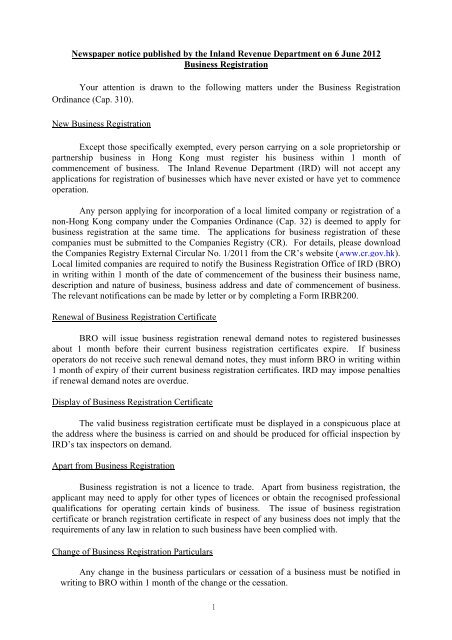

Ird Application For Business Registration

File a VAT return. Doing Business with the City Columbus Vendor Services is an eGov initiative made possible through a collaboration of the City Auditors Office the Department of Finance Management - Purchasing Office and the Mayors Office - Equal Business Opportunity Commission Office.

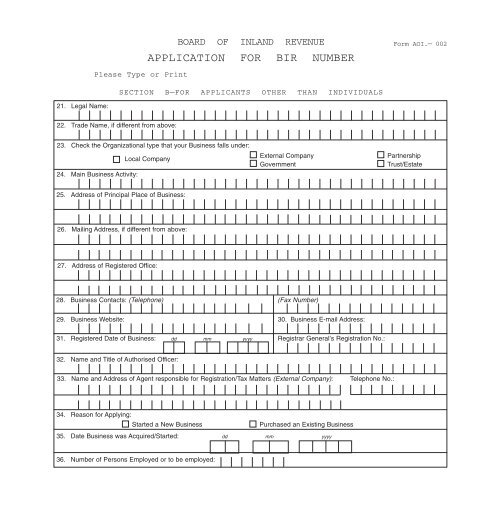

Form Aoi Section B Inland Revenue Division

Form Aoi Section B Inland Revenue Division

Service Hours of Business Registration Office.

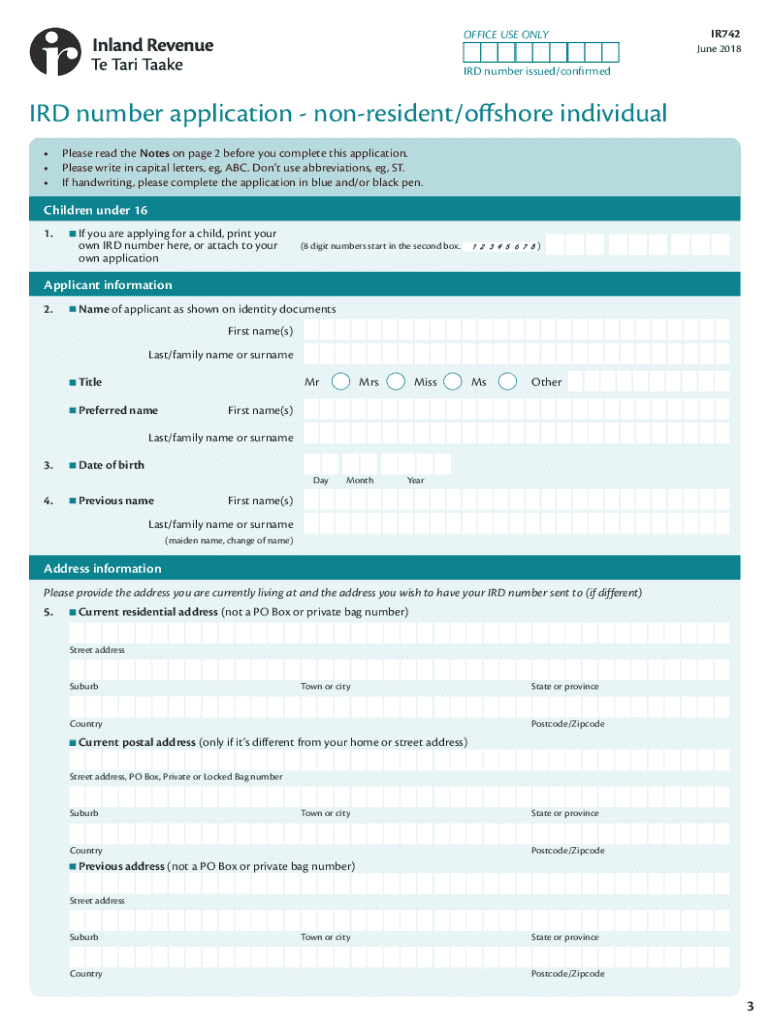

Ird application for business registration. Valid Business Registration Certificate. We recommend you check out the businessgovtnz website and also get advice from an accountant lawyer tax agent or business advisor. Apply online and then go to an AA driver licensing agent Use the following steps to help you get all of your documents ready to apply online.

Session 1 or before 500 pm. These instructions are for New Zealand resident companies partnerships superannuation schemes Māori authorities estates or trusts and clubs or. 2 rows Users should be aware that the information on the Business Register is for reference only.

The application forms will be sent to you by post. Once your business licence application has been approved make the payment online through the account you created or at any Royal Bank of Canada branch. How to Obtain Business Registration Application Forms e-mail to taxbroirdgovhk complete the form IRBR194 or request in writing by post or by fax 2824 1482 to the Business Registration Office.

For example if you apply for business registration on 15 May 2015 and you wish to apply for exemption from payment of business. Once youve applied make sure you take your identification documents to an AA driver licensing agent. Business Required to be Registered and Application for Business Registration.

Each partner in the partnership also needs a personal IRD number. Register create an account and submit your business licence application. Apart from Business Registration.

Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax. A company has its own IRD number and must be registered at the Companies Office. Apply for an IRD number for an offshore non-incorporated partnership joint venture or look-through company.

Our Smart business guide - IR320 has a lot of information that will help you start a new business. Business and organisations Ngā pakihi me ngā whakahaere. Application made via GovHK must be made not later than 7 weeks after applying for the business registration.

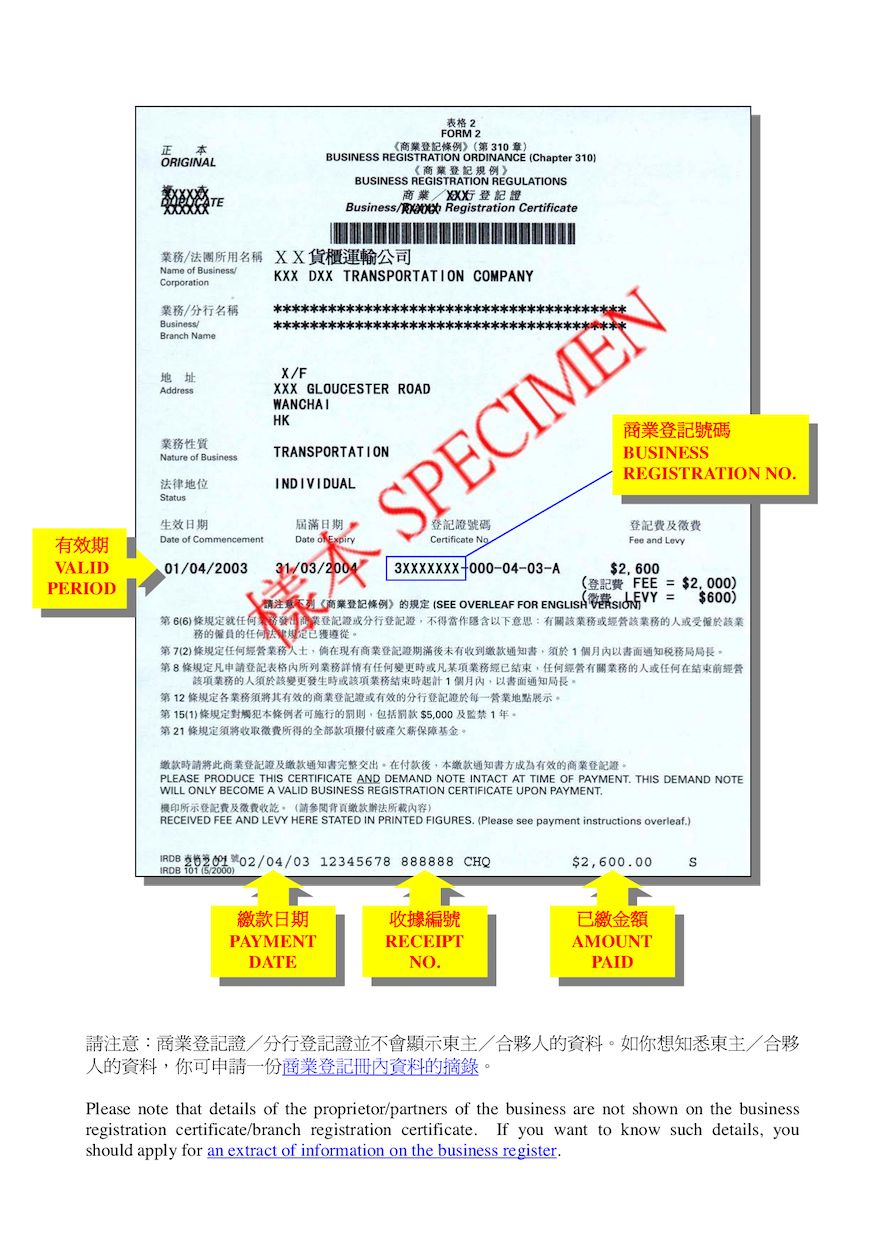

KiwiSaver for employers. Format of Business Registration Certificates Branch Registration Certificates and Renewal Notices. Renewal of Business Registration.

Goods and services tax GST Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha. IRD numbers Ngā tau IRD. Highlighted below are two important.

New Business Registration Application Counter. Your relationship to the entity. One-stop Company and Business Registration.

Your date of birth. If the IRD number is 8 digits long you will need to add a 0 to the start of it. Remit the Net VAT collected to the Cashiers Unit Inland Revenue Division.

Lose his or her driver license until requirements are met on first offense and ONE YEAR on second offense and TWO YEARS on additional offenses Lose his or her license plates and vehicle registration Pay reinstatement fees of 10000 first offense 30000 second offense and 60000 any additional offense Pay a 5000 penalty for any failure to. For new businesses application for exemption submitted in person or by post must be made not later than 1 month after applying for the business registration. Income tax Tāke moni whiwhi mō ngā pakihi.

Vendor Services provides a one-stop twenty-four hour portal for vendor services and contract information. Under the Ohio Unemployment Compensation Law most employers are liable to pay Unemployment Compensation taxes and report wages paid to their employees on a quarterly basis. The Value Added Tax Act 3789 requires most businesses and many organizations in Trinidad and Tobago to.

They need to verify your. Your entity can be a company trust partnership school society or club. Collect tax at twelve and a half per cent 125 on supply of goods and prescribed services.

Your IRD number or customer identifier. A self-employed contractor uses their own IRD number for their business. Please allow 2-3 business days for payments made at RBC Download and print your approved business licence for display.

Business Registration Certificates for 3 Years. Session 2 for processing instantly. A partnership needs a separate IRD number.

Register with the VAT Administration Centre. Employer Registration Congratulations on starting a business in the greatstate of Ohio. As the applicant has to pay the fee and collect the business registration certificate on the same date please submit your properly completed application to counter staff before 1230 pm.

Ministry Of Finance Inland Revenue Division

Ministry Of Finance Inland Revenue Division

2018 2021 Form Nz Ir742 Fill Online Printable Fillable Blank Pdffiller

2018 2021 Form Nz Ir742 Fill Online Printable Fillable Blank Pdffiller

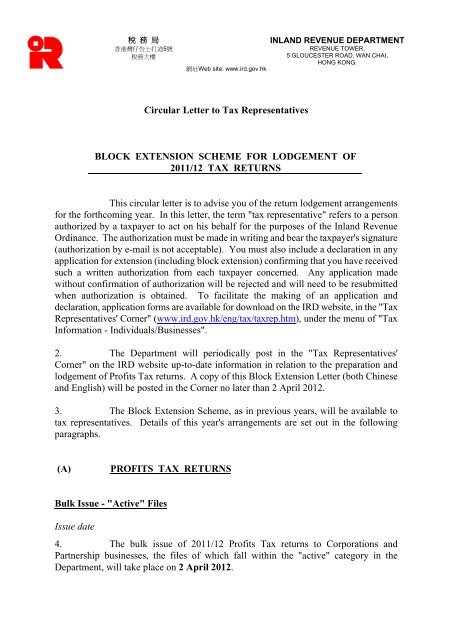

Circular Letter To Tax Representatives Block Extension Ird

Circular Letter To Tax Representatives Block Extension Ird

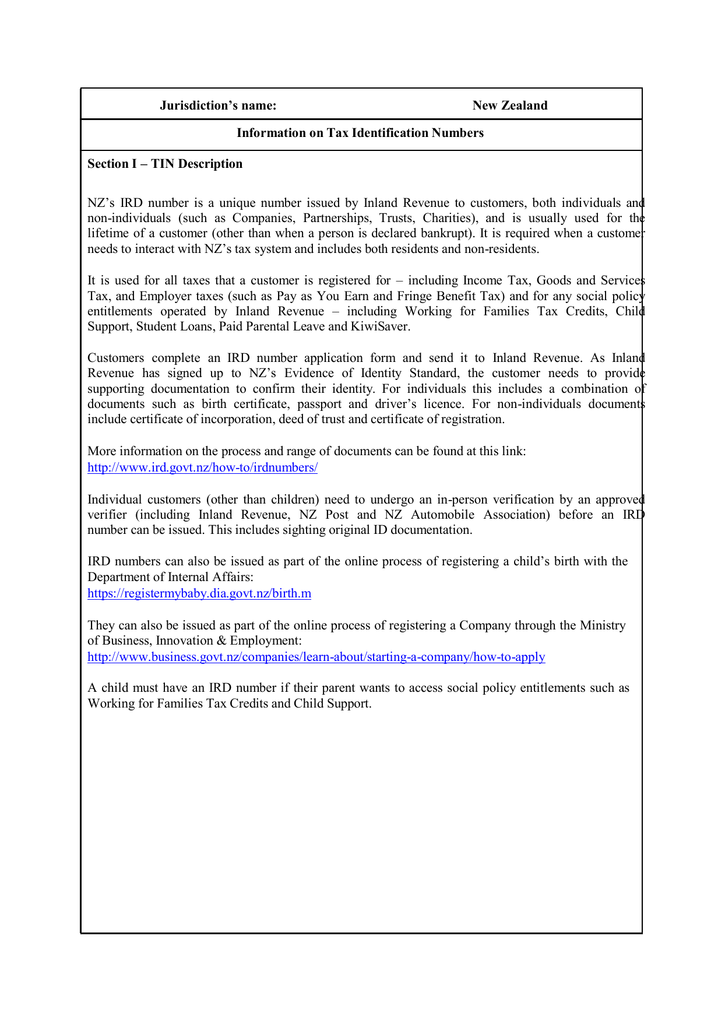

Jurisdiction S Name New Zealand Information On Tax Identification

Jurisdiction S Name New Zealand Information On Tax Identification

Business Registration Number In Hong Kong Definition Examples

Business Registration Number In Hong Kong Definition Examples

Tax Queries Miscellaneous Ird Tax Queries For Different Financial Issues Summary Hk Account Q A

Pin By Nakisha On Style Color Combinations Facilitation Where To Go 10 Things

Pin By Nakisha On Style Color Combinations Facilitation Where To Go 10 Things

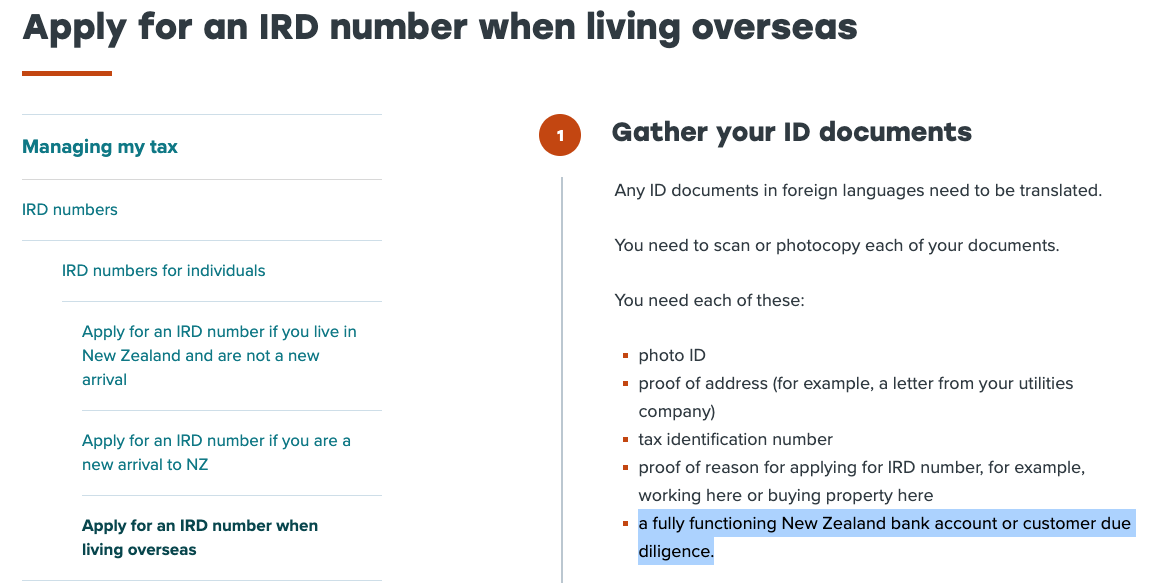

Buying A House In Nz While Living In Australia Catch 22 By Pete Lead Medium

Buying A House In Nz While Living In Australia Catch 22 By Pete Lead Medium

If You Are Looking Set Up Company In Hongkong Then We Will Solve Your Problem Online With Certificate Of Business Public Company Private Company Kong Company

If You Are Looking Set Up Company In Hongkong Then We Will Solve Your Problem Online With Certificate Of Business Public Company Private Company Kong Company

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers New 20zealand Tin Pdf

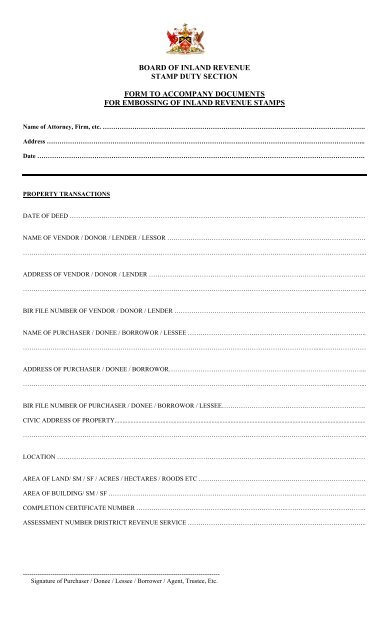

Board Of Inland Revenue Stamp Duty Section Form To Accompany

Board Of Inland Revenue Stamp Duty Section Form To Accompany

Statutory Provisions Of Taxation No 24 Of 2017 Inland Revenue Act

Statutory Provisions Of Taxation No 24 Of 2017 Inland Revenue Act

New Zealand Inland Revenue Tax Refund Phishing Scam Hoax Slayer

New Zealand Inland Revenue Tax Refund Phishing Scam Hoax Slayer

Gst Centre Invites Franchisees At Low Deposit And Low Cost Join With Gst Centre And Grow Together Starting Your Own Business Grow Together Knowledge

Gst Centre Invites Franchisees At Low Deposit And Low Cost Join With Gst Centre And Grow Together Starting Your Own Business Grow Together Knowledge

Drop Shipping Business To Niche Or Not To Niche Drop Shipping Business Dropshipping Business Tax

Drop Shipping Business To Niche Or Not To Niche Drop Shipping Business Dropshipping Business Tax

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers New 20zealand Tin Pdf

Guide To Corporate Income Tax Return Sri Lanka Inland Revenue

Guide To Corporate Income Tax Return Sri Lanka Inland Revenue