How To Change Sole Proprietorship Ownership

Most small businesses operate as sole proprietorships. File LLC Annual Report and Personal Property Tax Return.

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

The GST authorities have clarified that transfer or change in the ownership of business would happen in the case of death of the sole proprietor and would include the transfer or change in the ownership of a business.

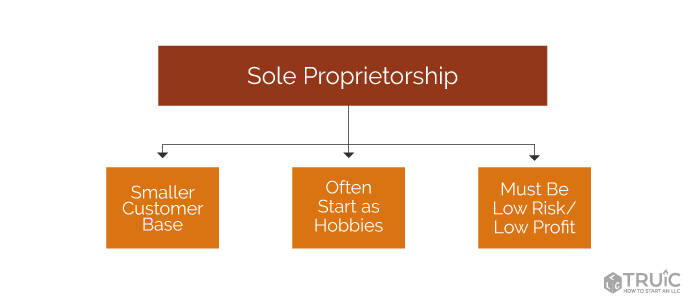

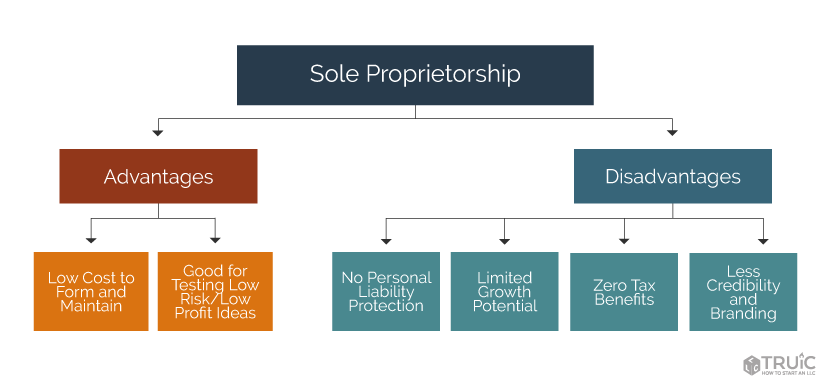

How to change sole proprietorship ownership. Sole proprietorships must file form 1040 Schedule C. Sole proprietorships present a few advantages over other business structures. In most states sole proprietorships do not have to register with the state business registrar.

Please note that if you had a business bank account for your sole proprietorship youll need to close that account and open a new one in the LLCs name and with your new EIN number. Instead you simply create a partnership as you normally would. As a business grows owners may decide to expand and form another structure such as a partnership or LLC.

The sole proprietor must determine which specific assets will be sold as part of the business. Additional tax and regulatory requirements may apply to your LLC. 9 rows A sole proprietor is someone who owns an unincorporated business by.

To convert a sole proprietorship to a limited liability company LLC youll file the same paperwork as you would if you had created the LLC from scratch. Change the contact information on any state business registration or license. If you plan to transfer business ownership of the Sole-Proprietorship you must lodge the change with the Registrar online via BizFile using SingPass or CorpPass within 14 days from the date of the change.

All the legal obligations and debts that youve undertaken throughout the operation of the business will remain with you and cannot be transferred to someone else. GST Authorities Clarifies ChangeTransfer In Ownership Of Sole Proprietorship. The parties to the transaction must agree on a fair price for the business.

If you have operated your sole proprietorship under a Doing Business As DBA name contact the state office where you registered the name. You can incorporate a sole proprietorship at any time of the year but it is best to do it close to the beginning of the year because you must file a different tax return for each business type you operate during the year. Since a sole proprietorship represents the owner of the business you cannot actually transfer a sole proprietorship to someone else.

Sole-proprietorships Partnerships Updating information of sole proprietorship Renewing sole proprietortorship Common offences under the Business Names Registration Act Closing the sole proprietorship Variable Capital Companies Setting up a VCC Managing a VCC Updating info of VCC and VCC officers Register a charge for VCC. Transferring from a sole proprietorship to a partnership is somewhat misleading. Late notification of the change may attract penalty.

Once you have created your corporation you must transfer assets from your sole proprietorship to the corporation. A handful states such as Nevada require all businesses even sole proprietorships to have a state business license. Youll also update sole proprietorship registrations including business permits licenses and trade name registrations bank accounts and contracts to reflect the change.

They require fewer forms to establish and have fewer legal restrictions and the owner retains profits. What Can a Sole Proprietorship Sell or Transfer. Procedure for Change in the Ownership of a Sole Proprietorship Separation of Assets.

Because a sole proprietorship requires no formal registration or creation process there is no need to dissolve or transfer the sole proprietorship before creating a partnership. This is not an. Sole Proprietorship Taxes The new owner of the business is now classified as a sole proprietorship unless he opts to form a corporation.

Learn the advantages of sole proprietorship as well as the disadvantages to determine if this is the right entity type for your small business.

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

Human Resource Management For Small Businesses

Human Resource Management For Small Businesses

Choosing A Business Structure Business Structure Infographic Small Business Growth

Choosing A Business Structure Business Structure Infographic Small Business Growth

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Forms Of Business Ownership Business Ownership Organization Development Business

Forms Of Business Ownership Business Ownership Organization Development Business

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

A General Partnership Is Much Like A Sole Proprietorship In That Liabilities Are Still Completely On General Partnership Sole Proprietorship Business Structure

A General Partnership Is Much Like A Sole Proprietorship In That Liabilities Are Still Completely On General Partnership Sole Proprietorship Business Structure

Types Of Business Ownership Powerpoint Note Taking Guide Quiz And Quiz Key Business Ownership Business Note Taking

Types Of Business Ownership Powerpoint Note Taking Guide Quiz And Quiz Key Business Ownership Business Note Taking

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate