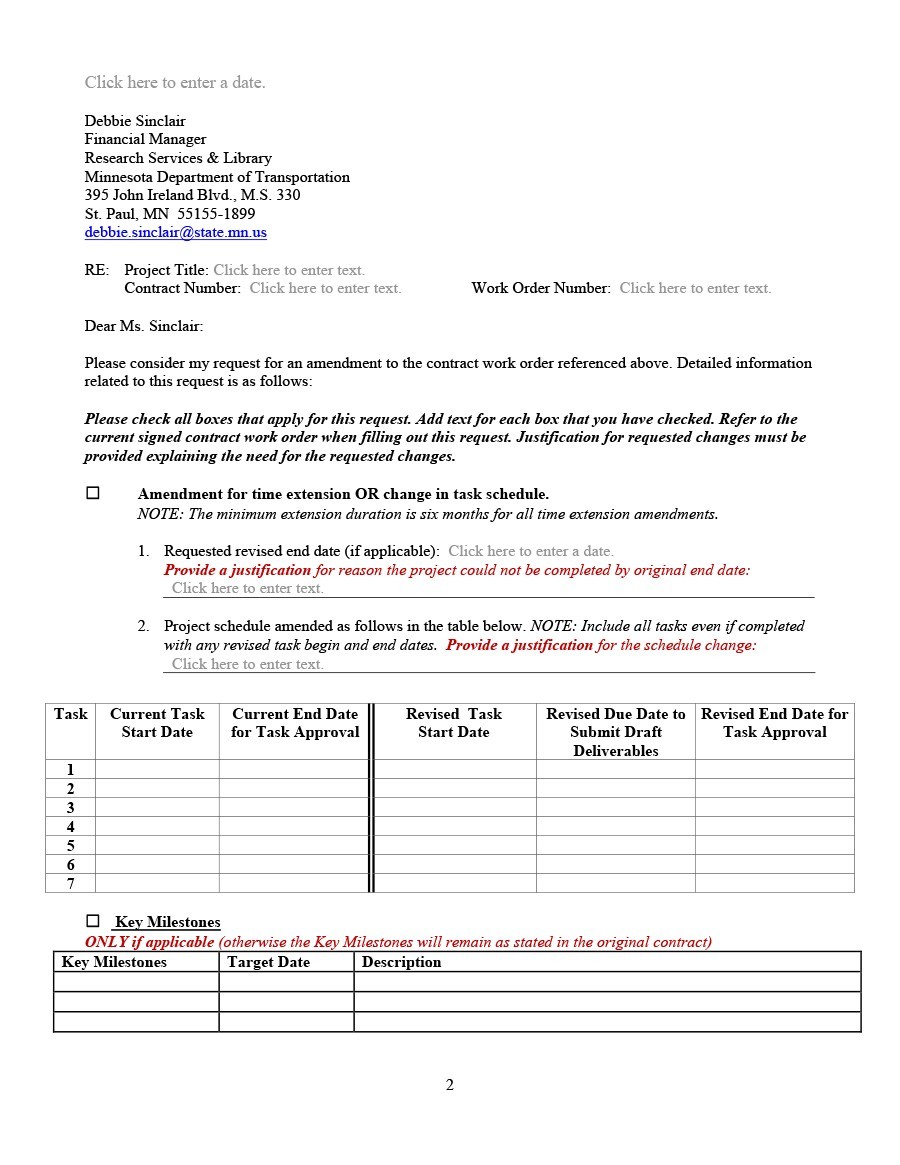

If approved you can get a new CPF account to hire the workers. Where an original lodged Activity Statement is present in Tax Manager right clicking on that return in Tax Manager and selecting Activity Statement Amendment will create a copy of the original return for amending. Original and revised activity statements must have different document identification numbers DINs.

To change or add a business activity submit a request and upload the relevant supporting documents of the new business activity. Your BAS will help you report and pay your. Print - Print the Business Activity Statement.

Find out what to do if you need to fix a mistake on a previously lodged business activity statement BAS or make an adjustment. Other Forms and Statements That May Be Required. There is a change in your business activity and you want to continue hiring your foreign workers.

A single electronic lodgment will change how the next BAS is issued. You can lodge your BAS. In the Tax menu select Returns then select the Filed tab.

Has anyone else noticed that if they were to report exactly as per the reports Xero compiles re Activity Statements that they are providing misleading and inaccurate figures to the ATO. Click Settings then make the required changes. Activity statement types and settings.

In addition its typically required as part of the supporting documents if your client goes to a bank to try and get a loan. How you complete your BAS depends generally on your business registrations. Principal Business Activity Codes.

We amend the assessment in full as a result of the application that is we fully accept. Finalised statements arent affected. Edit - Edit the Business Activity Statement.

Your BAS helps you to report and pay your GST PAYG instalments PAYG withholding tax and other taxes. If you own a business in Australia you must report and pay your business taxes to the Australian Taxation Office ATO using a Business Activity Statement BAS. Complete and return by the due date on your BAS along with any payment due.

Through a registered tax or BAS agent. Other Income Loss Line 12a. You wont need to submit tax invoices when you lodge your GST return but you will need to have them on hand.

A copy of the original statement is created in Draft and has Amendment nn next to its name. View statements of account and find your payment reference number PRN view your Single Touch Payroll STP reports. If we processed an activity statement then receive lodgment of another activity statement with the same DIN it can lead to incorrect refunds and account balances as well as processing delays.

Amend a filed activity statement. Other Income Loss Line 5. Applying for an amendment using a revised activity statement.

Click Save continue. In the Accounting menu select Reports. Online through the Business Portal or Standard Business Reporting SBR software.

If playback doesnt begin shortly try restarting your device. Revising activity statements Use the correct DIN. Once you have cleared your tax liabilities you can mark it as paid.

Where you apply for an amendment using a revised activity statement paper RBAS or lodge electronically via Standard Business Reporting SBR Online services for agents or portal a notice of amended assessment will not issue when. Open the return then click Amend. Update your Activity Statement settings if your registration details change.

Under Tax click Activity Statement. Changing settings deletes any draft Activity Statements youve saved. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS.

The statement of activities is a required financial statement for many purposes. If an organization files an annual return such as a form 990 or 990-EZ it must report the changes on its return. Amend an activity statement after youve filed it with the ATO.

Request a refund or transfer funds between accounts. Prepare lodge and revise activity statements. You can use the Business Portal to.

There are several options for lodging your business activity statements BAS. If your nonprofit client is having its records reviewed or audited it must have a statement of activities. If the organization needs to report a change of name see Change of Name- Exempt Organizations.

Statements and forms required of S corporations electing to be treated as an entity under. The Business Activity Statement created will reflect in the BAS Statement Log. Other Forms and Statements That May Be Required.

Update your business registration details including email addresses.

33 Proposal Writing Format Sample Example A Proposal Essay For Project Writin Business Proposal Letter Business Proposal Template Writing A Business Proposal

33 Proposal Writing Format Sample Example A Proposal Essay For Project Writin Business Proposal Letter Business Proposal Template Writing A Business Proposal

Simple Llc Operating Agreement Template 11 Operating Agreement Template For A Secure Company Management Operating Agr Templates Agreement Contract Template

Simple Llc Operating Agreement Template 11 Operating Agreement Template For A Secure Company Management Operating Agr Templates Agreement Contract Template

Photography Copyright Business Owner Small Business Tips Small Business Accounting

Photography Copyright Business Owner Small Business Tips Small Business Accounting

12 Business Continuity Plan Templates Word Excel Pdf Templates Business Continuity Planning Business Continuity Business Contingency Plan

12 Business Continuity Plan Templates Word Excel Pdf Templates Business Continuity Planning Business Continuity Business Contingency Plan

Certificate Of Insurance Request Form Template Fresh Certificate Insurance Request Form Templat In 2020 Certificate Of Achievement Template Templates Business Template

Certificate Of Insurance Request Form Template Fresh Certificate Insurance Request Form Templat In 2020 Certificate Of Achievement Template Templates Business Template

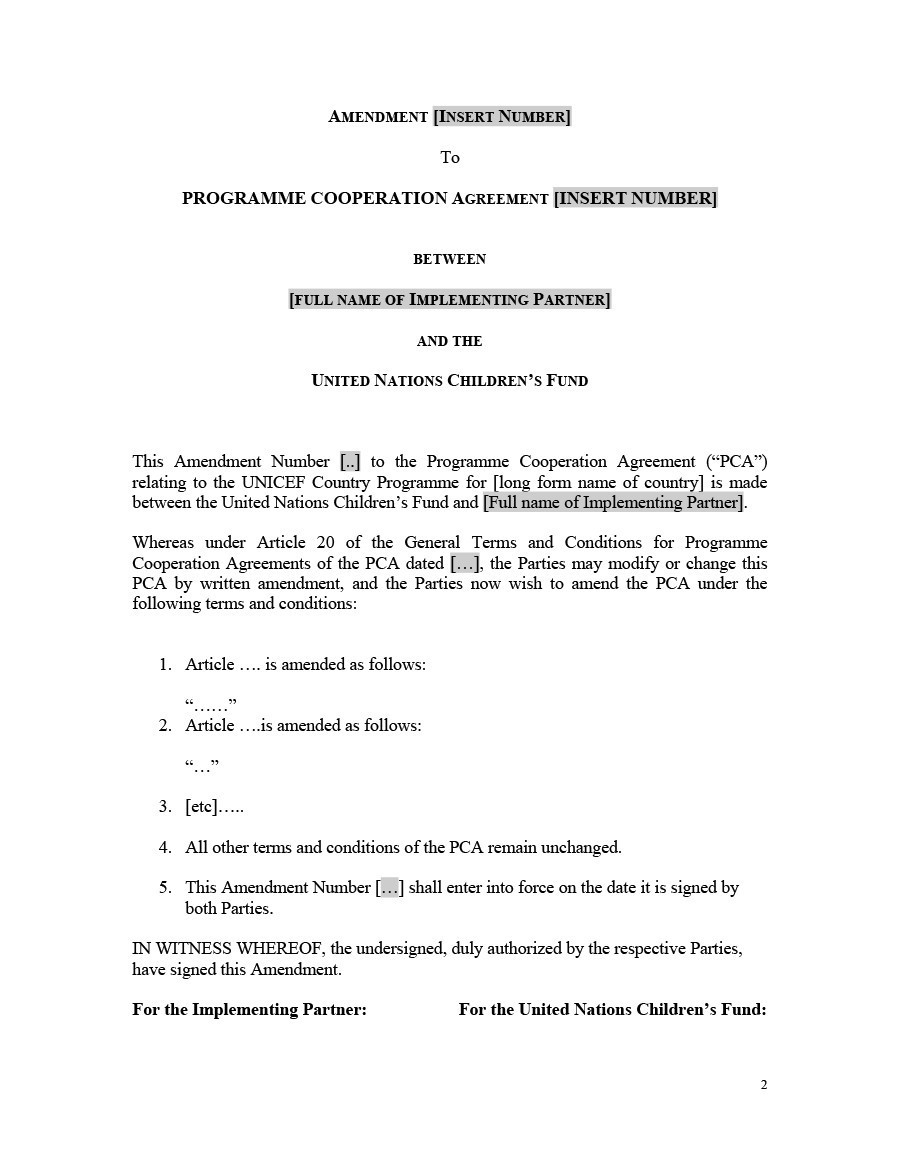

Explore Our Image Of Amendment To Promissory Note Template Promissory Note Notes Template Templates

Explore Our Image Of Amendment To Promissory Note Template Promissory Note Notes Template Templates

