Form 1065 K-1 Line 20 Codes

Keep it for your records. However this PTP added codes AH1 - AH9.

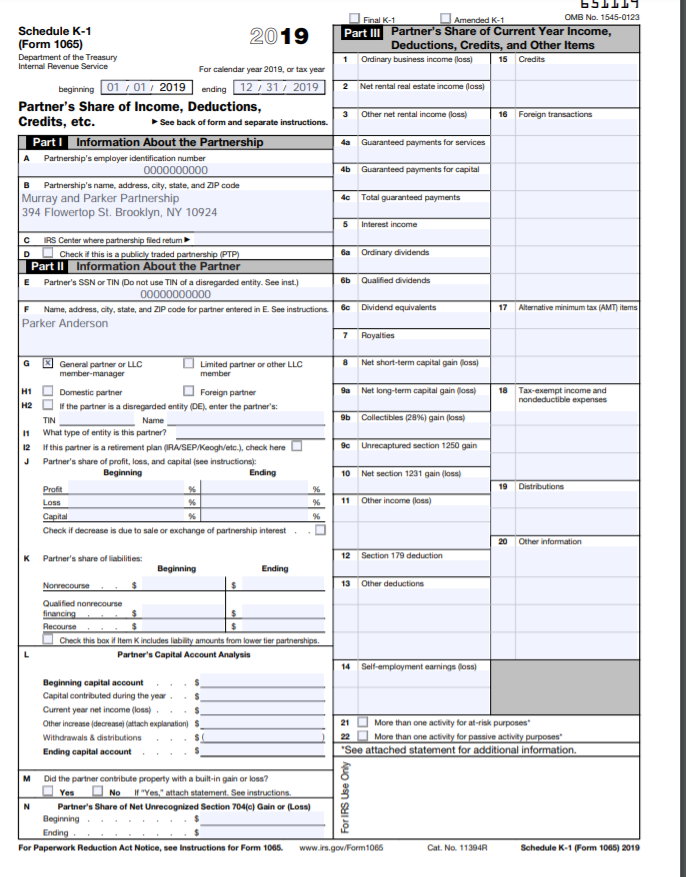

Irs Changes Form 1065 And The Form 1065 K 1 For 2019 December 17 2019 Western Cpe

Irs Changes Form 1065 And The Form 1065 K 1 For 2019 December 17 2019 Western Cpe

Line 20AH - Other Information - Box 20 Code AH are other items of information not found elsewhere on the Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc.

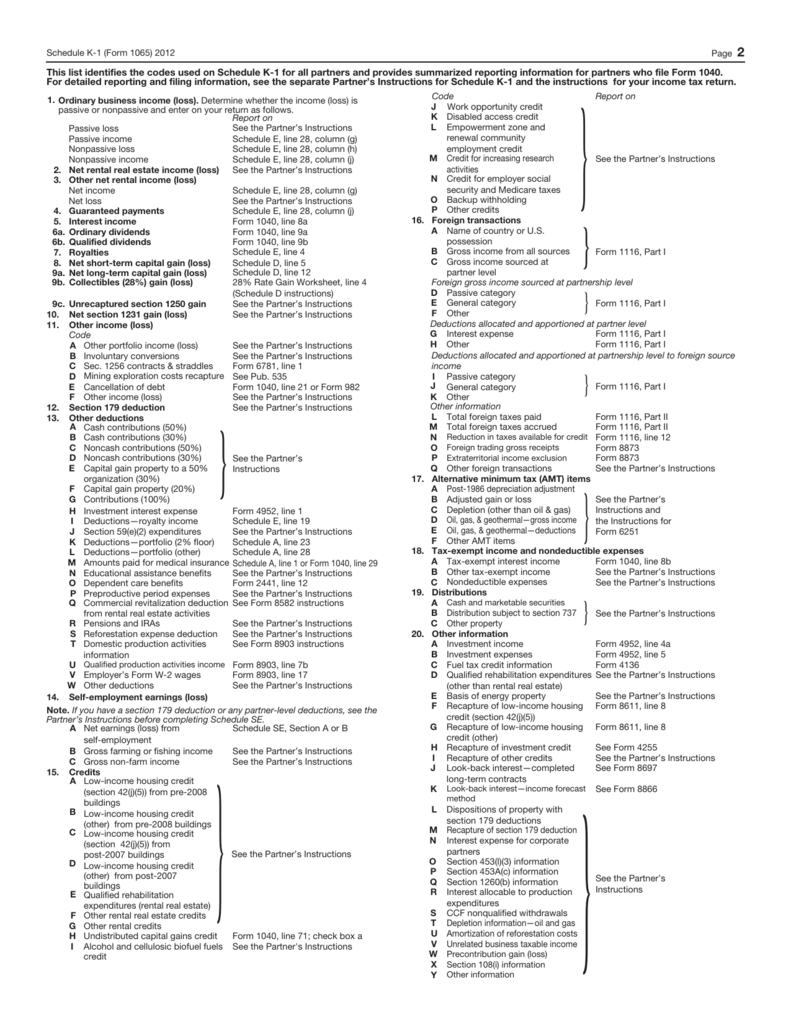

Form 1065 k-1 line 20 codes. Go into the Input Return workspace Enter Data in TY2012 and prior. There is an amount on the K-1 1065 line 20 code AG gross receipts for section 448c. Investment income Form 4952 line 4a Code B.

General Instructions Purpose of Schedule K-1 The partnership uses Schedule K-1 to report your share of the partnerships income deductions credits etc. I have no idea where. Locate the Credits section.

I received a Form 1065 Schedule K-1. Enter the applicable information regarding the sale. I received a K-1 from a PTP.

To enter Line 20 Code L. Only enter the information from Line 20 Code L manually if you are not exporting the K-1 from the Partnership module. Basis of energy property See page 16.

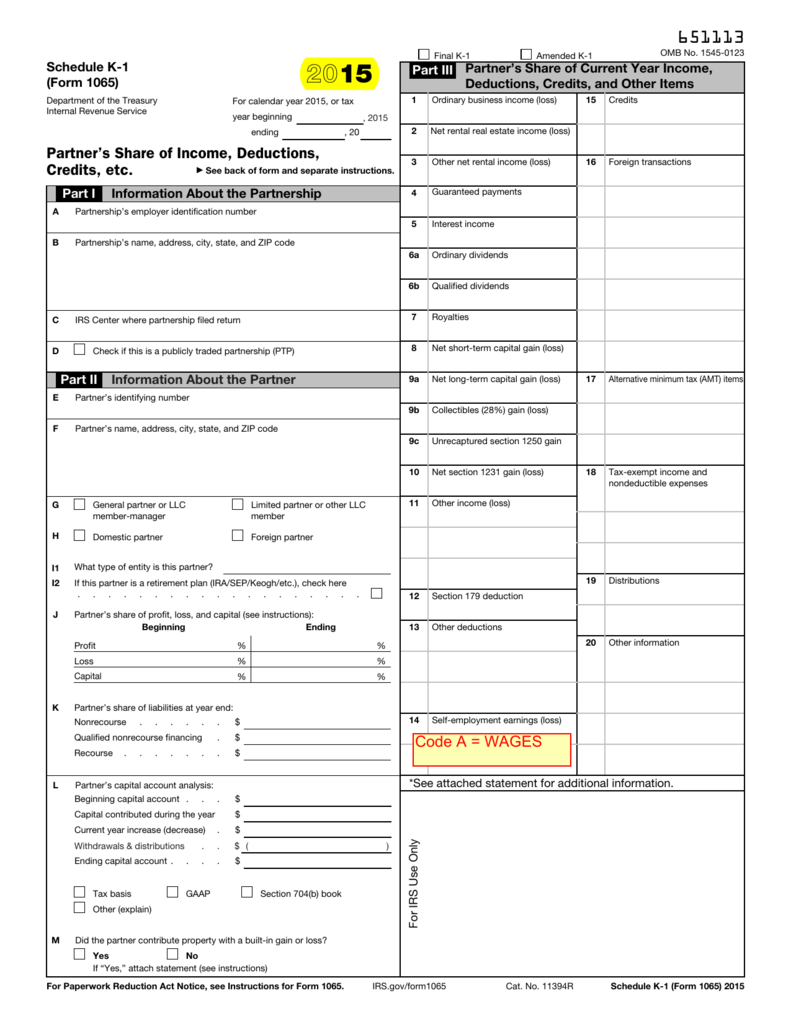

1545-0123 For calendar year 2020 or tax year beginning 2020 ending 20. The list of codes and descriptions are provided beginning at List of Codes Used in Schedule K-1 Form 1065 in these instructions. It is this information from Box 20 of the Schedule K-1 Form 1065 that should be used by the partner to calculate any 199A Deduction on their individual return.

The partnership reports this information on the Schedule K-1 Form 1065 in Box 20 Code Z. Go to Credits - General Business and Vehicle Credits. To enter Line 20 Code Z - Qualifying gasification project property See the K-1 instructions 6 below for more information.

The 2020 Form 1065 is an information return for calendar year 2020 and fiscal years that begin in 2020 and end in 2021. The K-1 belongs to an individual. Some items reported on your Schedule K-1 Form 1065 may need to be entered directly into a specific form instead of the K-1 entry screen.

The 2020 Form 1065 may also be used if. Yes for the Form 1065 return you are preparing in TurboTax Business you will need to enter it as box 20 code AH on the K-1s for each of the partners their share of that Statement amount with the same text information you were sent for the partnership as a whole. Other information Code A.

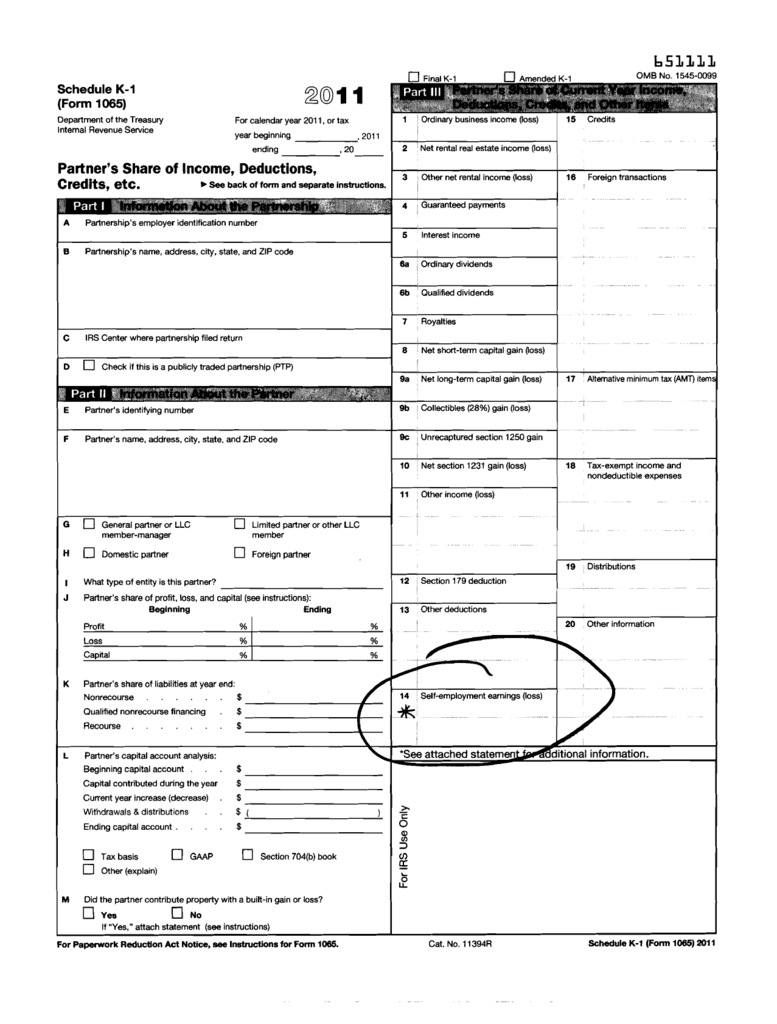

For detailed reporting and filing information see the separate Partners Instructions for Schedule K-1 and the instructions for your income tax return. Go to Screen 17 Dispositions. Schedule K-1 Form 1065 2006 Page 2 This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040.

The software allows only AH code. Below is a list of items that are not entered directly into Form 1065 Schedule K-1 within the program. 22 rows Items reported on your Schedule K-1 Form 1065 box 20 may need to be entered directly into.

Do not file it with your tax return. For a fiscal year or a short tax year fill in the tax year space at the top of Form 1065 and each Schedule K-1. The Box 20 information that is.

Qualified rehabilitation expenditures other than rental real estate See page 16 Code E. Box 20 new code AG has been added to report each partners share of the gross receipts under section 59Ae. Regulations section 1163j-6h created a new section 704d loss class for business interest expense effective for tax years beginning after November 12 2020.

Box 14 Self employmet earnings loss Code A -3988 and code C. Please find the specific item within Box 13 that is reported on your Form 1065. Form 1065 20 20 US.

NOw Line 20 has known codes and AH is the final one. Schedule K-1 Form 1065 Box 20 Code AH. Code AG box 20.

Instructions for Schedule K-1 Form 1065. As a result all partnerships must report business interest expense to partners on Schedules K-1 Form 1065. Enter the activity name.

According to final review this needs to be manually entered. The taxpayer should receive instructions from the partnership needed to address the items contained in this box. Gross receipts for sec-tion 448c2.

The amount reported 46239 represents gross sales less returns for the individuals percen. An executor is responsible to notify the partnership of the name and tax identification number of the decedents estate when the partnership interest is part of a decedents estate. Click on the Form CtrlT drop down menu.

Code N box 20. Investment expenses Form 4952 line 5 Code C. Fuel tax credit information Form 4136 Code D.

Return of Partnership Income Department of the Treasury Internal Revenue Service Go to for instructions and the latest information.

Drafts Of 2019 Forms 1065 And 1120s As Well As K 1s Issued By Irs Current Federal Tax Developments

Drafts Of 2019 Forms 1065 And 1120s As Well As K 1s Issued By Irs Current Federal Tax Developments

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Please Refer To The Multiple Choice Solution Below Chegg Com

Please Refer To The Multiple Choice Solution Below Chegg Com

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Irs Form 1120s Schedule K 1 Download Fillable Pdf Or Fill Online Shareholder S Share Of Income Deductions Credits Etc 2018 Templateroller

Irs Form 1120s Schedule K 1 Download Fillable Pdf Or Fill Online Shareholder S Share Of Income Deductions Credits Etc 2018 Templateroller

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Form 565 Schedule K 1 Partner S Share Of Income Deductions Credits Etc