Business Credit Form 3800

Jun 06 2019 The credit you are selecting is 8846 Employer SS and Medicare. What is the General Business Credit Form 3800.

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

The credits supported by our program that will populate on this form are.

Business credit form 3800. Jun 04 2019 IRS Form 3800 instructions state that they can be carried forward for 20 years but then may be taken as a deduction in thetax year following the last tax year of. 1545-0895 2020 Attachment Sequence No. The item Form 3800 general business credit represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library.

Credits Menu General Business Credit 3800 Select Current Year General Business Credits to complete a credit form for the current year only. Sep 12 2019 The General Business Credit Form 3800 calculates the total amount of tax credits youre eligible to claim in a particular tax year. Names shown on return.

The credit claimed is subject to a limitation based on your tax liability that is figured on the form used to compute that particular credit. Form 3800 Department of the Treasury Internal Revenue Service 99 General Business Credit Go to wwwirsgovForm3800 for instructions and the latest information. This item is available to borrow from 1 library branch.

If you claim more than one credit. There will be a place to explain how it was computed. The credit claimed is subject to a limitation based on your tax liability that is figured on the form used to compute that particular credit.

You enter the allowable credit as your general business credit on Form 1040 Line 54. File Form 3800 to claim any of the general business credits. Select General Business Credit Carryforwards to.

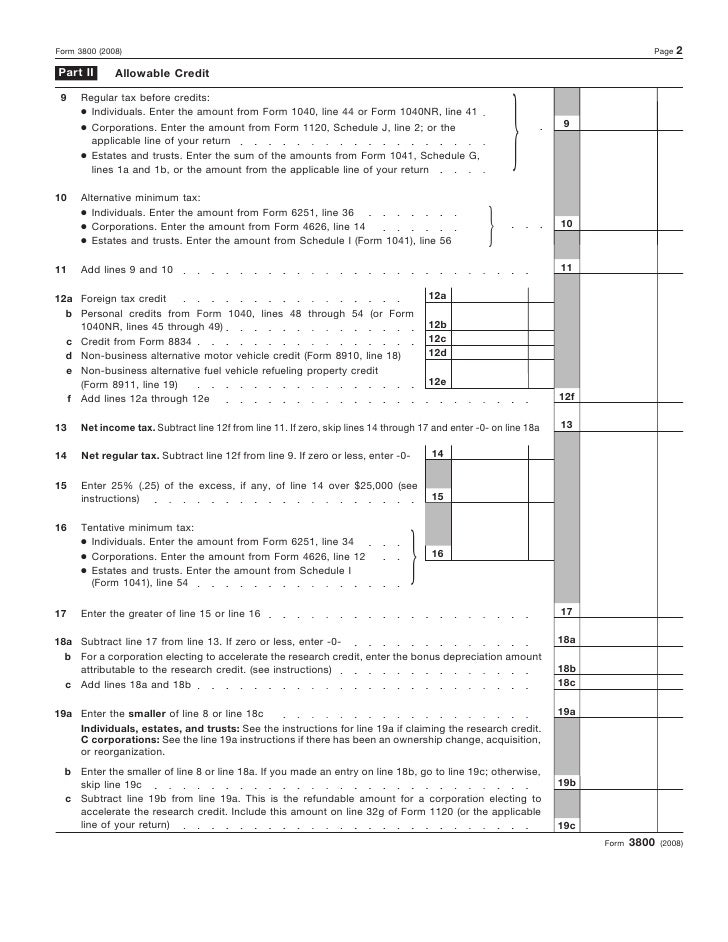

If the business that generated the credit is not an eligible small business the research credit will be reported on Form 3800 Line 1c. A Credit for increasing research activities is reported on Form 3800 Line 4i if the credit is from an eligible small business. 1545-0895 2019 Attachment Sequence No.

Form 3800 Department of the Treasury Internal Revenue Service 99 General Business Credit Go to wwwirsgovForm3800 for instructions and the latest information. You are claiming the investment credit Form 3468 or the biodiesel and renewable diesel fuels credit Form 8865. We last updated the General Business Credit in January 2021 so this is the latest version of Form 3800 fully updated for tax year 2020.

