Business Use Declaration Fbt

Business Use Percentage this is calculated based on the number of kilometres travelled for business use as a percentage of overall driving during a 12 week period in which a logbook is kept. For fringe benefits tax FBT purposes a car is any of the following.

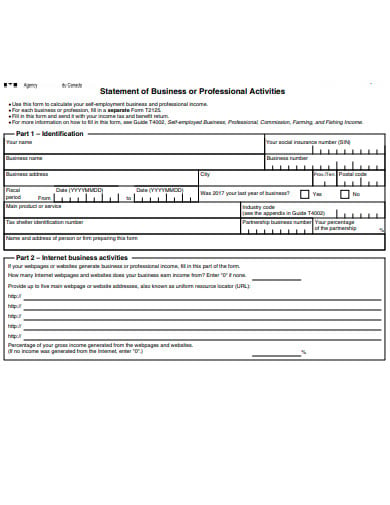

Self Declaration Of Income Letter Inspirational Self Employment Declaration Letter Fill Line Lettering Scholarship Thank You Letter Declaration

Self Declaration Of Income Letter Inspirational Self Employment Declaration Letter Fill Line Lettering Scholarship Thank You Letter Declaration

This section must be counter-signed by your employers authorised representative.

Business use declaration fbt. Where no declaration is submitted FBT is applicable. An employee declaration is written advice given by an employee to you their employer. FBT - Information Gathering Questionnaire.

You need to keep employee declarations to apply certain fringe benefit tax FBT concessions. They are not to be sent to the ATO but retained as part of business records. If youre providing special perks to your employees like gym memberships or work vehicles for personal use youre likely to be liable for fringe benefit tax FBT.

It must be provided before lodging the FBT return. Travel that is incidental to travel in the course of employment duties. FBT - Employees Car Business Use Declaration.

Find out what you need to know on this page and test yourself with our quiz. In order to substantiate the percentage of business use of an employees car the above declaration must be extended by the addition of sections B C or D below FBT-4. Employees car declaration Employment interview or selection test declaration - transport in employees car Expense payment benefit declaration Fuel expenses declaration Living-away-from-home declarations Loan fringe benefit declaration No private use declaration - expense payment benefits No private use declaration - residual benefits.

This documentation is required to substantiate the extent to which the cost of the benefit would have been deductible to the employee. Use by the departmentarea as a pool car for business purposes. FBT - Fuel Expenses Declaration.

It is a change from the objective test that has been in place. Declaration required The use of the otherwise deductible rule to reduce the taxable value of fringe benefit must be supported by particular documentation. The requirements for record keeping that is required for FBT purposes can be found in chapter 4 of this ATO Guide for employers with the specifics regarding declarations found at sections 48 and 49.

Submitting your FBT declaration on time enables QSS Taxation to accurately calculate your agencys FBT reductions saving your employer money. Additional Information please complete if you wish to advise the Taxation staff of any further information. Do not complete this section unless your Employer has given consent for the Logbook FBT method to be used.

Complete the Declaration only for the business use portion. FBT - Employment Interview or Selection Test Declaration. A logbook with supporting diary records must be maintained for a twelve 12 consecutive week period.

This means employees can provide employee declarations to you in the approved format. A business needs to keep employee declarations to apply certain fringe benefit tax FBT concessions. A sedan or station wagon any other goods-carrying vehicle with a carrying capacity of less than one tonne such as a panel van or utility including four-wheel drive vehicles any other passenger-carrying vehicle designed to carry fewer than nine passengers.

Appropriate substantiation must be retained to show that the items are used primarily for work-related purposes. The FBT declaration permits agencies to claim a reduction in the taxable value of some benefits. This documentation is the Otherwise Deductible.

You can also receive employee declarations electronically. FBT - Expense Payment Benefit Declaration. Appropriate substantiation must be retained to show that the items are used primarily for work-related purposes.

Travel between home and work. Vehicle Business Use Declaration Form to Smartsalary. SECTION 2 Logbook Business Use Declaration.

It contains information about the fringe benefits they have received. Which one is dependent on the type of benefit you received from your employer Section B Name of employee I declare that. 25 July 2018 3 years ago The ATO has made a change to the FBT rules set to take affect for the 2019 FBT year and beyond that will give businesses that supply employees with motor vehicles that are not cars a prescriptive method to apply to get an exemption to FBT.

If the vehicle was used for any private use other than between work and home please complete the attached Residual Fringe Benefit Private Use Declaration. This section is the loan expense payment property or residual fringe benefit declaration. You can receive employee declarations electronically however the declaration must be signed by the employee using an electronic signature.

An entity will be regarded as a small business entity for the 2019 FBT year if it carries on a business and its aggregated turnover is less than 10 million for the year ended 30 June 2019. An entity will be regarded as a small business entity for the 2018 FBT year if it carries on a business and its aggregated turnover is less than 10 million for the year ended 30 June 2018. FBT - Information Gathering Letter.

FBT is a tax on benefits you provide to. If your vehicle lease started or was refinanced late in the FBT year it is possible. An employees private use of a taxi or a panel van utility ute or other commercial vehicle that is one not designed principally to carry passengers see Table 1 is exempt from fringe benefits tax FBT if their private use is limited to.

The period of the FBT year the car was in use by me for business purposes was. An employee declaration is written advice given to you by your employee containing information relating to the fringe benefits they have received.

Running Sheet Motor Vehicle Running Sheet Pdf Easy To Download And Use Pdf Technology Template Motor Car Vehicles Templates

Running Sheet Motor Vehicle Running Sheet Pdf Easy To Download And Use Pdf Technology Template Motor Car Vehicles Templates

Identifying And Reporting Employee Fringe Benefits Paychex

Identifying And Reporting Employee Fringe Benefits Paychex

Fbt Refresher Common Mistakes And Update Ppt Download

Fbt Refresher Common Mistakes And Update Ppt Download

Fringe Benefits Tax Questionnaire Here Business Wealth

Fringe Benefits Tax Questionnaire Here Business Wealth

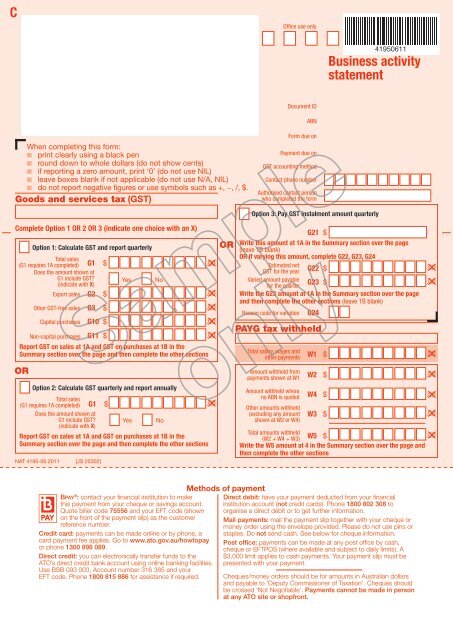

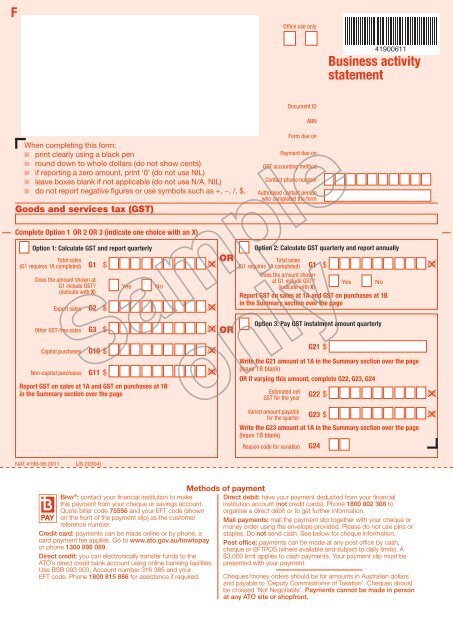

Quarterly Business Activity Statement Australian Taxation Office

Quarterly Business Activity Statement Australian Taxation Office

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

Fringe Benefits Tax Fbt 2020 Updates Phase 1 Change Gps

Fringe Benefits Tax Fbt 2020 Updates Phase 1 Change Gps

Fbt Refresher Common Mistakes And Update Ppt Download

Fbt Refresher Common Mistakes And Update Ppt Download

Fbt Refresher Common Mistakes And Update Ppt Download

Fbt Refresher Common Mistakes And Update Ppt Download

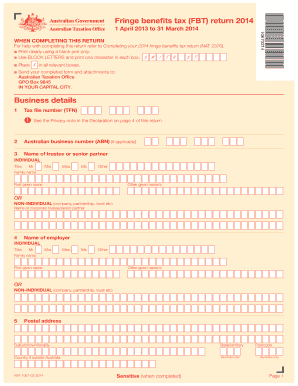

Fbt Return Fill Out And Sign Printable Pdf Template Signnow

Fbt Return Fill Out And Sign Printable Pdf Template Signnow

Smart Business Solutions Why You Should Lodge An Fbt Return In 2021

Smart Business Solutions Why You Should Lodge An Fbt Return In 2021

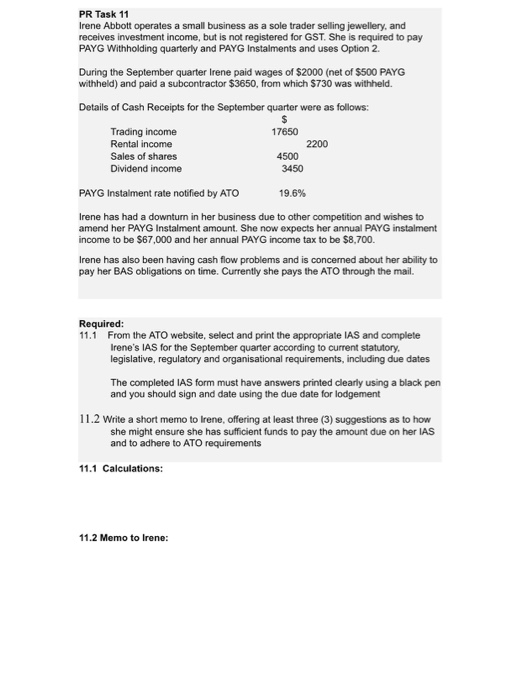

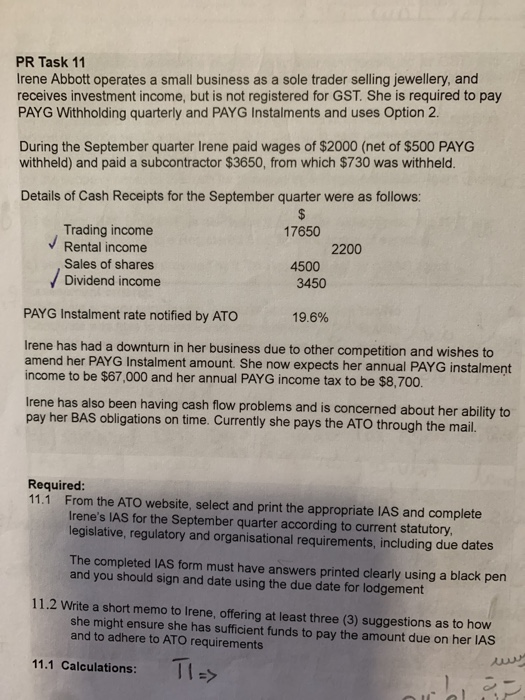

Complete Business Activity Instalment Activity S Chegg Com

Complete Business Activity Instalment Activity S Chegg Com

Expense Printable Forms Worksheets Expenses Printable Spreadsheet Business Business Expense

Expense Printable Forms Worksheets Expenses Printable Spreadsheet Business Business Expense

Business Offer Letter Pack Of 5 Premium Printable Templates Business Letter Format Business Proposal Letter Business Letter Template

Business Offer Letter Pack Of 5 Premium Printable Templates Business Letter Format Business Proposal Letter Business Letter Template

Complete Business Activity And Instalement Activit Chegg Com

Complete Business Activity And Instalement Activit Chegg Com

Govreports Brochure Payroll Taxes Brochure Tax Return

Govreports Brochure Payroll Taxes Brochure Tax Return

Webinar Fringe Benefits Tax 2020 Youtube

Webinar Fringe Benefits Tax 2020 Youtube