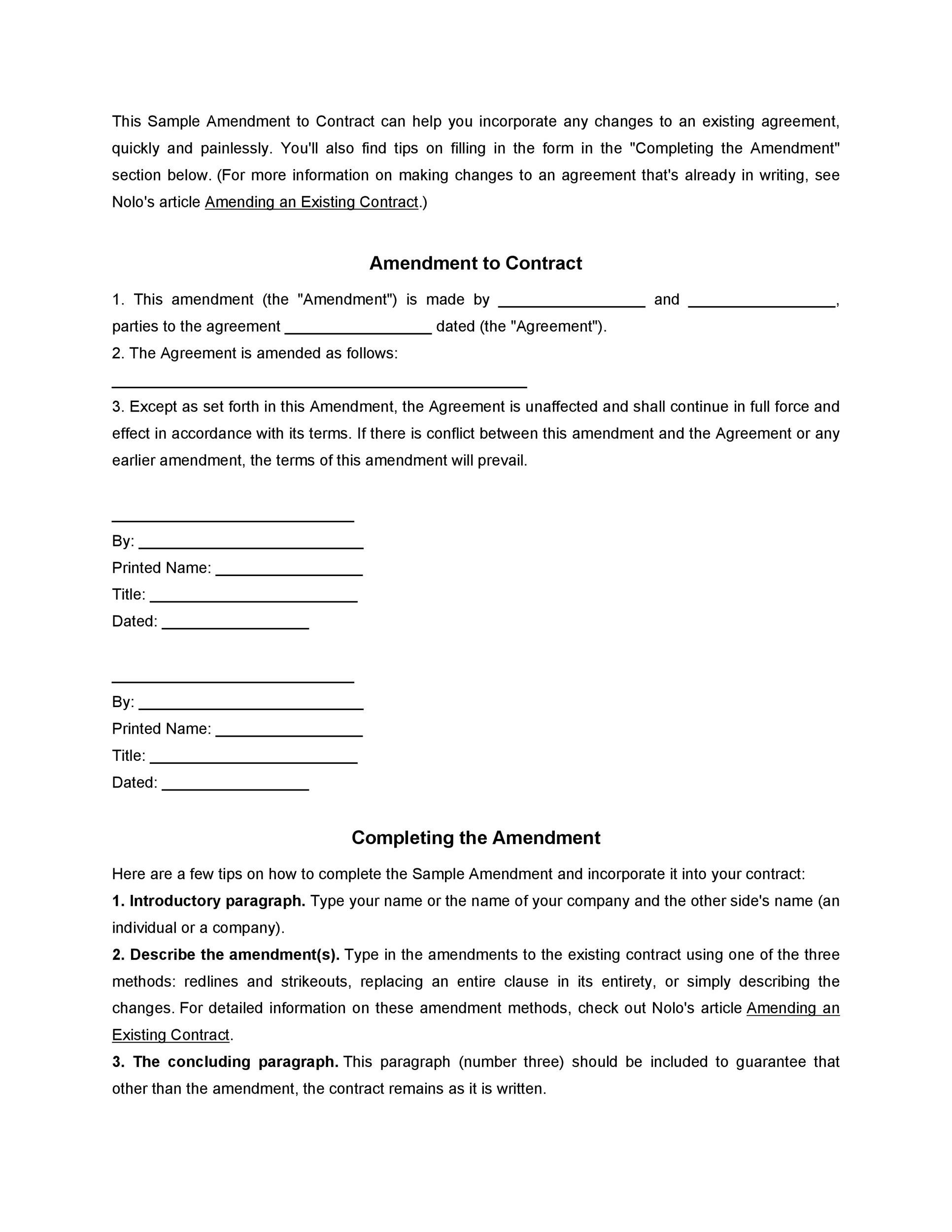

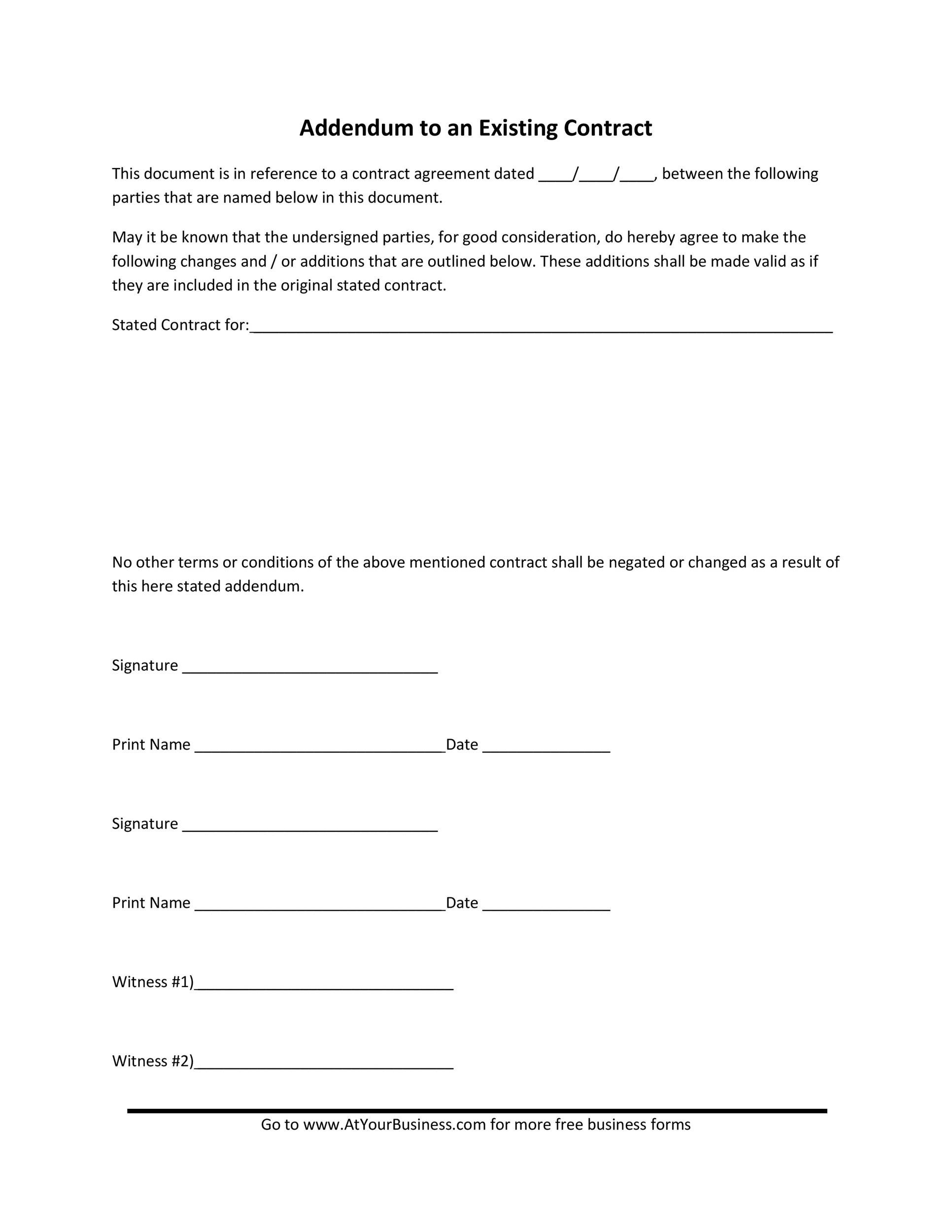

Addendum Agreement Sample Template Business Template Templates Agreement

Addendum Agreement Sample Template Business Template Templates Agreement

Sample Amendment To Agreement Contract Template Custom Return Address Labels Templates

Sample Amendment To Agreement Contract Template Custom Return Address Labels Templates

Construction Company Health And Safety Policy Statement Safety Policy Health And Safety Safety Management System

Construction Company Health And Safety Policy Statement Safety Policy Health And Safety Safety Management System

First Income Tax Form One Page Tax Forms Income Tax Tax Day

First Income Tax Form One Page Tax Forms Income Tax Tax Day

Instagram For Artists Essentials For Getting Started Instagram Instagram Artist Statement Art

Instagram For Artists Essentials For Getting Started Instagram Instagram Artist Statement Art

Govreports Brochure Payroll Taxes Brochure Tax Return

Govreports Brochure Payroll Taxes Brochure Tax Return

And Colourscheme8 1 Evaluation And Control The Action Plan Above Would Be Regularly Reviewed Andevaluated To Make Room How To Plan Marketing Plan Action Plan

And Colourscheme8 1 Evaluation And Control The Action Plan Above Would Be Regularly Reviewed Andevaluated To Make Room How To Plan Marketing Plan Action Plan