How To Register Company For Vat In South Africa

Login to SARS eFiling 3. Just follow these instructions from the South African tax authority on how to register for South African VAT.

This search will only return a result if an exact match is found.

How to register company for vat in south africa. Completed and signed PAYE application EMP101 form. It can either be manually or electronically via the SARS eFiling system. However a simpler alternative would be to book a free consultation call with one of our VAT specialists.

Select Maintain SARS Registered Details. Different types of Companies in South Africa. VAT is an indirect taxation on the value added to goods and services by Suppliers and Vendors in the economy.

The business must be a registered company. After successfully completing it submit it to a SARS branch near you. Value-Added Tax is commonly known as VAT.

Register your company for VAT with SARS. When a company is registered without a reserved name its registration number automatically becomes the company name with South Africa as the suffix. If you choose to do it manually you can download a VAT 101- Application for a Registration Form from the SARS website.

You can either register at your local SARS branch or via eFiling by completing a VAT 101 Application for Registration form. A sole proprietor registered Pty CC. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors.

Confirming the correct VAT Number. The representative and company are jointly liable for the reporting and payment of VAT to the South African authorities. Verified Tax Registration number Your company needs to have a Tax registration number issued by SARS.

If you experiencing problems finding the correct VAT registration information email us at helpvatsearch. Navigate to SARS Registered Details functionality. However other individuals and businesses may need to check the VAT database for validation.

You can register for this number in one of two ways. Click SARS Registered details on the side menu 5. This is the quickest way to register a company.

According to SARS you can register once. Private company may be registered with or without a company name while a not for. Click VAT under.

If your business has assets liabilities or both then you may have to follow the liquidation route. A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000. 28 March 2020 - VAT vendors can now request and obtain a VAT Notice of Registration on eFiling if they are registered on SARS eFiling.

How do I register for a VAT number in South Africa. The Maintain SARS Registered Details screen will display. R2750 once-off cost.

Select Notice of Registration 6. This means your business must be registered with the CIPC Companies and Intellectual Property. You need to consider which company structure will work best for your businesss setup and goals.

Original signed and stamped letter from bank confirming business bank details no internet. Your preferred Company Structure is the first consideration you need to make when you want to register a new business at the Companies and Intellectual Property Commission CIPC. South African Companies that are registered for VAT must charge an additional 15 on the prices of their products and services.

VAT Registration for a company in South Africa Contact Company Partners. Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million. Learning how to get a VAT number right is crucial.

Find out more about deregistering or liquidating a company from the Companies and Intellectual Property Commission CIPC or contact CIPC on 086 100 2472. Follow these easy steps. However they must appoint a South African VAT fiscal representative.

Businesses can find their VAT registration numbers in the certificate issued by the South African Revenue Service. VAT is an indirect tax on the consumption of goods and services in the economy. Our business address is 50 Long Street Cape Town South Africa 8000.

Govchain Pty Ltd registration number 201725782507 is registered in South Africa. A foreign company may register for VAT without the requirement to form a local company. Go to the Organizations main menu 4.

We will handle all the admin of dealing with SARS. 0800 007 269 Va. In terms of the Companies Act 2008 a for profit company eg.

Results are limited to a maximum of 19 possible companies in the results list. How do you register for VAT in South Africa. Certified copies of registration document COR143 Certified copies of identity documents of the two main directors.

So turns out you do need to register for tax in South Africa. There are several VAT registration requirements to be met before registering for a VAT number for your business in South Africa. For instance if you sell a product of R100 you need to add R15 to the price 10015 so the inclusive price which your customers have to pay is R115.

A VAT Number is a 10-digit number and starts with 4. Minimum requirements for a VAT registration. It is required by the South African Revenue Services SARS that any business with an annual income that exceeded or is likely to exceed R1-million in any consecutive 12-month period should be registered for Value-Added Tax VAT.

Ultimately you will receive a VAT registration number which establishes you in the South Africa tax system as a legal business. A business generating an income exceeding R50 000 within a 12-month period may voluntary register for VAT. If you are registered for VAT you need to add 15 VAT to your selling price.

How Does VAT Work in South Africa. The check is mainly essential when dealing with a new business partner. Select I Agree to confirm that you are authorised to perform maintenance functions of the.

SARS E-filing account can assist with the set up for R 690 Certified copies of ID for all directors. Httpswwwptycompanyregistrationcoza -Toll free landline. It should not be confused with Income Tax.

How To Register For Vat On Efiling

How To Register For Vat On Efiling

How To Register For Vat On Efiling

How To Register For Vat On Efiling

Vat And Your Company Documents What You Need To Know How To Plan Need To Know This Or That Questions

Vat And Your Company Documents What You Need To Know How To Plan Need To Know This Or That Questions

Dc Media Has An End Of Month Special Available To Our South African Customers Buy The 55 Lg Sm5ke Scre Digital Signage Free Training Advertising Effectiveness

Dc Media Has An End Of Month Special Available To Our South African Customers Buy The 55 Lg Sm5ke Scre Digital Signage Free Training Advertising Effectiveness

Best Branding South Africa Branded Promo Gifts Clothing Promo Gifts Promotional Gifts Free Prints

Best Branding South Africa Branded Promo Gifts Clothing Promo Gifts Promotional Gifts Free Prints

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Company Registration South Africa Bee Certificate Ideal Business Work From Home Moms Construction Business Construction

Company Registration South Africa Bee Certificate Ideal Business Work From Home Moms Construction Business Construction

Pin By Vitrinemedia Southafrica On Vitrinemedia South Africa Visual Communication Unclutter Enhancement

Pin By Vitrinemedia Southafrica On Vitrinemedia South Africa Visual Communication Unclutter Enhancement

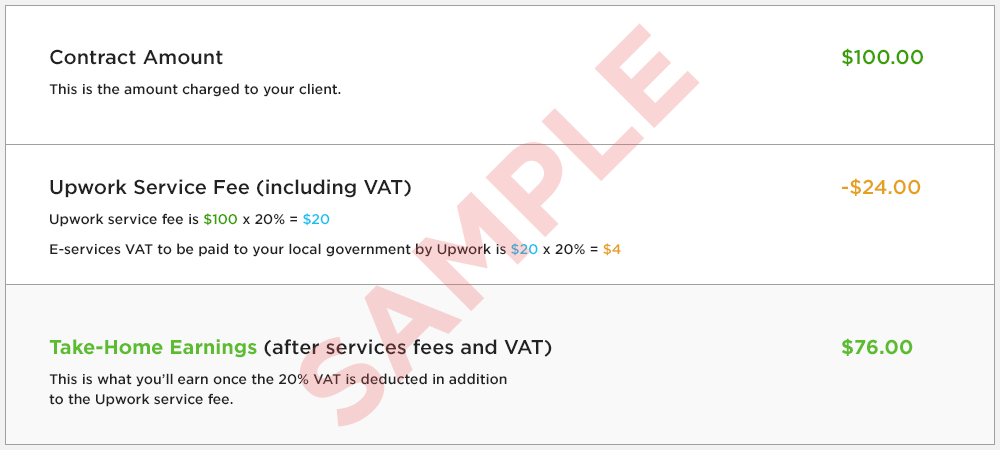

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

The Register Is A Company Registration Consultant That Can Assist You To Register Your Company In South Africa A Bee Certificate Income Tax Return Tax Services

The Register Is A Company Registration Consultant That Can Assist You To Register Your Company In South Africa A Bee Certificate Income Tax Return Tax Services

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificate Abstract Grey Wallpaper Grey Wallpaper Background

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificate Abstract Grey Wallpaper Grey Wallpaper Background

Sars Vat Registration Durban 0713483407 No Nonsense Vat Reg R4k City Centre Gumtree South Africa 121548726 Financial Services Financial Service

Sars Vat Registration Durban 0713483407 No Nonsense Vat Reg R4k City Centre Gumtree South Africa 121548726 Financial Services Financial Service

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificat Digital Marketing Agency Workplace Public Relations

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificat Digital Marketing Agency Workplace Public Relations

Our Team Will Evaluate Your Transactional Sales And Purchases Create An Accurate Vat Report That Can Be Traced To All Your Documents Finance Investing Solving

Our Team Will Evaluate Your Transactional Sales And Purchases Create An Accurate Vat Report That Can Be Traced To All Your Documents Finance Investing Solving

Filing Vat Return Online At Simplysolved Ae Enterprise Business Social Security Card Bookkeeping

Filing Vat Return Online At Simplysolved Ae Enterprise Business Social Security Card Bookkeeping

Here S All You Should Know About Vat In Uae And Its Accounting Vat In Uae Accounting Uae

Here S All You Should Know About Vat In Uae And Its Accounting Vat In Uae Accounting Uae

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

Map Of Africa Drawing Africa Mapa Fisico Southafricawildlife Africa Fashion Girls Africa Do Sul Viagem Af Africa Traveling By Yourself Trip Planning

Map Of Africa Drawing Africa Mapa Fisico Southafricawildlife Africa Fashion Girls Africa Do Sul Viagem Af Africa Traveling By Yourself Trip Planning