In some cases each credit must be claimed on its own unique form the source form. I nvestment Form 3468. Names shown on return.

22 Names shown on return Identifying number. The following exceptions apply. To access the general business credits in TaxSlayer Pro from the Main Menu of tax return From 1040 select.

The one credit youre claiming is your general business credit. You must attach all pages of Form 3800 pages 1 2 and 3 to your tax return. You must attach all pages of Form 3800 pages 1 2 and 3 to your tax return.

If you are adding a second one there. Each credit is. You can make sure it is correct by going to the Forms Mode.

22 Names shown on return Identifying number. You must attach all pages of Form 3800 pages 1 2 and 3 to your tax return. Only source for a credit listed on Form 3800 Part III is from a partnership S corporation estate trust or cooperative can report the credit directly on Form 3800.

Form 3800 Department of the Treasury Internal Revenue Service 99 General Business Credit Information about Form 3800 and its separate instructions is at wwwirsgovform3800. Form 3800 must be filed. Form 3800 is not required.

The IRSs website currently lists 25 eligible business credits although this can change from year to year. You must attach all pages of Form 3800 pages 1 2 and 3 to your tax return. Form 3800 Department of the Treasury Internal Revenue Service 99 General Business Credit Go to wwwirsgovForm3800 for instructions and the latest information.

Do not include any general business credit claimed on Form 3800 any prior year minimum tax or any credit claimed on Form 8912 Credit to Holders of Tax Credit Bonds. If you claim multiple business credits then our program will draft Form 3800 General Business Credits onto your return.

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 5884 Instructions How To Fill Out And File Form 5884

Form 5884 Instructions How To Fill Out And File Form 5884

Form 3800 General Business Credit

Form 3800 General Business Credit

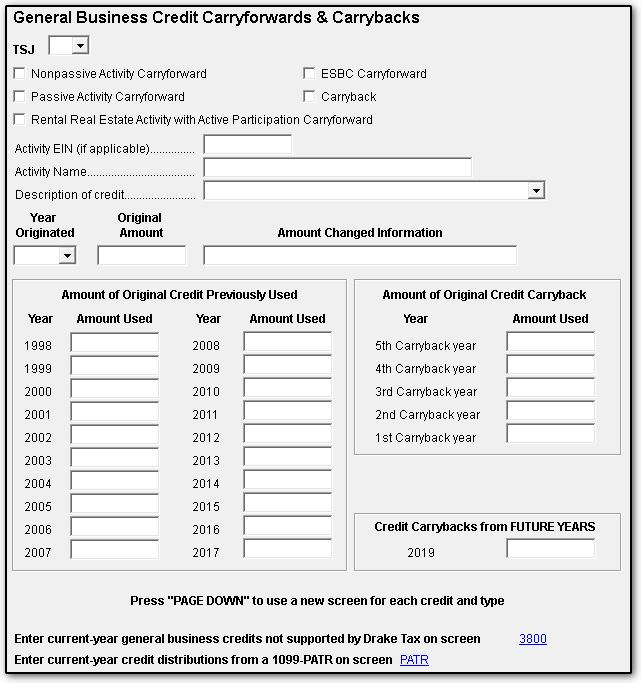

Gbc And 3800 Screens For General Business Credits

Gbc And 3800 Screens For General Business Credits

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Https Www Irs Gov Pub Irs Prior I8908 2020 Pdf

Form 3800 General Business Credit

Form 3800 General Business Credit

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Gbc And 3800 Screens For General Business Credits

Gbc And 3800 Screens For General Business Credits

Form 3800 How To Complete It Fora Financial Blog

Form 3800 How To Complete It Fora Financial Blog

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

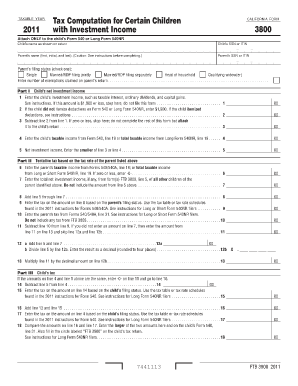

California Form 3800 Fill Online Printable Fillable Blank Pdffiller

California Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 General Business Credit

Form 3800 General Business Credit

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form