Sole Proprietorship Change Owner

Incorporating a Sole Proprietorship Changing from a sole proprietorship to a corporation helps protect the business owners personal assets by separating them from those of the business. You can sell your sole proprietorship or transfer it to another person just like any other business but if.

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

Costs are minimal with legal costs limited to obtaining the necessary licenses or permits.

Sole proprietorship change owner. The GST Goods Services Tax Authority on Thursday made it clear that transfer or change in the ownership of business will include transfer or change in the ownership of business. The owner is liable for all business debts and all assets and liabilities are placed in the name of the owner and not in the name of a. Also use Schedule C to report wages and expenses you had as a statutory employee.

Because you are the sole owner of the business you have complete control over all decisions. Report farm income and expenses. Changing from a sole proprietorship to an LLC may be a smart move for your business as well as for the protection of your personal assets.

A sole proprietorship is an alter ego of its owner not an independent legal entity like a corporation. A sole proprietorship is the simplest and least expensive business structure to establish. Still you should be aware that you could end up paying more in taxes and fees with an LLC than you would have if you had stayed a sole proprietor.

Sole-proprietorships Partnerships Updating information of sole proprietorship Renewing sole proprietortorship Common offences under the Business Names Registration Act Closing the sole proprietorship Variable Capital Companies Setting up a VCC Managing a VCC Updating info of VCC and VCC officers Register a charge for VCC. A sole proprietorship is an unincorporated business with only one owner who pays personal income tax on profits earned. The owner is personally responsible for all business obligations and debts which means that business creditors can come after the owners personal assets.

Easy and inexpensive to form. How to Start a Sole Proprietorship in Maryland. Change of Ownership of a Sole-Proprietor Business Business Owner Must Know A sole-proprietorship operates as an aspect of the owners personal identity.

Report income or loss from a business you operated or a profession you practiced as a sole proprietor. Sole proprietorships are easy to. Schedule F 1040 or 1040-SR Profit or Loss from Farming.

File it with Form 1040 or 1040-SR 1041 1065 or 1065-B. They can elect to have their jointly-owned business treated as a sole proprietorship as long as they follow certain rules. A sole proprietor is not an incorporated individual because the sole proprietor has not formed a corporation.

Usually to qualify as a sole proprietorship a business can only have one owner. Being a sole practitioner or solo practitioner does not necessarily mean that the practitioner is a sole proprietor and vice versa. The level of protection varies depending on the type of corporation you select.

According to LegalZoom a sole proprietorship changes ownership when you transfer or sell all assets associated with the business. Technically the new owner must establish a. There is an exception to this rule for spouses who own a business together.

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Forms Of Business Ownership Business Ownership Organization Development Business

Forms Of Business Ownership Business Ownership Organization Development Business

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

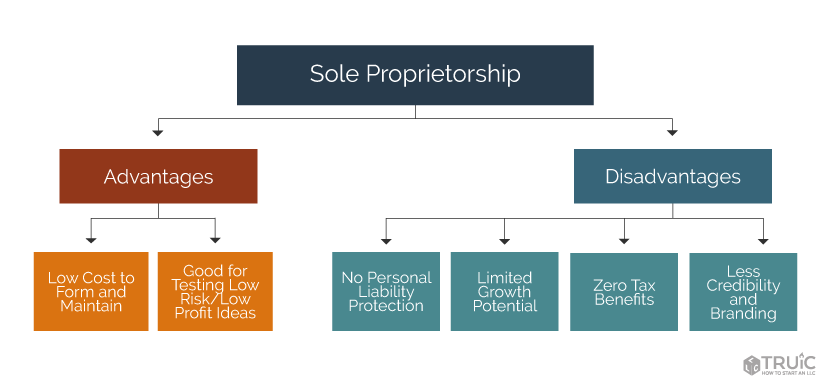

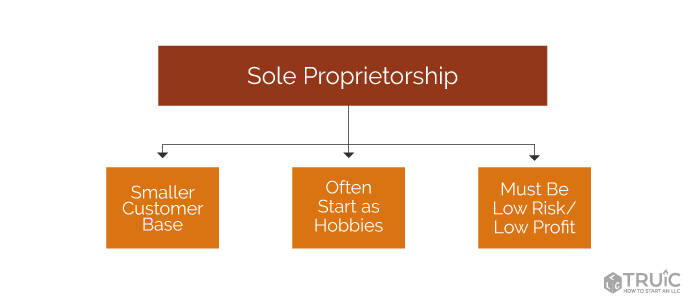

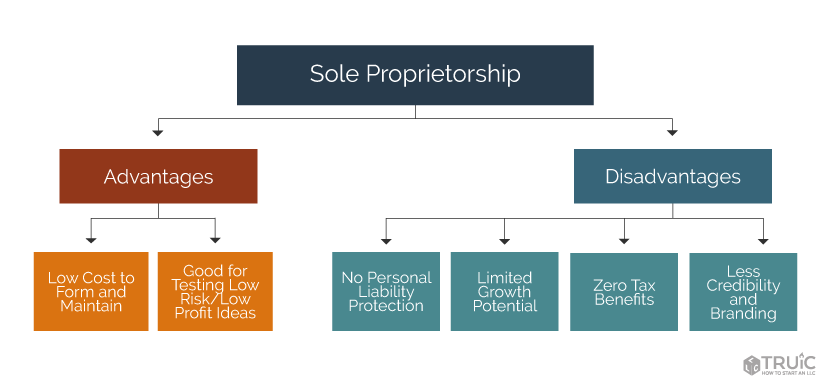

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Choosing A Business Structure Business Structure Infographic Small Business Growth

Choosing A Business Structure Business Structure Infographic Small Business Growth

Income Contribution Letter Example Of Sole Proprietorship Letter Sole Proprietorship Letter Example Lettering

Income Contribution Letter Example Of Sole Proprietorship Letter Sole Proprietorship Letter Example Lettering

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Pros And Cons Of A Sole Proprietorship

Pros And Cons Of A Sole Proprietorship

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

Corporate Structure Hierarchy Sole Proprietorship Business Systems Leadership Management

Advantages Of Business Incorporation Business Business Structure Sole Proprietorship

Advantages Of Business Incorporation Business Business Structure Sole Proprietorship

Human Resource Management For Small Businesses

Human Resource Management For Small Businesses

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management

California Assembly Bill 5 What Entrepreneurs Need To Know Business Beyond The Shoe Box Small Business Growth Business Tax Financial Health

California Assembly Bill 5 What Entrepreneurs Need To Know Business Beyond The Shoe Box Small Business Growth Business Tax Financial Health

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection