How To Get A 1099 Form From Wells Fargo

Why is the interest on my Form 1098 more this year than it was last year. If using 2020 to calculate loan amount this is required.

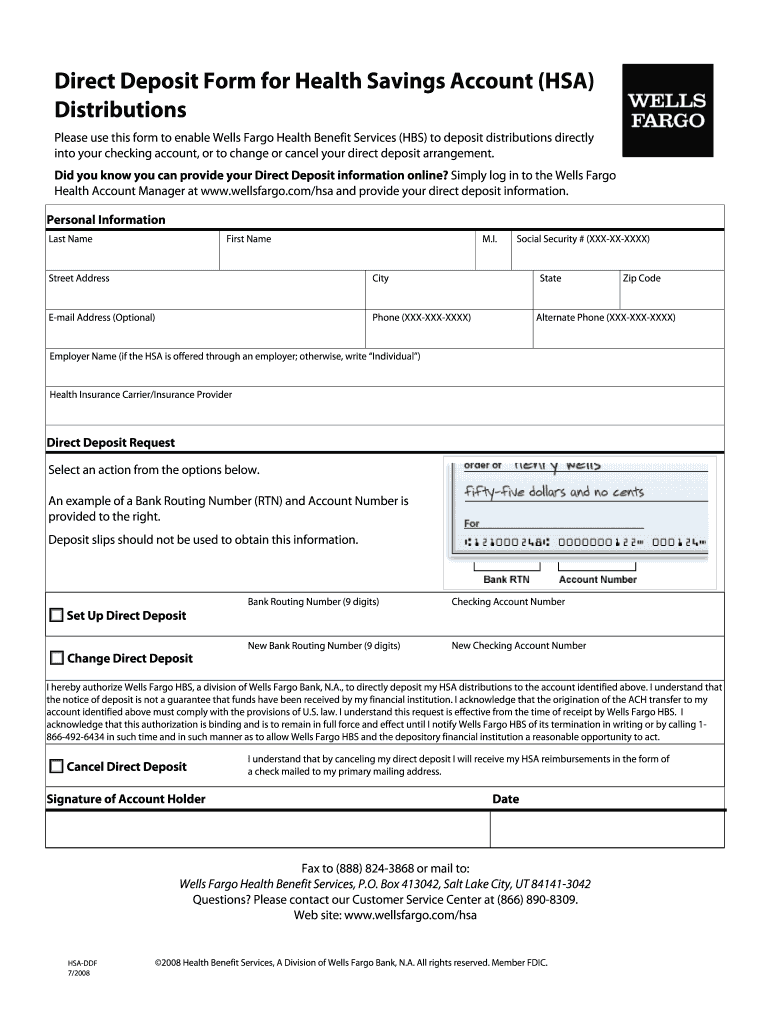

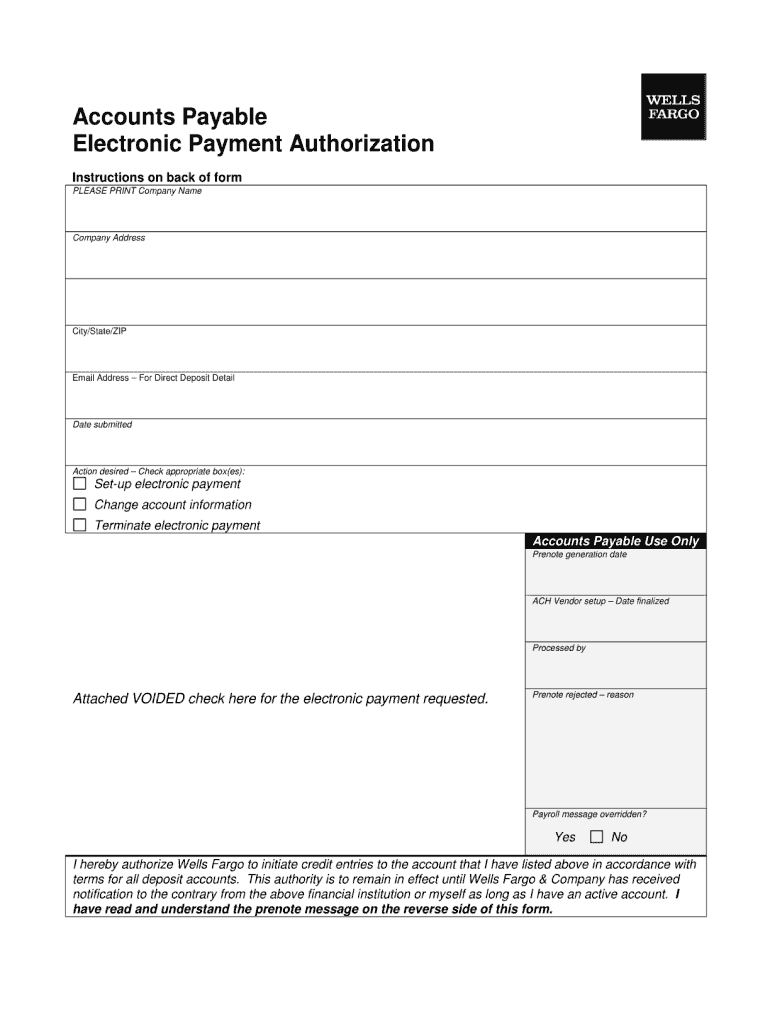

Wells Fargo Direct Deposit Form Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Direct Deposit Form Fill Online Printable Fillable Blank Pdffiller

Oddly some people are getting a Form 1099-INT from Wells for the bonus while others have not.

How to get a 1099 form from wells fargo. Tax form - IRS 1099. Click Portfolio and then Statements Docs. We will mail your 2020 IRS Form 1098 no later than January 31 2021 please allow for delivery time.

Amounts on the applicable Form 1099-OID or Form 1099-INT based on broker reporting defaults or differing customer elections for which we were notified in writing by year-end. Does one IRS form cover multiple accounts. Wells Fargo Home Mortgage is a division of Wells Fargo Bank NA.

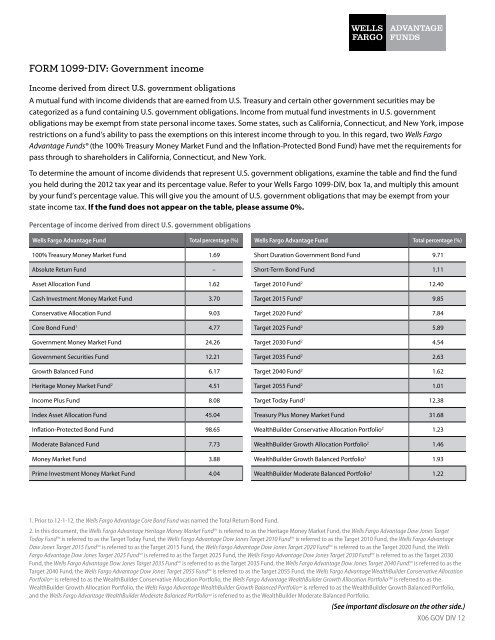

If the fund does not appear on the table please assume 0. You may fax W-9 forms to Wells Fargo. WFCS provides a consolidated statement Most issuers of Form 1099-B and Form 1099-DIV now request.

If youd like to receive separate Form 1099 documents in the future you can call us at 1-800-TO-WELLS 1-800-869-3557 to make your request. The fund you held during the 2020 tax year and its percentage value. A lot of us did the 250 Wells Fargo personal checking bonus during 2017 since it was easy and a nice bonus.

Follow the screens and youll be able to import your form Please keep in mind that your financial institution has until March 31 2020 to provide you with the form. We cannot process faxed or copied W-8 forms. How do I get my tax forms from Wells Fargo.

Sign in to TurboTax and open or continue your return. The 1099-C form is a tax reporting document. If youre a Wells Fargo customer receiving a 1099R form from Wells Fargo the bank should mail it to you early in the following year giving you time to file your taxes.

Tax return - federal. For all W-8 forms you must send us the originals. This information is general in nature is not complete and may not apply to your specific situation.

This will give you the amount of US. If you dont have an account yet register. Repeated customer service and supervisor requests all yield the same reply.

Wells Fargo makes no warranties and is not responsible for. Select your investment account. IRS Form 1099-MISC detailing nonemployee compensation received box 7 IRS Form 1099-K invoice bank statement or book of record establishing borrower was self-employed during relevant time period.

Pursuant to the IRS reporting regulations Wells Fargo Advisors has defaulted all customers to amortize premiums annually on all fixed income. The Wells Fargo Tax Center and all information provided here are intended as a convenient source of tax information. You should consult your own tax advisor regarding your tax needs.

Not enrolled in Wells Fargo Online. Tax return - corporate. If you have paid less than 10000 in eligible interest and fees Wells Fargo will not mail an official document through US.

If you use Wells Fargo online banking you can access tax forms online as well. It has little to do with your financing agreement or repossession of your car. If you would like to receive amended Forms 1099.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services LLC WFCS and Wells Fargo Advisors Financial Network LLC Members SIPC. The IRS no longer requires financial institutions to provide clients amended Forms 1099 for amounts where the change in any box is 100 or less. Sign on to access tax forms online.

From your mobile phone. Gove rnment obligations that may be exempt from your state income tax. Search for 1099-B and select the Jump to link in the search results.

For business accounts call 1-800-225-5935. We can determine from the form that Wells Fargo does not think the 331059 is recoverable under the definitions of banking regulations or the IRS. Refer to your Wells Fargo 1099-DIV box 1a and multiply this amount by your funds percentage value.

For business accounts call 1-800-225-5935. Your account is a non-interest bearing account and is not subject to a 1099 even on the signup bonus. If you have multiple accounts under the same legal name you may submit one W-8 or W-9 for all of those accounts provided the ownership is the same for each account.

Wells Fargo customer who had a First Draw PPP Loan with a different lender. Tax form - IRS 2106. If you have paid any amount of eligible interest and fees during the tax year a tax document will automatically be located within Wells Fargo Online for you to view and print.

From the Document Type drop-down menu choose Tax Documents1099s. Of Form 1099 information are included with the Form 1099-B this postmark due date applies to all Forms 1099 included in the statement. If youd like to receive separate Form 1099 documents in the future you can call us at 1-800-TO-WELLS 1-800-869-3557 to make your request.

Get wells fargo 1099 sa form signed right from your smartphone using these six tips. Customers who switched to online statements before December 31 2020 will be among the first to receive their documents. If you have multiple qualifying accounts with Wells Fargo you might receive multiple forms.

From your desktop or tablet.

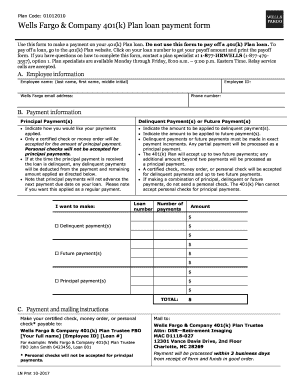

Wells Fargo 401k Loan Payoff Fill Online Printable Fillable Blank Pdffiller

Wells Fargo 401k Loan Payoff Fill Online Printable Fillable Blank Pdffiller

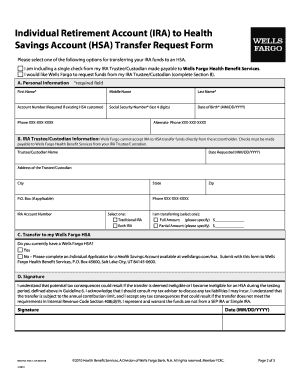

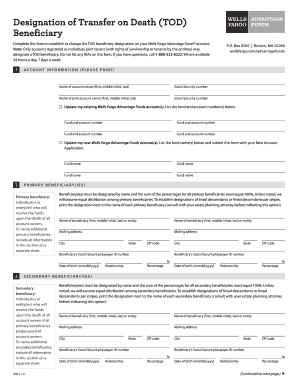

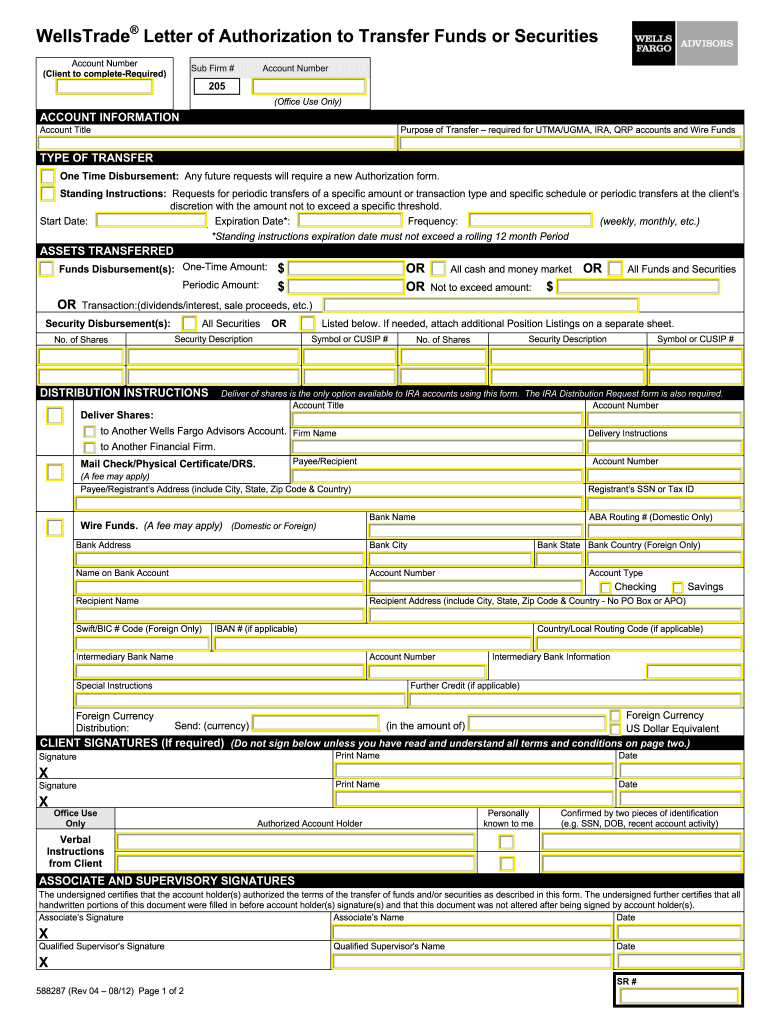

Wells Fargo 401k Rollover Form Fill Online Printable Fillable Blank Pdffiller

Wells Fargo 401k Rollover Form Fill Online Printable Fillable Blank Pdffiller

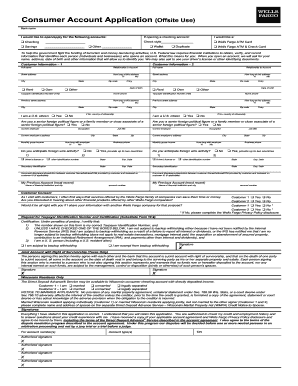

Wells Fargo Authorization Form Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Authorization Form Fill Online Printable Fillable Blank Pdffiller

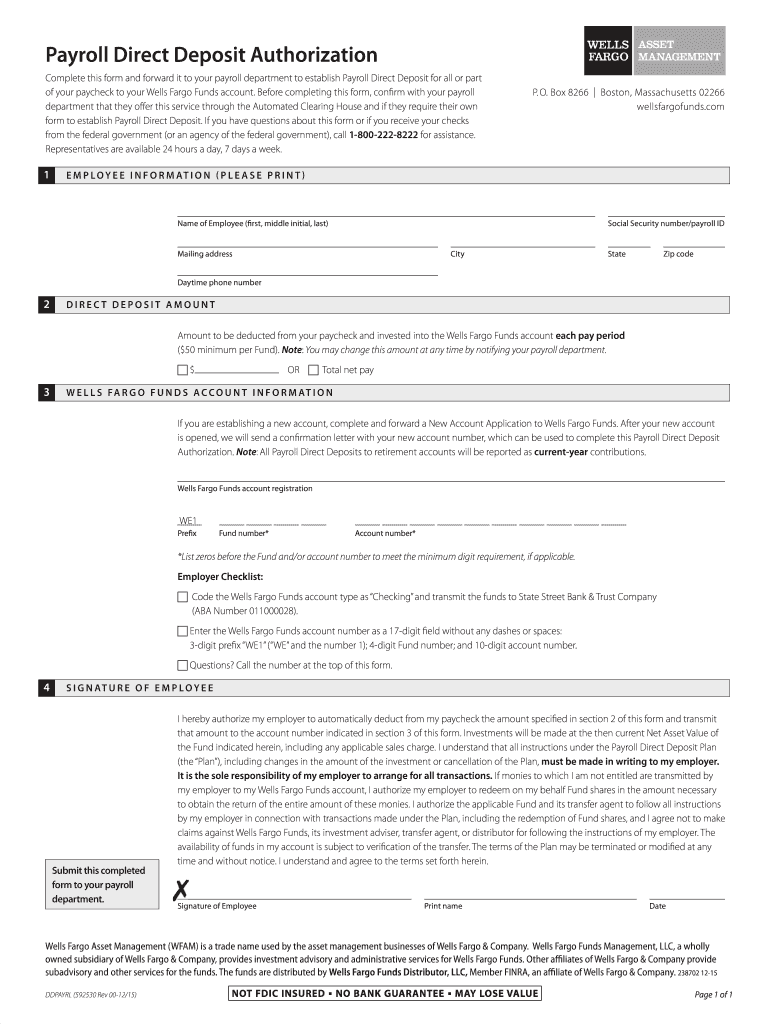

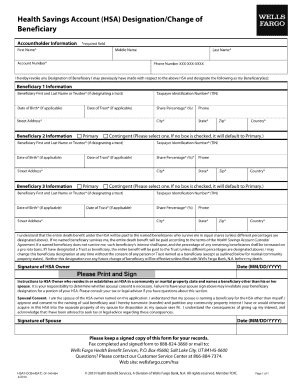

19 Printable Direct Deposit Form Wells Fargo Templates Fillable Samples In Pdf Word To Download Pdffiller

19 Printable Direct Deposit Form Wells Fargo Templates Fillable Samples In Pdf Word To Download Pdffiller

Wells Fargo Ira Nightmare Vaughn S Summaries

Wells Fargo Ira Nightmare Vaughn S Summaries

Wells Fargo Ira Nightmare Vaughn S Summaries

Wells Fargo Ira Nightmare Vaughn S Summaries

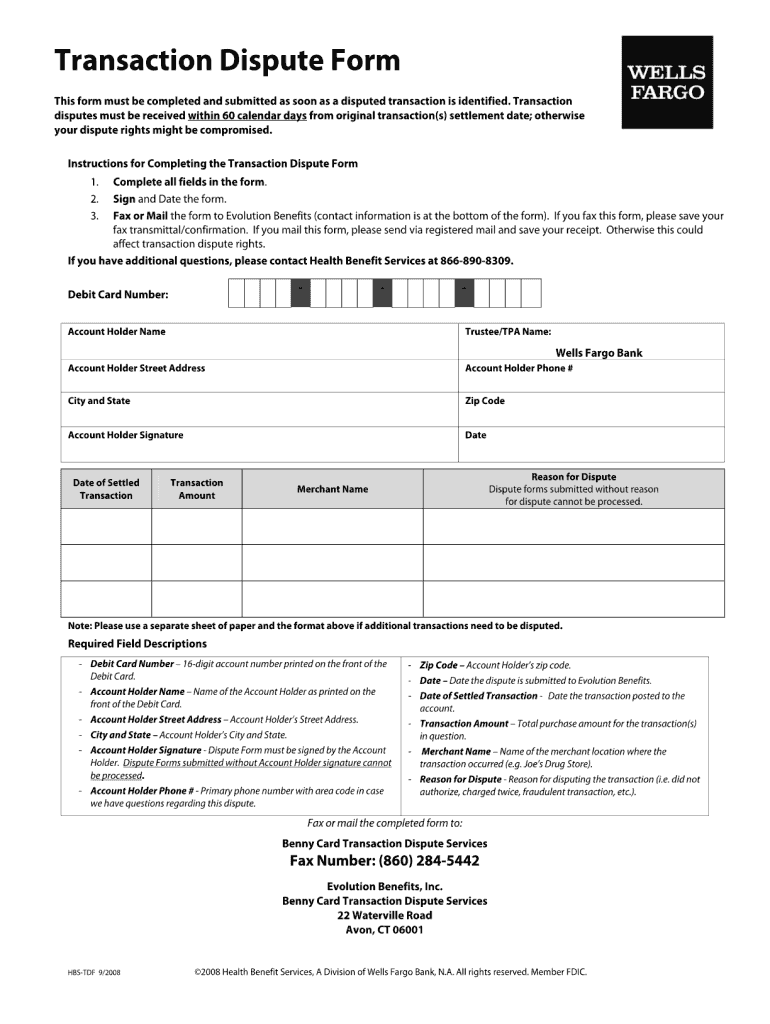

Wells Fargo Dispute Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Dispute Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Login Fill Out And Sign Printable Pdf Template Signnow

Wells Fargo Login Fill Out And Sign Printable Pdf Template Signnow

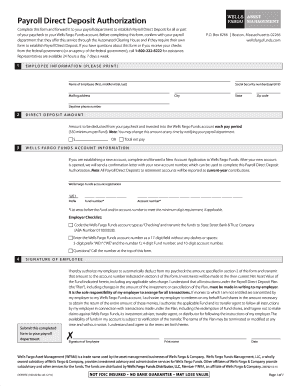

2015 2021 Form Wells Fargo Ddpayrl Fill Online Printable Fillable Blank Pdffiller

2015 2021 Form Wells Fargo Ddpayrl Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Login Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Login Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Ach Form Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Ach Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Div Government Income Wells Fargo Advantage Funds

Form 1099 Div Government Income Wells Fargo Advantage Funds

Bank Statement Wells Fargo Template Fake Custom Printable Income Monthly Verification Direct D Statement Template Credit Card Statement Bank Statement

Bank Statement Wells Fargo Template Fake Custom Printable Income Monthly Verification Direct D Statement Template Credit Card Statement Bank Statement

Wells Fargo Login Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Login Fill Online Printable Fillable Blank Pdffiller

Https Retailservices Wellsfargo Com Pdf Watsco 0810 Hp Watsco Gemaire Pdf

2016 Instructions For Form 1099 Int New 1099 Int Form Wells Fargo Chase Resume Exa Pantacake Models Form Ideas

2016 Instructions For Form 1099 Int New 1099 Int Form Wells Fargo Chase Resume Exa Pantacake Models Form Ideas

Did You Get A 1099 Int From Wells Fargo And More 1099 Anomalies Doctor Of Credit

Did You Get A 1099 Int From Wells Fargo And More 1099 Anomalies Doctor Of Credit

Wells Fargo Letter Of Authorization Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Letter Of Authorization Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Personal Login Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Personal Login Fill Online Printable Fillable Blank Pdffiller