Missouri Corporate Income Tax Filing Requirements

Missouris corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Missouri. The tax is paid by the shareholder on their Missouri individual income tax return.

2021 Taxes A Comprehensive Guide To Filing Money

2021 Taxes A Comprehensive Guide To Filing Money

Missouri Nonprofits State Filing Requirements Any corporation Tax Exempt Nonprofits filing a Federal Form 990 990EZ 990N or 990PF is NOT required to file a Missouri corporation income tax return and should NOT send a copy of the federal form to the Department of Revenue.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Missouri corporate income tax filing requirements. Not only is the corporations income taxed but when corporate earnings are distributed to stockholders in the form of dividends the stockholder receiving the money is also taxed. The corporation begins with Federal Taxable Income from the federal tax return. However Form MO-7004 must still be submitted to the Department.

Similar to the personal income tax businesses must file a yearly tax return and are allowed deductions such. Corporation income tax returns are due on the 15th day of the fourth month after the close of the tax year for companies whose tax year corresponds with the. The franchise tax is due the 15th day of the fourth month from the beginning of the taxable period and is calculated based on the par value of outstanding shares and surplus if in excess of 200000.

Missouri requires corporations to file an Annual Registration Report by April 15. By paying your Corporate Estimated Tax payment through the online payment system you are also filing form MO-1120ES. The amount of your Missouri adjusted gross income is less than the standard deduction amount for your filing status.

The income of a corporation is taxed in the same manner as the income of an individual though the corporate tax scheme and rates differ from personal income tax. You are a resident with less than 1200 of Missouri adjusted gross income. Annual report and franchise tax.

Skip to main content. Employers engaged in a trade or business. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

The Missouri corporate income tax is the business equivalent of the Missouri personal income tax and is based on a bracketed tax system. Missouri taxes the income of traditional C-type corporations at a flat rate of 625. However a Form MO-1120S return must be filed to fulfill the S Corporations franchise tax liability and payment of franchise tax must be paid if the corporations assets in or apportioned to Missouri exceed one million dollars for franchise taxable years beginning on or after January 1 2000 or ten million dollars for franchise.

Pay Corporate Tax Return Payment Click here for requirements Select this option to pay the amount due on Form MO-1120 or MO-1120S. Corporate Extension Payments can also be made under this selection. The annual report fee is 45.

Missouri state filing information for tax-exempt organizations. If you would like to file an extension you will need to register for a MyTax Missouri. If you are NOT required to file a Missouri income tax return you must file a Form MO-PTC Property Tax Credit Claim to claim your credit.

You are a nonresident with less than 600 of Missouri source income. If you are required to file a Missouri income tax return you may file a Form MO-1040P or Form MO-1040 and Form MO-PTS together to claim your credit or refund. The tax rate is 625 percent for tax years beginning on or after September 1 1993.

State Charities Regulation State Tax Filings State Filing Requirements for Political Organizations State Nonprofit Corporation Filings. Missouri charges a 625 corporate income tax. After you form an LLC in Missouri you need a state Tax ID number and you need to file state and local taxes.

Corporate income tax is a tax based on the income made by the corporation.

Tax Changes For Different Groups Flowingdata Missouri State Change Tax

Tax Changes For Different Groups Flowingdata Missouri State Change Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Missouri Income Tax Rate And Brackets H R Block

Missouri Income Tax Rate And Brackets H R Block

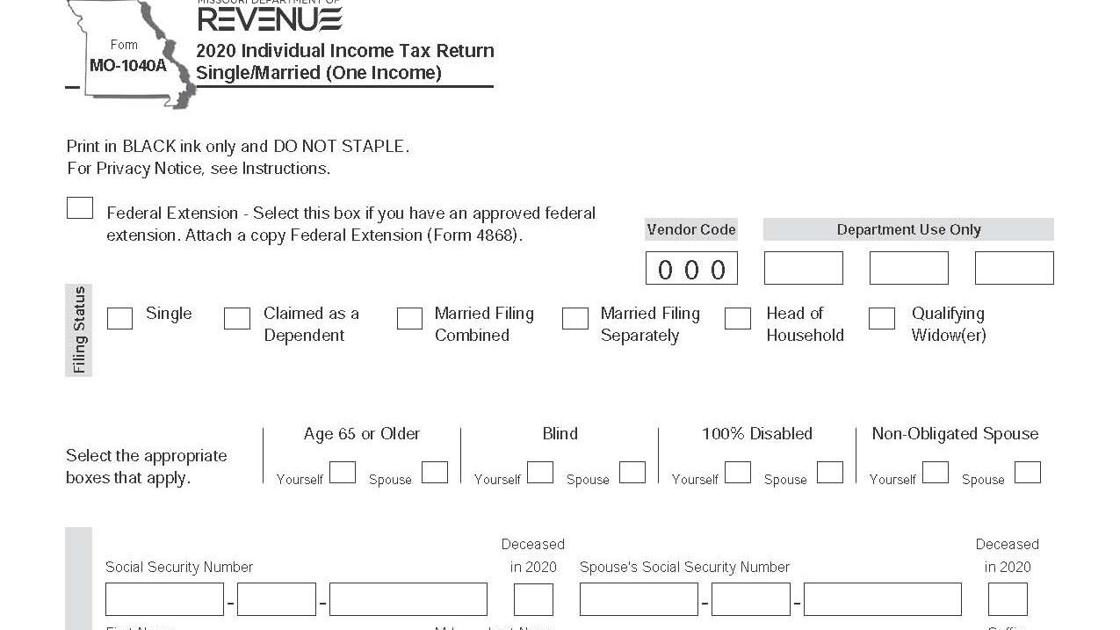

Missouri Delays Tax Filing Deadline To May 17

Missouri Delays Tax Filing Deadline To May 17

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Information And Online Services Regarding Your Taxes The Department Collects Or Processes Individual Income Tax Estate Tax Estimated Tax Payments Filing Taxes

Information And Online Services Regarding Your Taxes The Department Collects Or Processes Individual Income Tax Estate Tax Estimated Tax Payments Filing Taxes

Income Taxes Filing Procedures For City State Federal

Income Taxes Filing Procedures For City State Federal

/GettyImages-1090495926-106925432b3946468ec6163d89484a50.jpg) Top Software To Prepare Taxes For Free

Top Software To Prepare Taxes For Free

Find Apply To Incometaxjobs In India On Placementindia Com Business Tax Tax Services Income Tax

Find Apply To Incometaxjobs In India On Placementindia Com Business Tax Tax Services Income Tax

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Paying Social Security Taxes On Earnings After Full Retirement Age

Paying Social Security Taxes On Earnings After Full Retirement Age

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Money Template Birth Certificate Template

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Money Template Birth Certificate Template

Recent Changes In Federal Income Tax Returns Affect The Free Application For Federal Student Aid Fafsa Starting Fafsa Grants For College Federal Income Tax

Recent Changes In Federal Income Tax Returns Affect The Free Application For Federal Student Aid Fafsa Starting Fafsa Grants For College Federal Income Tax