Covid 19 Business Loan Application Rbc

One-time Federal Government registration fee of 2 of the loan amount which may be included in the amount borrowed A 125 Administration Fee is. Quotes As Canada fights a powerful second wave of COVID-19 many of our small businesses are facing immense uncertainty.

Rbc Unveils Second Phase Of Covid 19 Relief Eye Witness News

Rbc Unveils Second Phase Of Covid 19 Relief Eye Witness News

To qualify for the maximum forgiveness of 10000 the maximum balance.

/https://www.thestar.com/content/dam/thestar/business/2019/08/12/rbc-analyst-charged-with-insider-trading-a-year-after-finishing-nyu-business-undergrad/rbc.jpg)

Covid 19 business loan application rbc. RBC Scotiabank introduce online enrollment for emergency business loans. Access to funds through Online Banking for Business ATMs or in branch. This program is designed to help small businesses and small agricultural cooperatives who have suffered substantial economic loss due to the pandemic.

The COVID-19 Targeted EIDL Advance was signed into law on December 27 2020 as part of the Economic Aid to Hard-Hit Small Businesses Non-Profits and Venues Act. Businesses can qualify for loans up to 40000 to help cover operating costs. This gave lenders and community partners more time to work with the smallest businesses to submit their applications while also ensuring that larger PPP-eligible businesses.

As the nation and the world grapple with the spread of COVID-19 and global economies shut down in an effort to keep people safe at home business owners are facing a crisis of their own. Canadian financial institutions have reacted quickly to the changing needs of business owners and many have put relief measures in place as a means to support those financially affected by COVID-19. TORONTO February 5 2021 - As businesses across Canada continue to manage the fallout caused by COVID-19 RBC today announced that it is now accepting applications for the Government of Canadas Highly Affected Sectors Credit Availability Program HASCAP.

Repaying the balance of the loan on or before December 31 2022 will result in loan forgiveness of. RBC has donated funds to The World Health Organizations COVID-19 Solidarity Response Fund. The program is available to eligible business clients that have been negatively impacted by COVID-19 and provides access to loan.

Let us find a tailored solution just for you. Credit lines start at 10000. Businesses are continuing to face significant cash flow challenges and disruption to their business continuity as a result of the prolonged COVID-19.

The Canada Emergency Business Account CEBA provides interest-free partially forgivable loans of up to 60000 to small businesses and not-for-profits that have experienced diminished revenues due to COVID-19 but face ongoing non-deferrable costs such as rent utilities insurance taxes and wages. Businesses heavily impacted by COVID-19 can access guaranteed low-interest loans of 25000 to 1 million to cover operational cash flow needs. The CEBA loan forgiveness amount is based on the maximum balance on the RBC CreditLine for Small Business at any time between the date of account open and June 30 2021.

Canada Emergency Business Account CEBA interest-free loans. Who Can Apply for a Coronavirus Small Business Loan. The Targeted EIDL Advance provides businesses in low-income communities with additional funds to ensure small business continuity adaptation and resiliency.

Businesses cannot apply independentlyfirst local county and state officials. The financial fallout of mass social distancing. Loan forgiveness of 25 will apply when 75 of your maximum loan balance is repaid by December 31 2022.

RBC is providing support to a team of researchers at Sinai Health and the University of Toronto with funds to back the early stages of developing a blood test that can identify who is immune to COVID-19 on a mass scale. The line of credit will automatically be paid down with supplemental funds from your everyday operating account. Royal Business Operating Line.

The EDC BCAP provides eligible mid-sized and large RBC business clients with a loan of up to 625 million to offer short-term liquidity. RBC business clients who have been registered as a business. RBC announced today that the online-only enrollment process to participate in the Government of Canadas Canada.

You can apply for a CEBA loan through the financial institution where your primary Business Operating Account is held. Specifically on February 24 2021 at 900 am. The Canada Emergency Business Account CEBA was created to help small businesses who are financially struggling because of COVID-19.

For instance RBC is offering a number of temporary relief solutions 1 for eligible small business and commercial clients. View all Mid and Long Term Business Loans. To apply eligible businesses and not-for-profits need to contact the financial institution that provided their initial CEBA loan and provide the appropriate information and documentation.

Answer a few short questions using Your Digital Business Advisor tool and well recommend the right products and services tailored to meet your business needs. Highly Affected Sectors Credit Availability Program HASCAP Guarantee. In recognition of the economic risks posed by the pandemic the federal government is unveiling new measures to help.

Access the credit you need when you need it to run your business smoothly with a line of credit. TORONTO April 17 2020 - Today RBC announced the launch of the Government of Canadas Export Development Canada EDC Business Credit Availability Program BCAP. On February 22 2021 President Biden announced the following changes to SBAs COVID-19 relief programs to ensure equity.

Renewal fee 0 if stand-alone CSBFL Registration Fee. An important qualification is that these businesses must be unable to secure alternative funding. ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees.

The CERB application will be accessible through a secure web portal starting in.

Rbc Royal Bank Launches New Campaign To Highlight Acts Of Kindness Across The Caribbean Ieyenews

Rbc Royal Bank Launches New Campaign To Highlight Acts Of Kindness Across The Caribbean Ieyenews

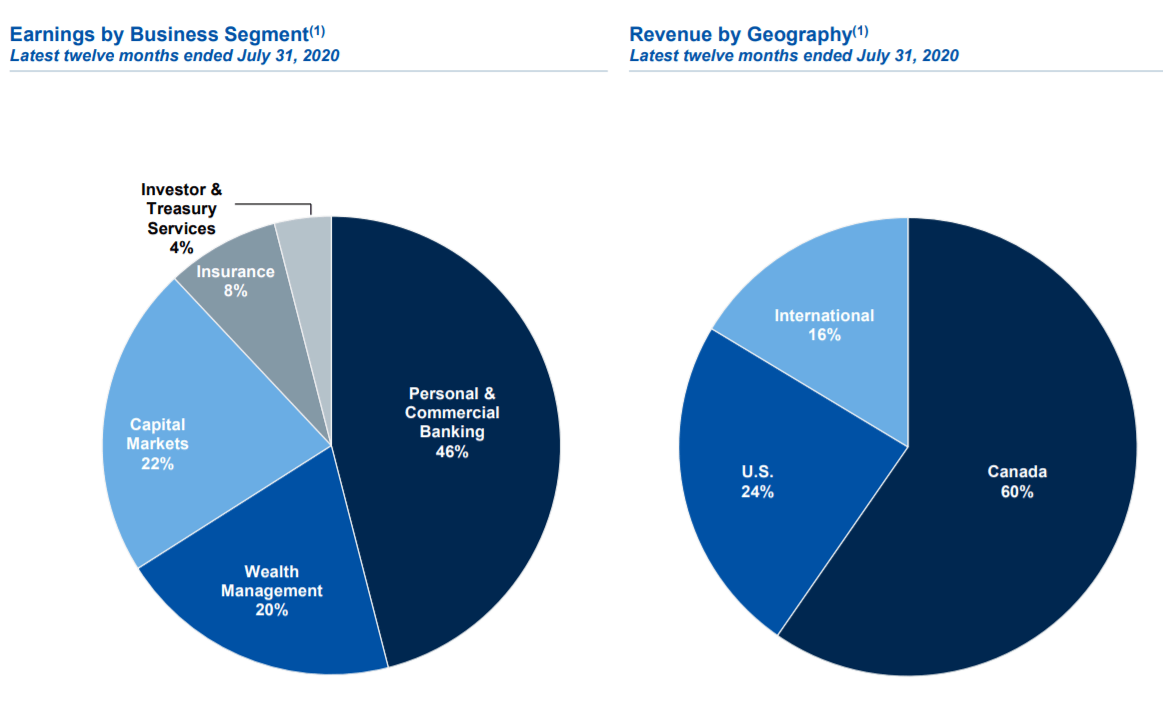

Company Insights Royal Bank Of Canada Is Reserved Boring And Copiously Profitable Nyse Ry Seeking Alpha

Company Insights Royal Bank Of Canada Is Reserved Boring And Copiously Profitable Nyse Ry Seeking Alpha

/https://www.thestar.com/content/dam/thestar/business/2019/08/12/rbc-analyst-charged-with-insider-trading-a-year-after-finishing-nyu-business-undergrad/rbc.jpg) Rbc Analyst Charged With Insider Trading A Year After Finishing Nyu Business Undergrad The Star

Rbc Analyst Charged With Insider Trading A Year After Finishing Nyu Business Undergrad The Star

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

Rbc Drive App Puts Canadians In Control Of Car Records Travel Expenses

Credit Card Transfer Creditcard Credit Card Rewards Credit Card Creditcard Credit Card Rewards Creditcard Cr Visa Credit Card Credit Card Credit Card Visa

Credit Card Transfer Creditcard Credit Card Rewards Credit Card Creditcard Credit Card Rewards Creditcard Cr Visa Credit Card Credit Card Credit Card Visa

New Rbc Research Reveals Financial Mismanagement Rising Costs As Key Impacts Of Cognitive Decline Caregiving

New Rbc Research Reveals Financial Mismanagement Rising Costs As Key Impacts Of Cognitive Decline Caregiving

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/7EIYFNKXNBHGDBWHTLHDWGEX34.jpg) Rbc Launches More Services For Clients Hardest Hit In Pandemic Using Hundreds Of Retrained Staff The Globe And Mail

Rbc Launches More Services For Clients Hardest Hit In Pandemic Using Hundreds Of Retrained Staff The Globe And Mail

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

Rbc Correspondent Services And Rbc Advisor Services Launch New Wealth Management Technology Platform

How To Find And Use Your Rbc Bank Login Gobankingrates

How To Find And Use Your Rbc Bank Login Gobankingrates

Rbc Royal Bank Launches Second Phase Of Client Relief Options American Airlines Saint Vincent And The Grenadines Resume Services

Rbc Royal Bank Launches Second Phase Of Client Relief Options American Airlines Saint Vincent And The Grenadines Resume Services

This Fintech Makes Banks Like Rbc More Profitable

This Fintech Makes Banks Like Rbc More Profitable

Canada S Rbc To Create Us Digital Bank For Super Affluent Consumers Fintech Futures

Canada S Rbc To Create Us Digital Bank For Super Affluent Consumers Fintech Futures

Newest Rbc Royal Bank Promotions Bonuses Offers And Coupons January 2021 Gobankingrates

Newest Rbc Royal Bank Promotions Bonuses Offers And Coupons January 2021 Gobankingrates