Does Paypal Send 1099 For Crypto

For most states the threshold is set by the IRS at 20000 USD and 200 transactions in a. The position of PayPal is very balanced and pro-crypto.

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

PayPal will most likely issue Form 1099-Ks to users and the IRS if account holders gross proceeds exceed more than 20000 and have more.

Does paypal send 1099 for crypto. If all the payments are made through PayPal PayPal may then issue form 1099-K also for 50000. Form 1099-K is no different in this regard and cryptocurrency exchanges send out two copies of the form. If a user wants to close the PayPal crypto.

Only those customers that meet the 1099-K eligibility requirements will see the 1099-K available for download in their account. One to the qualifying customer and one to the IRS. However there are ways for crypto users to move funds through PayPal as outlined above.

The crypto space has acted accordingly Bitcoin jumped to the mark of 12000. Buy But Not Send. From this the IRS knows that you have been trading cryptocurrency and thus you will likely be expected to report crypto on your tax return.

To make matters worse users cant send their crypto funds elsewhere nor request it to their account. If you cross the IRS thresholds in a given calendar year PayPal will send Form 1099-K to you and the IRS for that tax year the following year. Whether you receive a 1099-K or not you are required to report your cryptocurrency transactions on your taxes.

PayPal will not cover losses from Cryptocurrency price fluctuations and we recommend that customers make sure purchasing Crypto is right for their. But it does not report your total gains or losses. The company issued a statement where the importance of wider adoption and understanding of the cryptocurrency space is highlighted.

Its considered taxable income. However THIS IS NOT the amount that you are on the hook for your taxes. Yes you need to report 1099-K income on your tax return regardless of whether the issuer of the form was required to send it to you or not.

We hope the guide on How To Withdraw Cryptocurrency To PayPal has been helpful for you. And bear in mind that when the issuer sends you a copy they also send it to the IRS who might wonder whats going on if you dont report it. But you only pay taxes on your capital gains.

If you dont want to get 1099kTHERE is a way Paypal sent one if you meet the 20k200 transactions thresholdif you split your business between AMZN and EbayAMZN has its own Paypal called AMZN one clickand like Paypalit will send you 1099k if you meet the same threshold. As more adoption takes place other financials institutions and services will likely allow for this as well. Visit our crypto tax FAQ post to learn more about how to report cryptocurrency on your tax return.

PayPal will provide the consumer with a 1099 tax form and report to. The buying and selling take place strictly within the PayPal platform. No unfortunately the 1099-MISC will not include everything you need for a full crypto tax report.

Paypal now lets you buy and sell cryptocurrencies like Bitcoin and Ethereum. Because they are operating the crypto hub as a closed platform and are restricting wallet transfers its possible that they will report a 1099-B which is actually more helpful for tax reporting purposes. Theres also no option to withdraw funds to an external cryptocurrency wallet.

This form is also known as a Payment Card and Third Party Network Transactions form. Its not clear yet whether PayPal will follow what Coinbase and other prominent exchanges do in using 1099-K to report crypto activity for users meeting certain qualifying factors. Sell But Not Transfer.

You can access your 1099-K from your PayPal account by January 31st annually. As for the services well we see PayPal joining the play. As is the case for many tax forms if youve received a Form 1099-K so has the IRS.

In this situation the taxpayer will be looking at 1099s totaling 100000 when in fact only. A lot of people are excited about it and some have speculated that. As a payment processor PayPal is required to issue Form 1099-Ks to users and the IRS if an account holders total proceeds go over 20000 and includes more than 200 transactions in.

This 1099-K is automatically sent to the IRS so they have an idea of your activity on third party exchanges. PayPal Pushes Crypto Further Mainstream With Planned Checkout Service for 29M Merchants. The gold standard in tax reporting for asset sales would be a Form 1099-B which is what brokerage firms use to report stocks and securities.

As part of PayPals commitment to protecting its users PayPal will not hold customers liable for Crypto purchases or sales made as a result of unauthorized activity in their PayPal account.

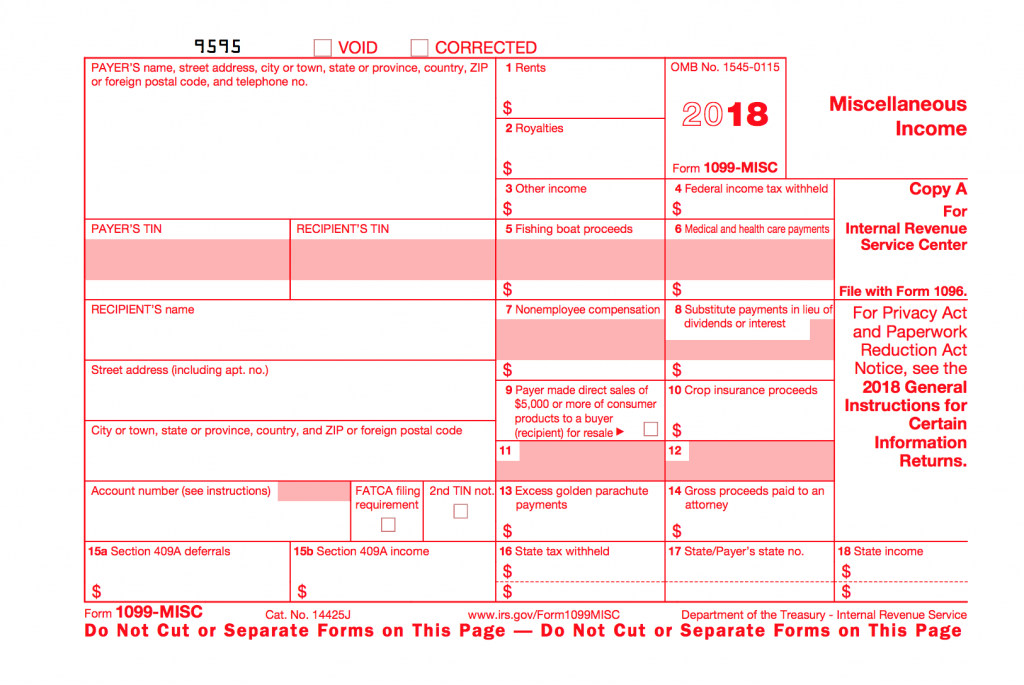

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Form 1099 Misc 2017 2018 Fillable Forms Irs Forms Payroll Template

Form 1099 Misc 2017 2018 Fillable Forms Irs Forms Payroll Template

1098 Software To Create Print And E File Irs Form 1098 Mobile Credit Card Software Tax Forms

1098 Software To Create Print And E File Irs Form 1098 Mobile Credit Card Software Tax Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

Do You Need To Issue A 1099 Misc Due

Do You Need To Issue A 1099 Misc Due

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

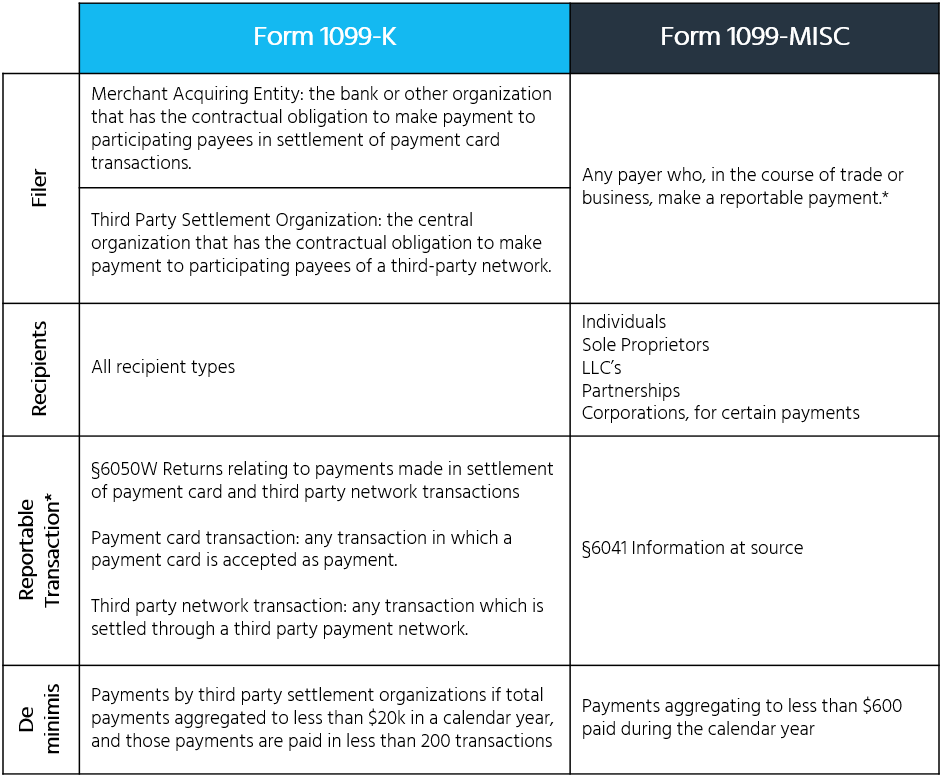

1099 Misc 1099 K Solutions For Double Reporting Paypal Coinbase Steemit

1099 Misc 1099 K Solutions For Double Reporting Paypal Coinbase Steemit

Coinbase Issue 1099 How To Use Bitfinex From Usa One Stop Solutions For Web And Mobile Development

Coinbase Issue 1099 How To Use Bitfinex From Usa One Stop Solutions For Web And Mobile Development

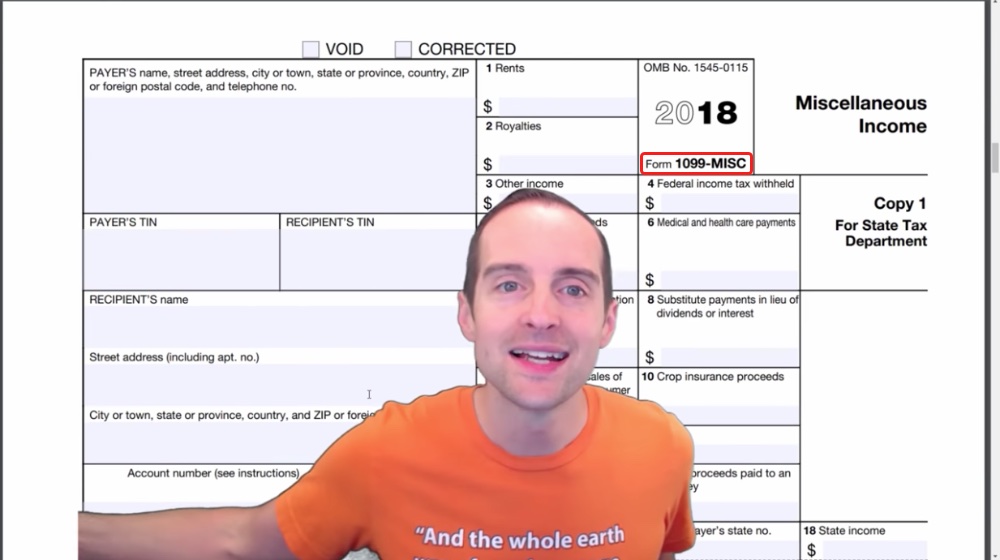

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

1099 Misc 1099 K Solutions For Double Reporting Paypal Coinbase Steemit

Pin By Saven Up On Visual Manifestation It Is So Credit Card App Finance Saving Free Money Now

Pin By Saven Up On Visual Manifestation It Is So Credit Card App Finance Saving Free Money Now

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos