What Does Business Name/disregarded Entity Name Mean

1 If this sounds like a double negative it is. Determining Disregarded Entity Status.

Advance Notice Business Name And Address To Be Displayed On The Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Advance Notice Business Name And Address To Be Displayed On The Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Single Member Limited Liability Companies A Limited Liability Company LLC is an entity created by state statute.

What does business name/disregarded entity name mean. Sole proprietorships and partnerships are not disregarded entities because the business does not exist as a separate entity from the owner. This means that the business does not file a tax return and the income and loss are reported on a single tax return filed by the owner. A single-member LLC SMLLC for example is considered to be a disregarded entity.

The term disregarded entity refers to how a single-member limited liability company LLC may be taxed by the Internal Revenue Service IRS. A disregarded entity refers to a business entity with one owner that is not recognized for tax purposes as an entity separate from its owner. Another way to say this is that the business is not separated from the owner for tax purposes.

There are a number of advantages to setting up a business as a disregarded entity. The IRS lets the owner of this business entity to report various aspects of the business like the losses income credits and deductions on. A disregarded entity is an incorporated business that is considered separate from the owner for liability purposes Point 1 above but is considered the same as the owner for tax purposes Point 2.

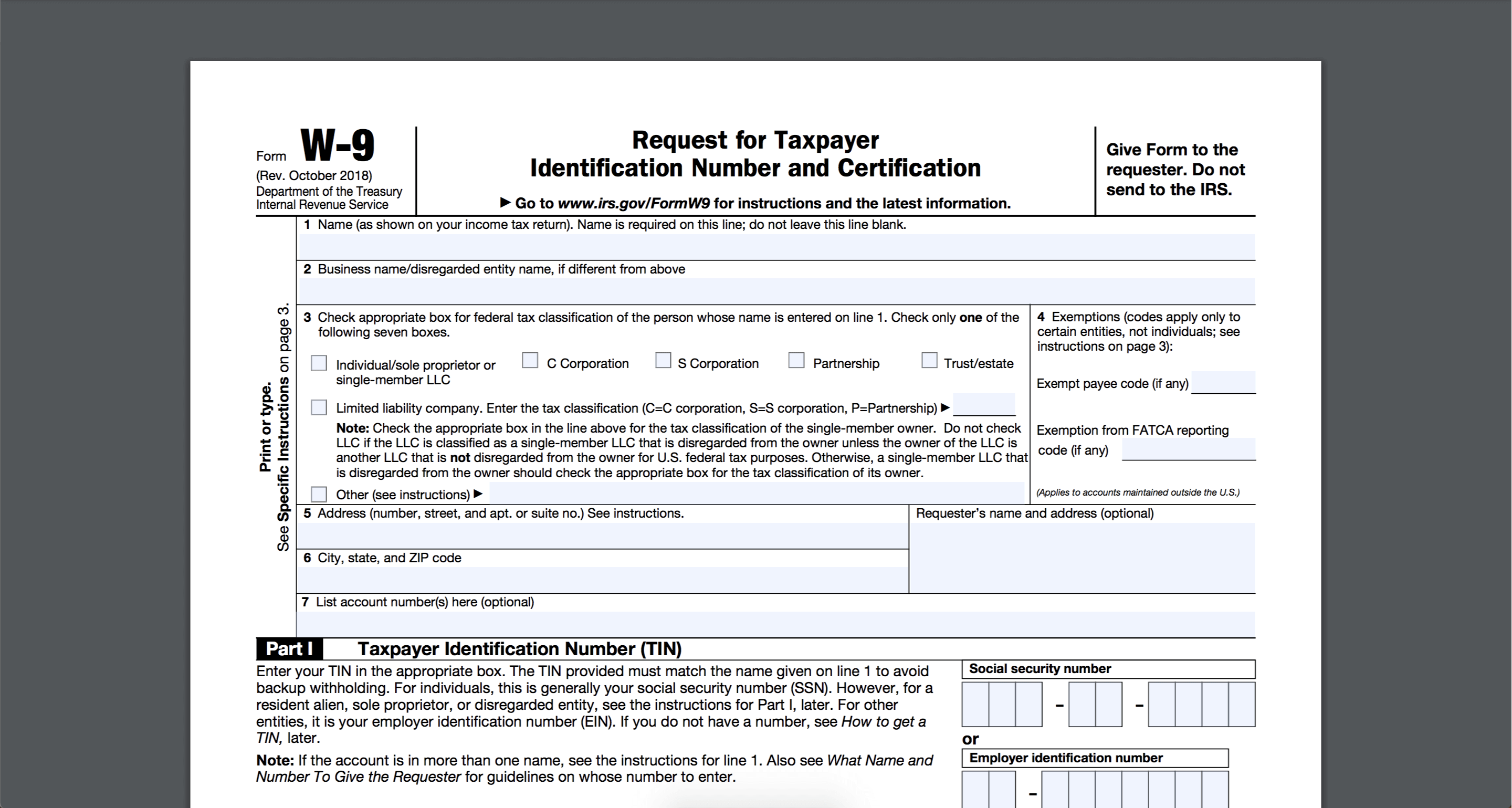

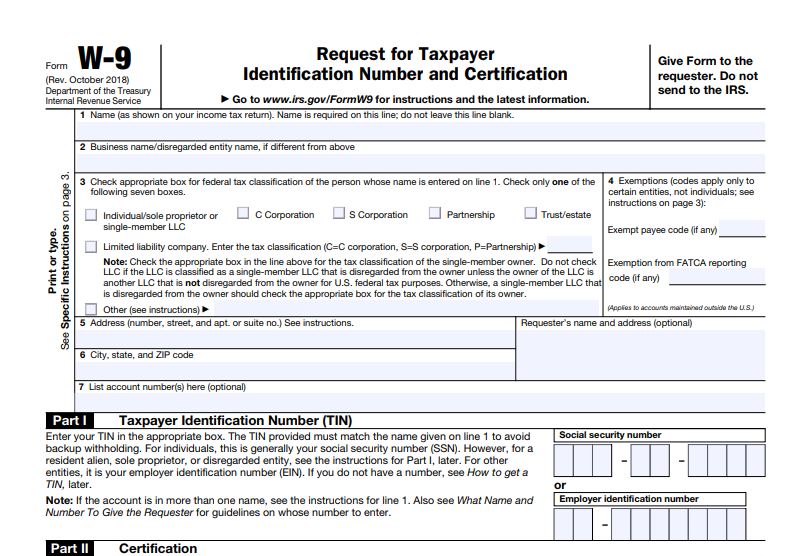

Federal tax purposes an entity that is disregarded as an entity separate from its owner is treated as a disregarded entity See Regulations section 3017701-2 c 2 iii. This means that the owner of the SMLLC is taxed like a sole proprietorship. Enter the owners name on line 1.

If your LLC is deemed a disregarded entity it simply means that in the eyes of the IRS your LLC is not taxed as an entity separate from you the owner. A disregarded entity is a business entity which is separate from its owner however disregards this distinction for the tax issues. A disregarded entity is a tax classification reserved for single-member limited liability companies LLC.

A disregarded entity is a single-member LLC. The business owner essentially wants the IRS to disregard the fact that the business is a. A disregarded entity is a business unit that is separate from its owner except when it comes to taxes.

A Disregarded Entity refers to a business entity owned by one person but is separate from its owner for liability purposes. The term disregarded entity refers to a business entity thats a separate entity from its owner but that is considered to be one in the same as the owner for federal tax purposes. A disregarded entity is a business entity considered separate from the owner when it comes to liability and the same as the owner for tax purposes.

A sole proprietorship is a one-owner business thats personally owned by the proprietor aka the owner and its the simplest way to organize and run any business. Is a disregarded entity the most advantageous tax classification for your single-member LLC SMLLC. The owner claims the business on personal taxes but when liability issues arise the owners personal assets are protected.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. An example of a disregarded entity is a single-member LLC as it absorbs the liabilities. However an LLC with only one member is disregarded as separate from its owner for income tax purposes.

However profits from it are reported on the owners personal tax returns. A disregarded entity is a business that is separate from its owner but which elects to be disregarded as separate from the business owner for federal tax purposes. This means that you.

For federal and state tax purposes the entity is disregarded meaning the entity does not file a separate tax return. Corporations are generally not disregarded for tax purposes. For other entities it is your employer identification number EIN.

The answer is disregarded entity which is basically a fancy way of saying that the IRS pretends that the LLC doesnt exist. Resident alien sole proprietor or disregarded entity see the instructions for Part I later. In other words these entities are regarded as separate in terms of liability but disregarded as separate in terms of taxation.

In other words a disregarded entity is a business entity with one owner that is not recognized for tax purposes as separate from its owner. An LLC is typically considered as a separate entity from the owners.

How To Form An Llc In California Startingyourbusiness Com

How To Form An Llc In California Startingyourbusiness Com

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

How To Fill Out And Sign Your W 9 Form Online

How To Fill Out And Sign Your W 9 Form Online

How To Fill Out An Irs Form W 9 Sheila Hansen Cpa

How To Fill Out An Irs Form W 9 Sheila Hansen Cpa

What Is A Form W9 And How Do I Fill One Out Countless

What Is A Form W9 And How Do I Fill One Out Countless

What Is A W 9 Business Attorney Nonprofit Attorney

What Is A W 9 Business Attorney Nonprofit Attorney

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

6 Questions To Find Your Perfect Brand Name Branding Your Business Design Company Names Branding Website Design

6 Questions To Find Your Perfect Brand Name Branding Your Business Design Company Names Branding Website Design

/w-9_147044986-5bfc3441c9e77c00519c4986.jpg) Filling Out Form W 9 Request For Taxpayer Identification Number Tin And Certification

Filling Out Form W 9 Request For Taxpayer Identification Number Tin And Certification

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

Can The W 9 Tax Form Be Filled Out Under A Company S Name Or Only Under An Individual S Name Quora

How To Change Your Llc Name With The Irs Llc University

How To Change Your Llc Name With The Irs Llc University

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

Change Your Business Name With The Irs Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services

Https Www Michigan Gov Documents Setwithmet W9 Aug2013 Contractbox 433950 7 Pdf

Reminder Notice Business Name And Address To Be Displayed On Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Reminder Notice Business Name And Address To Be Displayed On Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Advance Notice Business Name And Address To Be Displayed On The Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Advance Notice Business Name And Address To Be Displayed On The Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums