How Do I Get A 1099 G Form From Unemployment

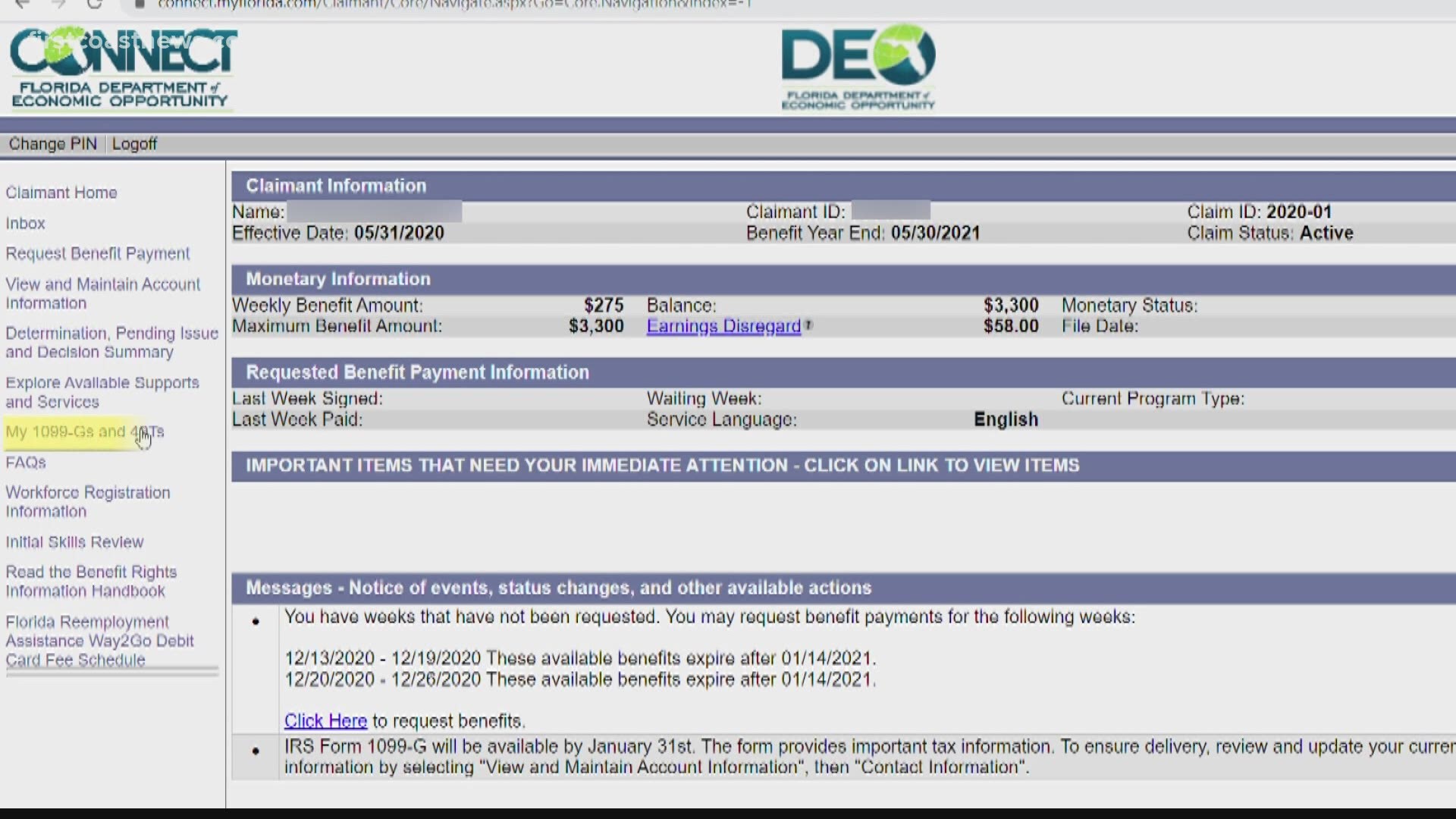

Look for the 1099-G form youll be getting online or in the mail. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

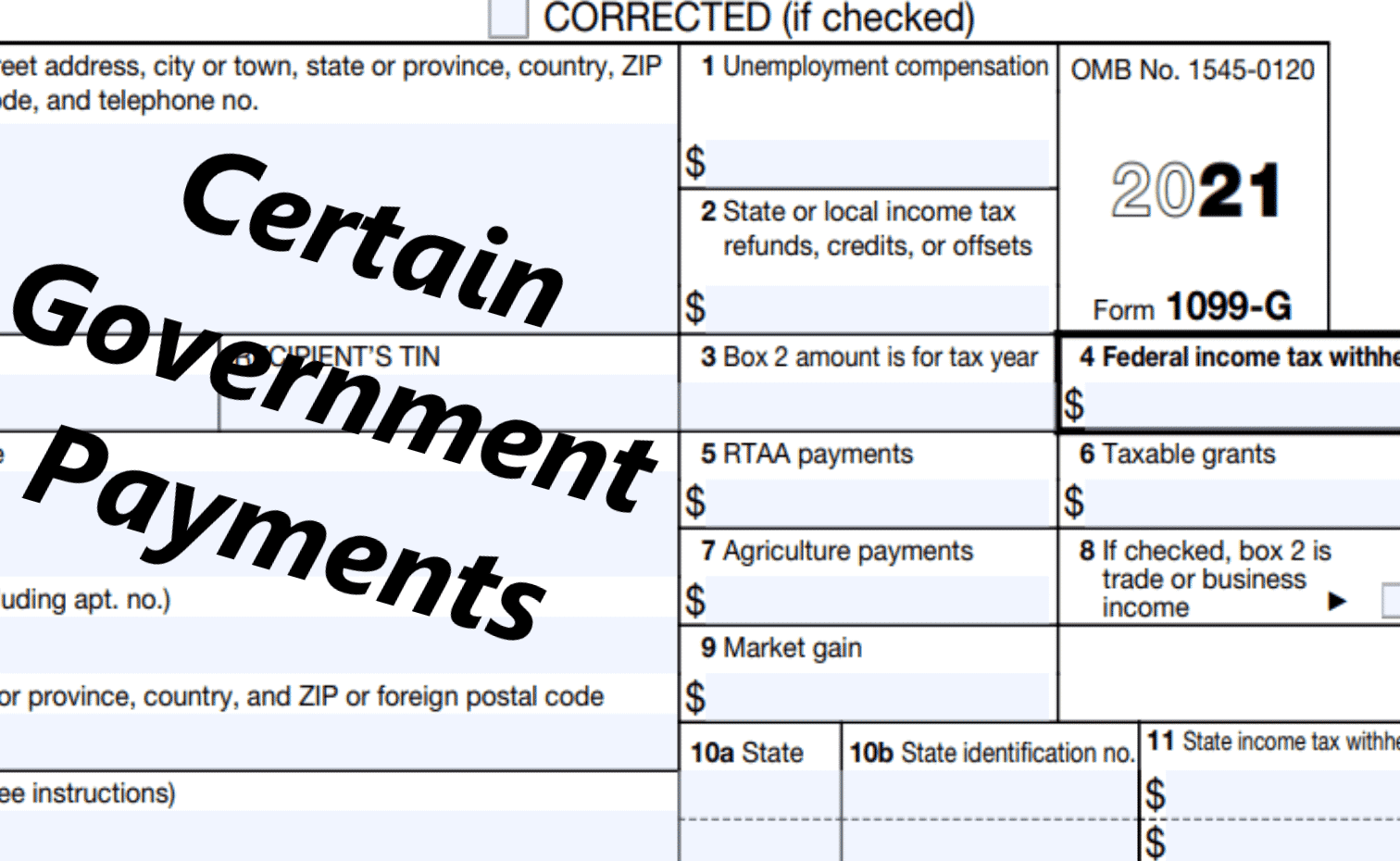

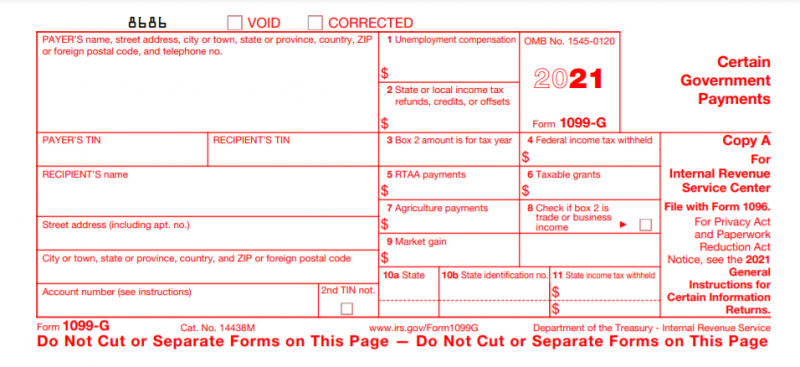

1099 G Form 2021 Irs Forms Zrivo

1099 G Form 2021 Irs Forms Zrivo

You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and.

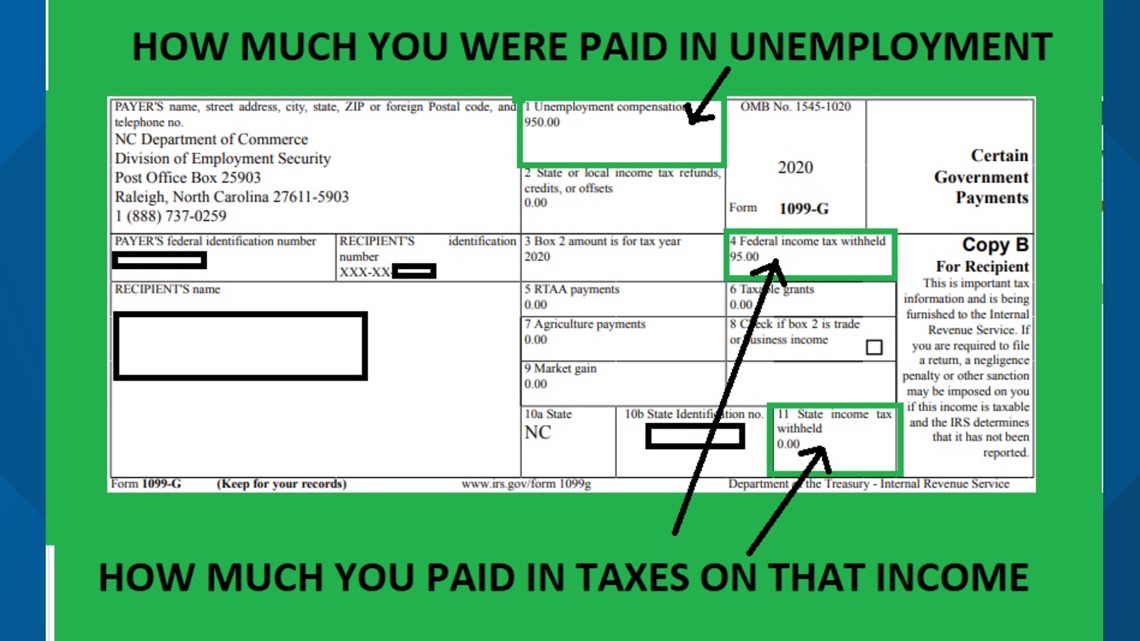

How do i get a 1099 g form from unemployment. The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account. Search for unemployment compensation and.

Enter the Social Security number that appears first on your New Jersey Gross Income Tax return and the tax year you wish to view. To access this form please follow these instructions. If you do not have an online account with NYSDOL you may call.

Instead youll get a 1099G for the 2021 tax year. 1099-G income tax statements for 2020 are available online. We sent 1099Gs to the address we have on record for each person who received unemployment benefits.

How to requestRequest your unemployment benefits 1099-G. Regardless of the initial method of delivery all claimants can access copies of their 1099-G form in multiple ways. You can access your Form 1099G information in your UI Online SM account.

Getting Your 1099-G Tax Form. If you have additional questions about accessing your 1099-G form please call IDES at 800 244-5631. We will mail you a paper Form 1099G if you.

Click on the down arrow to select the right year. Go to Services for Individuals Unemployment Services and select Form 1099-G Information from the sub-navigation options presented. 31 2020 you wont get a 1099G for the 2020 tax year.

These forms will be mailed to the address that DES has on file for you. Open or continue your tax return in TurboTax online. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

You can also download your 1099-G income statement from your unemployment benefits portal. 31 there is a chance your copy was lost in transit. For Pandemic Unemployment Assistance PUA claimants the.

Unemployment is taxable income. Click on View 1099-G and print the page. If you havent received your 1099-G copy in the mail by Jan.

Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. I have not received my 1099-G form and have been trying to get it through my state unemployment department and the IRS website but keep hitting walls. Ive heard that if I file myself online which I usually do and dont add my 1099 the IRS will basically fix it and send me a bill.

You can view 1099-G forms for the past 6 years. Your local office will be able to send a replacement copy in the mail. You may choose one of the two methods below to get your 1099-G tax form.

Every year we send a 1099-G to people who received unemployment benefits. We do not issue Form 1099-G for pensions or unemployment or family leave insurancefamily leave during unemploymentdisability during unemployment. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. Pacific time except on state holidays. Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended.

31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. IDES began sending 1099-G forms to all claimants via their preferred method of correspondence email or mail in late January. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G.

Click on View and request 1099-G on the left navigation bar. All of your benefit payments were made after Dec. Remember even if you were unemployed you still have to file income taxes.

Then you will be able to file a complete and accurate tax return. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. How to Get Your 1099-G online.

On the row marked 2020 click View to open a. If you moved without updating your address with us your 1099G was sent to your old address. If you received unemployment your tax statement is called form 1099-G not form W-2.

These forms are available online from the NC DES or in. Log in to your UI Online account. Heres how you enter the unemployment.

We also send this information to the IRS.

1099 Form Available For 2017 Unemployment Recipients

1099 Form Available For 2017 Unemployment Recipients

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Floridians Report Tax Documents With Inaccurate Information 13newsnow Com

Floridians Report Tax Documents With Inaccurate Information 13newsnow Com

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor