Michigan Business Sales Tax Registration

Required to pay business taxes in Michigan. You must have your Federal EIN FEIN to register using this site.

How To Register For A Sales Tax Permit In Michigan Taxvalet

How To Register For A Sales Tax Permit In Michigan Taxvalet

Do not use your Social Security number as your FEIN number.

Michigan business sales tax registration. For more information regarding business taxes visit Treasurys Web www. You must enter a filing number. If mailing Form 518 allow 4-6 weeks for processing.

Instead file Form 2271 Concessionaires Sales. Form 518 can be downloaded from the Department of Treasury here. Michigan Department of Treasury.

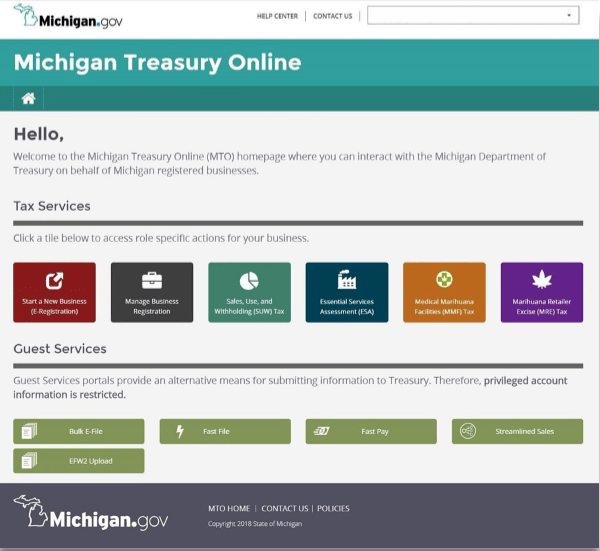

How to File and Pay Sales Tax in Michigan. The online application will open in a new tab or window on your web browser. Start a new business or reinstate an old business.

To register for Michigan business taxes you may either complete the online eRegistration process through MTO or mail Form 518 Registration for Michigan Taxes. The Michigan Department of Treasury offers an Online New Business Registration process. According to the state of Michigan anybody who sells tangible personal property in the state needs to register for a sales tax permit.

Change the type of ownership of your business eg from sole proprietorship to partnership or incorporate a sole proprietorship or partnership. In other words the Court upheld economic presence nexus for sales tax. Notice of New Sales Tax Requirements for Out-of-State Sellers.

While generally slower than applying online you can apply for a Michigan Sales Tax License for your business offline using Form 518 the Registration for Michigan Taxes. Employers may now register for most Michigan Business Taxes including UIA Employer Account Number and or a Sales Tax License using this on-line e-Registration application. Welcome to e-Registration for Michigan Taxes.

350000 with the exception of insurance companies and Complete this Registration Form if you. If your business collects less than 6250 in sales tax per month then your business should file returns on an annual basis. After completing the online application you will receive a confirmation number of your electronic submission.

You have three options for filing and paying your Michigan sales tax. This registration will also allow a business to register for their Employer Account Number. This process is easy fast secure and convenient.

On the MTO homepage click Start a New Business E-Registration to register the business with Treasury for Michigan taxes. Do not complete this Registration Form if you. File pay and manage your tax accounts online - anytime anywhere.

The Michigan Department of Treasury offers an Online New Business Registration process. How to register for a sales tax license in Michigan A sales tax license can be obtained by registering the E-Registration for Michigan T a xes or submitting Form 518. Display number of items to view.

How often you need to file depends upon the total amount of sales tax your business collects. Make sales at fewer than three events in Michigan during a calendar year. Mail Completed Form 518 To.

Need to register for any of the Michigan taxes listed below. All the information you need to file your Michigan sales tax return will be waiting for you in TaxJar. All you have to do is login.

Business registration cannot be done over the phone. If the business has a federal Employer Identification Number EIN the EIN will also be the Treasury business account number. Complete Treasurys registration application.

Treasury is committed to protecting sensitive taxpayer information while providing accessible and exceptional web services. Michigan Sales Tax License Retailers wholesalers selling tangible personal property some contractors and certain services in Michigan need a register for a Sales Tax License also called a Sales Tax Permit from the Michigan Department of Treasury. Register online at the Michigan Department of Treasurys Michigan Business One Stop Website.

ERegistration is authenticated within 10-15 minutes of application submission. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax. File online - File online at the Michigan Department of Treasury.

As a business owner selling taxable goods or services you act as an agent of the state of Michigan by collecting tax from purchasers and passing it along to the appropriate tax authority. Michigan Department of Treasury. This process is easy fast secure and convenient.

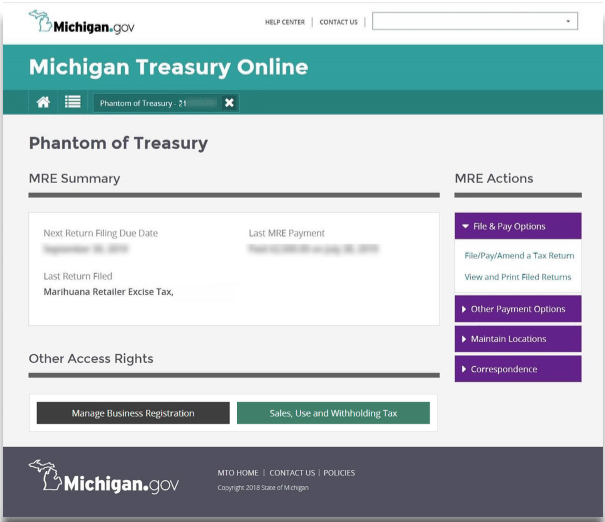

However as of March 2019 there are no local sales taxes in Michigan. How do you register for a sales tax permit in Michigan. MTO is the Michigan Department of Treasurys web portal to many business taxes.

Consistent with Wayfair effective after September 30 2018 Treasury will require remote sellers with sales exceeding 100000 to or more than 200 transactions with purchasers in Michigan in the previous calendar year to pay sales tax. You can remit your payment through their online system. The e-Registration process is much faster than registering by mail.

Welcome to Michigan Treasury Online MTO. This e-Registration process is much faster than registering by mail. After completing this on-line application you will receive a confirmation number of your electronic submission.

Streamlined Sales and Use Tax Project.

Taxes Getting Familiar With Michigan Treasury Online Mto

Taxes Getting Familiar With Michigan Treasury Online Mto

Stumped How To Form A Michigan Llc The Easy Way

Https Www Michigan Gov Documents Taxes Mto Optimization Learning Series 6 Fast File Now Function 510255 7 Pdf

Https Www Michigan Gov Documents Taxes Access Mto 3 Register Your Business With Treasury 651751 7 Pdf

Https Www Michigan Gov Documents Taxes Mto Optimization Learning Series 4 Manage Business Account Functions 510252 7 Pdf

How To Register For A Sales Tax Permit In Michigan Taxvalet

How To Register For A Sales Tax Permit In Michigan Taxvalet

Https Www Michigan Gov Documents Taxes Mto Optimization Learning Series 4 Manage Business Account Functions 510252 7 Pdf

Taxes Getting Familiar With Michigan Treasury Online Mto

Taxes Getting Familiar With Michigan Treasury Online Mto

How To Register For A Sales Tax Permit In Michigan Taxvalet

How To Register For A Sales Tax Permit In Michigan Taxvalet

Taxes Getting Familiar With Michigan Treasury Online Mto

Taxes Getting Familiar With Michigan Treasury Online Mto

How To Search Available Business Names In Michigan Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

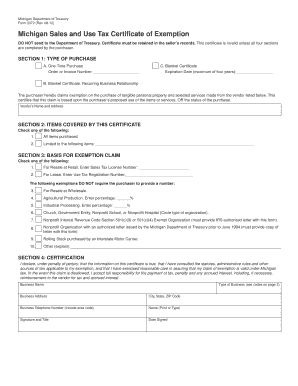

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Https Www Michigan Gov Documents Taxes Mto Optimization Learning Series 4 Manage Business Account Functions 510252 7 Pdf

Https Www Michigan Gov Documents Treasury Treasury Update June 2020 694075 7 Pdf

Https Www Michigan Gov Documents Taxes Access Mto 3 Register Your Business With Treasury 651751 7 Pdf

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller