Business Central 1099

On users purchase documents you can specify that the document is 1099 liable and users can specify the 1099 code for the vendor. Mark the header with the appropriate 1099 code.

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

These are codes defined on the IRS 1099 Form Box which is also where you can add new 1099 codes.

Business central 1099. Dynamics 365 Business Central brings the power of Dynamics NAV to the cloud. The amount reported on the 1099-G will be for the aggregate amount of all three BWC payments received in the calendar year 2020. Were 1099-MISC forms issued to central Ohio residents.

With every new year processing 1099 statements become a necessity for every accounting team. As such Business Central has at its foundation a set of trusted proven technol. Then at the line level make sure to checkun-check the 1099 Liable column appropriately.

Microsoft Dynamics Business Central and NAV Global Development is in the process of creating the new report. The new 1099-NEC Report will release in cumulative updates for Microsoft Dynamics NAV 2016 through current versions. The steps below need to be ran by a user with admin permissions 1.

If YES attach copies to this return. City Income Tax Return For Businesses. For each tax liable vendor you can then specify the relevant 1099 code on the Payments FastTab on the Vendor card.

ATTACH A COPY OF YOUR FEDERAL RETURN INCLUDING ALL SUPPORTING SCHEDULES TO THE BACK OF THIS RETURN. The 1099 Toolkit a Business Central add-in is the only tool available that allows you to prepare and print the 1099 forms right from Business Central and without the time-consuming manual preparation. Microsoft Business Central 1099 MISC NEC forms show incorrect Dollar Amounts in Preview Known Bug Fiscal Year 2020.

Its new capabilities also make transitioning to the new 1099 NEC form quick and simple. Select Process Update Form Boxes. W-2 Upload Frequently Asked Questions.

The codes are defined on the IRS 1099 Form Box page where you can also add new 1099 codes. Updated W-21099 Upload Feature NOW LIVE on the Ohio Business Gateway. Microsoft Dynamics 365 Business Central 1099 Processing.

If its a corporation you can leave it blank. Before users submit their reporting for 2020 users must first upgrade their Business Central to. If you do business with vendors that are subject to United States US 1099 tax you must track the amount that you pay to each vendor and report that information to the US tax authorities at the end of the calendar year.

1099 Upload Frequently Asked Questions. The vendors are typically individuals who arent employees and who provide services to your organization. Dynamics 365 Business Central will record 1099 transactions so you can report them at the end of the year.

Microsoft has acknowledged a problem with the PREVIEW features of 1099 MISC and 1099 NEC forms in Dynamics 365 Business Central as of 1-26-2020. The problem occurs when you press the PREVIEW button on the 1099 Misc and 1099 NEC forms. To make the processing simpler we have provided the following information on how you can set up process and report 1099 information within Dynamics 365 Business Central.

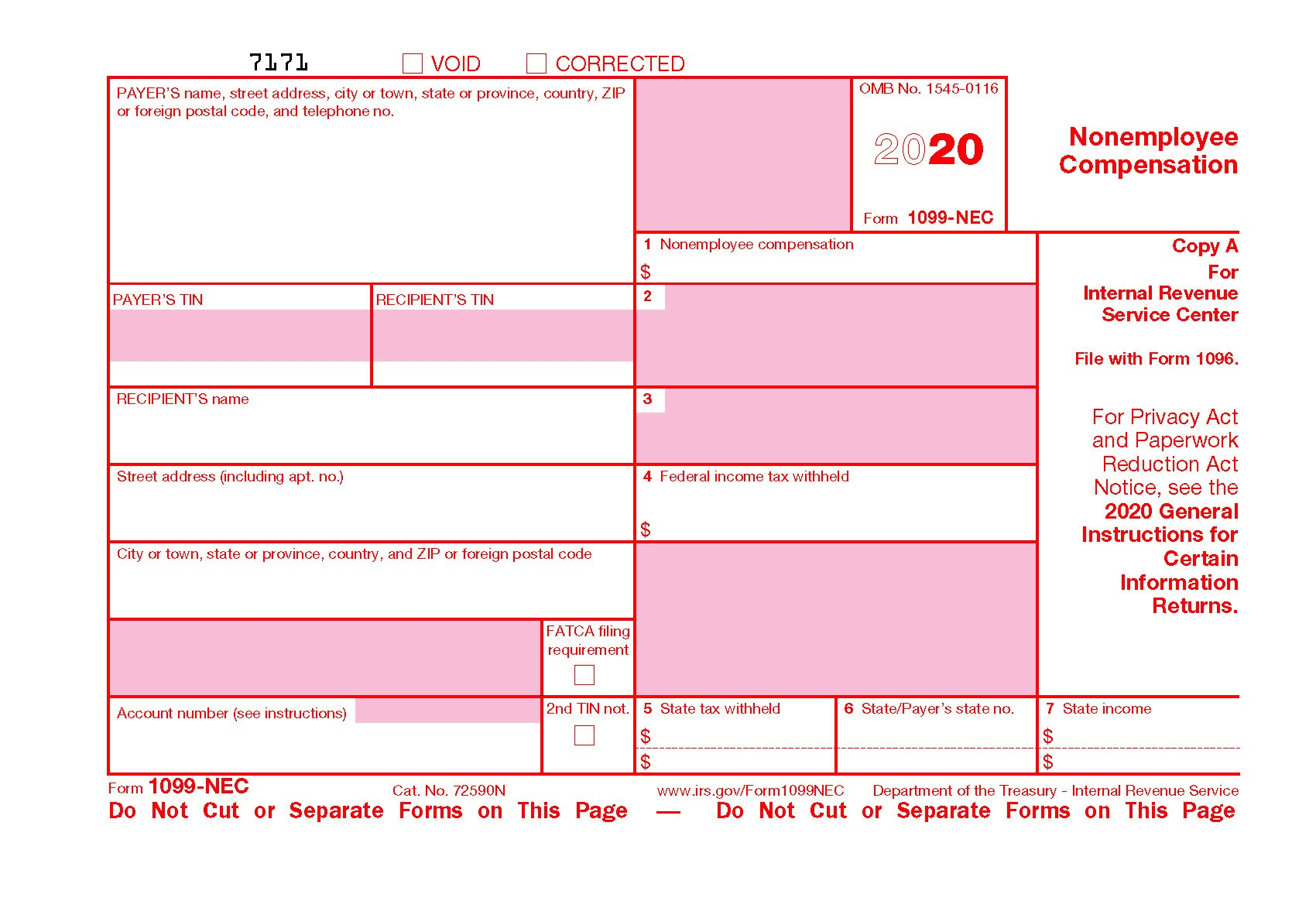

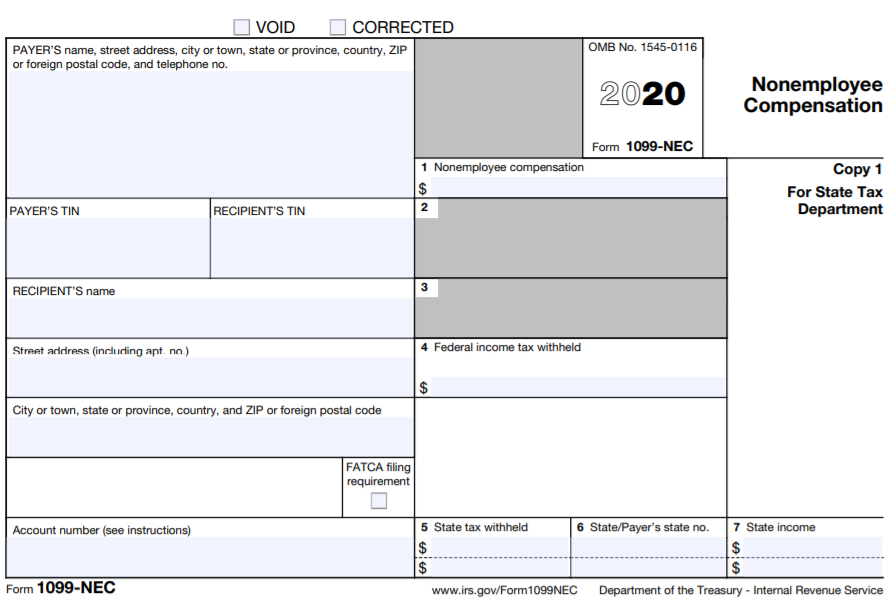

So if you have unsettledopen invoices that have 1099 codes and 1099 amounts they wont show up in the reports. Ohio Business Central 100 of all filings needed to start or maintain a business in Ohio may now be submitted online. Business Central has added new 1099 Form Box codes NEC-01 MISC-14 and a new Vendor 1099 NEC form all of which are relevant for the reporting year 2020.

The minimum reportable amount should match up to the IRS threshold on amounts of money that needs to be paid to a vendor in order for the vendors income to be reported. In Business Central the most common 1099 codes are already set up for you so you are ready to generate the required reports. 1099 reports will show data if the invoice that has a 1099 amount 1099 form box code as well was settled with a payment.

In the Global Search enter 1099 Form Boxes and select the option in red. According to BWC the forms will be mailed to employers in March 2021 at the latest and BWC will make every effort to issue them as soon as it is possible to do so they are still in the process of collecting W-9s from employers. Hope that helps everyone facing this problem.

Local business address if different from mailing address. You can specify the correct 1099 code on the Payments FastTab on the Vendor card in BC. Only the settled invoices with 1099 will show up.

Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. Business Central supports the new 1099 changes and we have provided the steps below on how you can update the forms. Also you will need to add in their Tax ID and Federal ID No.

But it will only record them if you have them set as a 1099 vendor. City of Columbus Income Tax. In this article we will understand about the update and How partners should apply this hotfix for customers using 1099 Form in.

With latest cumulative update Microsoft have released update for North America version which includes a Application change related to IRS 1099 Form. 1099 Codes Common 1099 codes are included within Business Central and can be used when generating your reports. This is a quick article about changes in IRS 1099 Form in Dynamics NAV and Business Central.

For example if only half of a 100 invoice is 1099able you can key in a two line purchase invoice 50 per line and only mark one of. Businesses are required to register with the Ohio Secretary of State to legally conduct business in the State of Ohio this is commonly called a business license. The 1099 Form Boxes window stores the Minimum Reportable amounts for 1099s to be printed.

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Red Flags For Job Searching On Craigslist Job Search Job Hunting Social Media Job Search

Red Flags For Job Searching On Craigslist Job Search Job Hunting Social Media Job Search

Forms And Associated Taxes For Independent Contractors Independent Contractor Contractors Internal Revenue Service

Forms And Associated Taxes For Independent Contractors Independent Contractor Contractors Internal Revenue Service

Irs Webinar For Small Business Tax Changes 2018 Tax Reform Basics For Small Businesses And Pass Through Entities Thursday Irs Taxes Income Tax Payroll Taxes

Irs Webinar For Small Business Tax Changes 2018 Tax Reform Basics For Small Businesses And Pass Through Entities Thursday Irs Taxes Income Tax Payroll Taxes

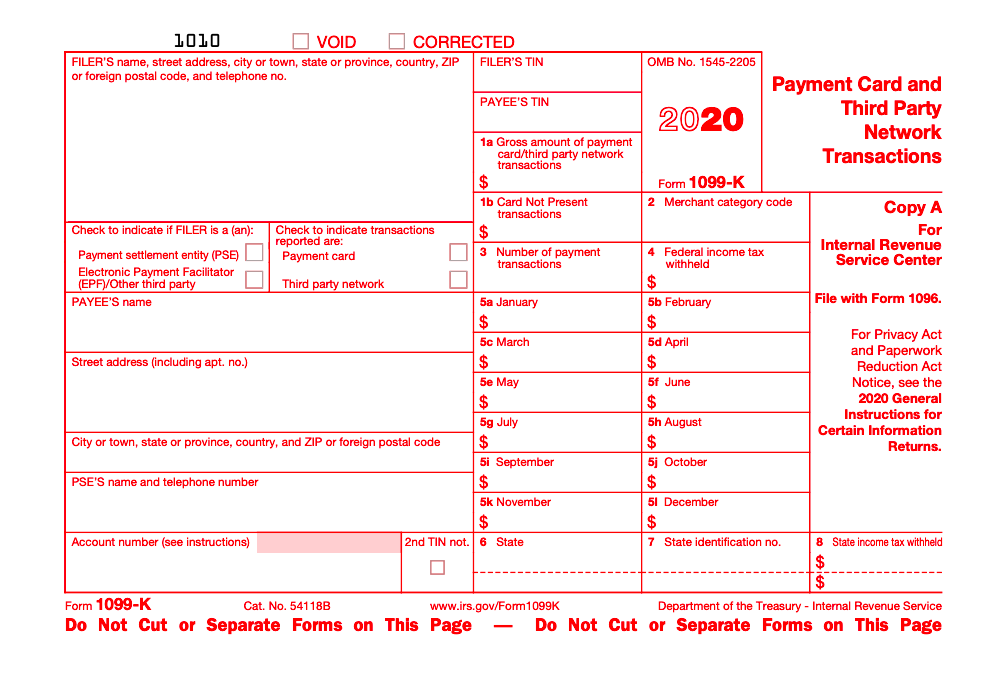

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

Tax Statements You Need To File Your 2020 Return Don T Mess With Taxes

New Irs Form 1099 Nec What It Means For Dynamics Gp Rsm Technology Blog

New Irs Form 1099 Nec What It Means For Dynamics Gp Rsm Technology Blog

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

We Have Many Years Of Experience In Evaluating Credit And Guiding Consumers To Assert Their Legal Righ Financial Services Quickbooks Training Quickbooks Online

We Have Many Years Of Experience In Evaluating Credit And Guiding Consumers To Assert Their Legal Righ Financial Services Quickbooks Training Quickbooks Online

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

Best 50 Online Job Search Websites Pouted Com Online Job Search Job Search Websites Online Job Websites

Best 50 Online Job Search Websites Pouted Com Online Job Search Job Search Websites Online Job Websites

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos Tax Forms 1099 Tax Form Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos Tax Forms 1099 Tax Form Irs Forms