Irs Business Travel Reimbursement Rate

Using Tier One and Two rates for employee reimbursement. 14 rows The following table summarizes the optional standard mileage rates for employees self.

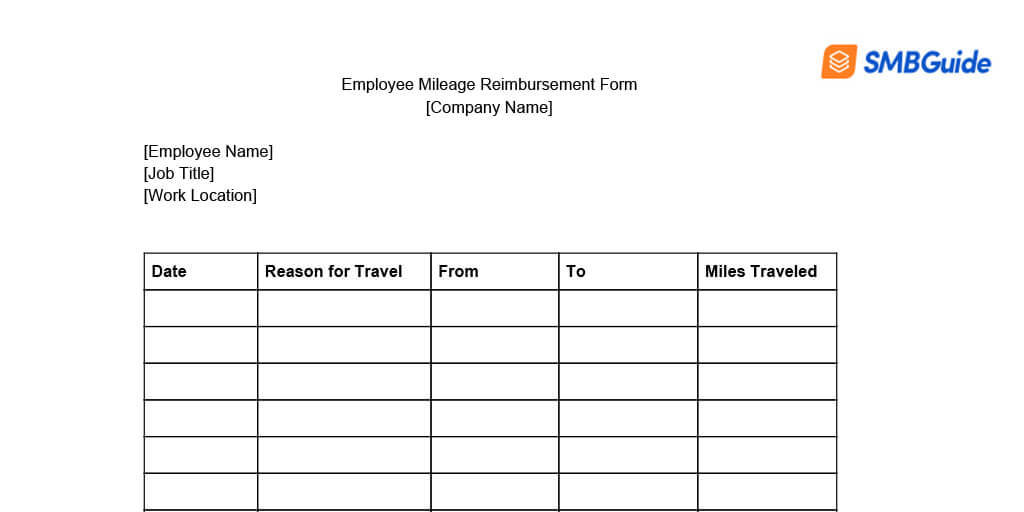

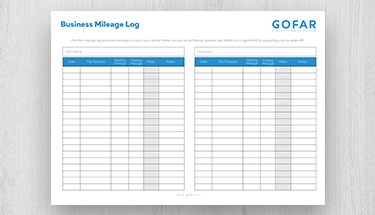

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

Smaller cities usually fall within the range of 56 to 71 and places that see business travel even less frequently have a minimum tier rate of 55.

Irs business travel reimbursement rate. The deduction for unreimbursed business meals is generally subject to a. Note that lower rates apply for the first and last days of travel. For 2020 the standard IRS mileage rates are.

14 cents per mile driven in service of charitable organizations. The deduction for business meals is generally limited to 50 of the unreimbursed cost. The per diem rate for traveling for work to what the government calls high-cost locality is 297.

Use the Tier Two rate for the business portion of any travel over 14000 kilometres in a year. 58 cents per mile driven for business use 20 cents per mile driven for medical or moving purposes 14 cents per mile driven in service of charitable organizations. It is 200 for any other locality.

14 cents per mile driven in service of charitable organizations. The GSA website lists these rates by location. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and.

The new IRS mileage rates apply to travel starting on January 1 2021. The Tier Two rate is for running costs only. The standard meal allowance which is the federal meals and incidental expense MIE per diem rate.

Find current rates in the continental United States CONUS Rates by searching below with city and state or ZIP code or by clicking on the map or use the new Per Diem tool to calculate trip allowances. For example larger cities will typically set a maximum per diem rate of 76 for meals and incidentals. Per-diems are fixed amounts to be used for lodging meals and incidental expenses when traveling on official business.

In 2019 the IRS released a report that states non-profit business mileage can be reimbursed at58 cents per mile. The business mileage rate increased 35 cents for business travel driven and 2 cents for medical and certain moving expense from the rates for 2018. Per Diem Rates Look-Up.

56 cents per mile for business purposes 16 cents per mile for medical or. The special meals and incidental expenses rates for taxpayers in the transportation industry are 66 for any locality of travel within CONUS and 71 for any locality of travel outside CONUS both unchanged after increasing 3 two years ago. If youre an employer you can use Tier One and Tier Two kilometre rates to get a reasonable estimate of costs.

This rate applies to both cars and trucks and fluctuates year by year. Each year the IRS sets a standard mileage reimbursement rate so contractors employees and employers can use them for tax purposes. 58 cents per mile driven for business use up 35 cents from the rate for 2018 20 cents per mile driven for medical or moving purposes up 2 cents from the rate for 2018 and.

Also for miles driven while helping a non-profit you can reimburse14 cents per mile. 575 cents per mile for regular business driving. Rates are set by fiscal year effective October 1 each year.

The per diem rate is 71 for a high-cost locality and 60 to any other locality. Federal per diem rates are set by the General Services Administration GSA and are used by all government employees as well as many private-sector employees who travel. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and. This includes private use travel. Under the Tax Cuts and Jobs Act non-profits can no longer deduct any unreimbursed employee travel expenses.

The rate adjusted for 2020 is 575 cents per mile taking into account oil and gas prices inflation economic conditions and the cost of car ownership into calculating the reimbursement rate. In 2019 the IRS standard mileage reimbursement rate was 58 cents per mile. The rate of per diem varies and is dependent on location.

If youre self-employed you can deduct travel expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or if youre a farmer on Schedule F Form 1040 Profit or. As of January 1 2020 the IRS mileage reimbursement rates for cars vans pickups and panel trucks are. The per diem rate per day for meals is listed under TCJA Sec.

The IRS therefore sets mileage reimbursement rates every year to make it easier to calculate reimbursements.

When Do I Need To Attach A Receipt To My Expense Reports

When Do I Need To Attach A Receipt To My Expense Reports

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

2018 Irs Mileage Rates For Business Travel Charitable Medical And Moving Expenses Cpa Practice Advisor

2018 Irs Mileage Rates For Business Travel Charitable Medical And Moving Expenses Cpa Practice Advisor

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Https Mn Gov Mmb Assets 20201230a Tcm1059 461559 Pdf

Top 5 Measurements The Irs Uses To Determine Mileage Rate

Top 5 Measurements The Irs Uses To Determine Mileage Rate

Irs Issues Standard Mileage Rates For 2021 Youtube

Irs Issues Standard Mileage Rates For 2021 Youtube

What Do Most Companies Pay For Mileage Reimbursement

What Do Most Companies Pay For Mileage Reimbursement

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

2020 Irs Business Mileage Rate Of 57 5 Cents Informed By Motus Cost Data And Analysis

2020 Irs Business Mileage Rate Of 57 5 Cents Informed By Motus Cost Data And Analysis

Irs Mileage Reimbursement Rate For 2019 Rating Walls

Mileage Reimbursement Rate What S Best For Your Company And Drivers

Mileage Reimbursement Rate What S Best For Your Company And Drivers

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar