How To Track Small Business Loan From Government

Government will provide loans to small businesses including sole traders and the self-employed impacted by COVID-19 to support their cash flow needs. Applications have been extended and are now open until 31 December 2023.

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

Guide to Government Business Loans.

How to track small business loan from government. For COVID-19 government-backed business loans this guarantee is 50 of the funding amount. We support Americas small businesses. Select Settings then select Chart of Accounts.

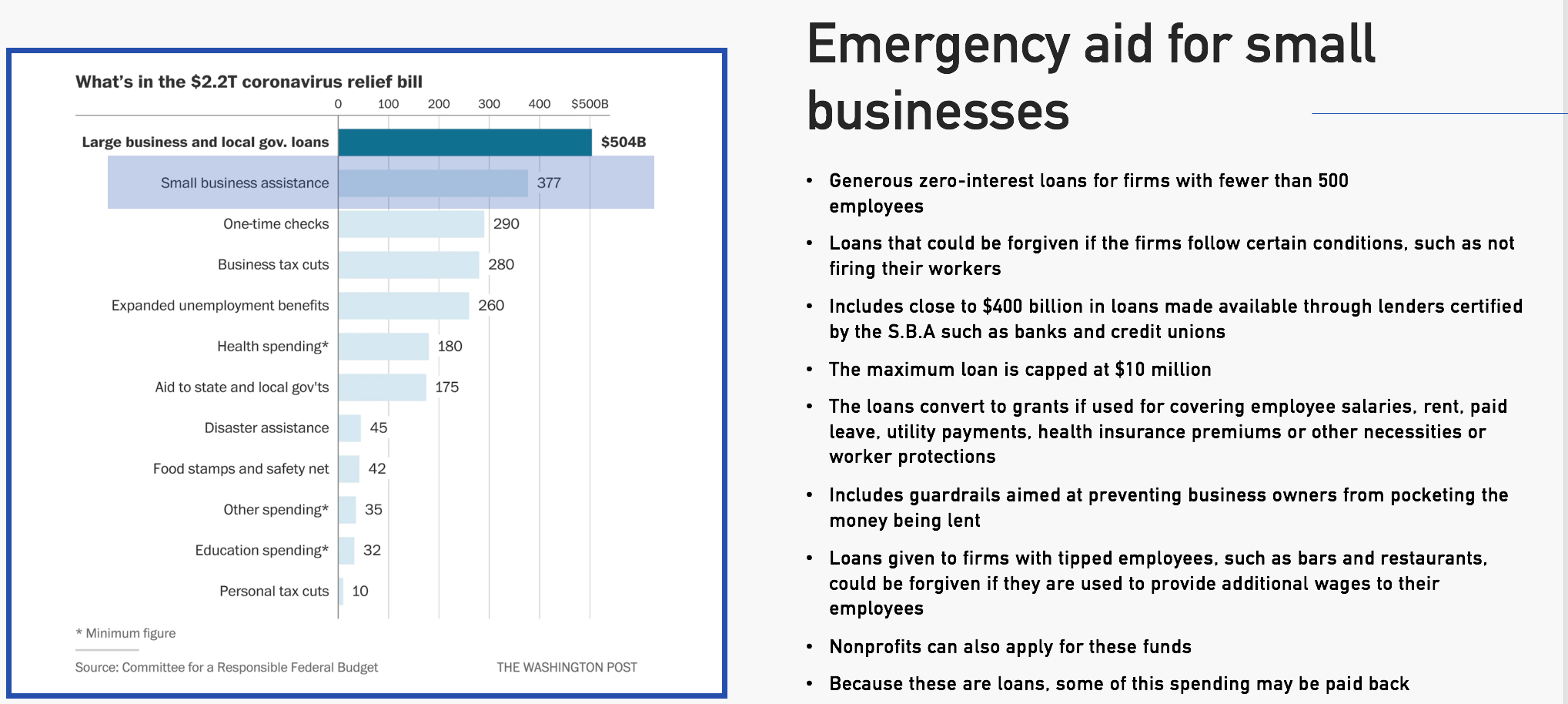

On February 22 2021 President Biden announced the following changes to SBAs COVID-19 relief programs to ensure equity. Governments Paycheck Protection Program PPP for small business coronavirus relief loans reopened on Monday for round two with a fresh 310 billion in the chamber after the first round ran through 349 billion in 13 days. Be sure to check out other loan options from the Small Business Administration SBA other federal loan programs and organizations and companies providing grant money.

Search for Government Loans. Specifically on February 24 2021 at 900 am. Applicants can check the status of their CEBA Loan online at httpsstatus-statutceba-cuecca.

Please wait 5 to 7 business days after finalizing your application before checking your loan status on this loan status website or with the call centre. Use Lender Match to find lenders that offer loans for your business. A government-backed business loan is a loan that the government provides a guarantee to the lender on.

First set up a liability account to record the loan. Established by the current government Micro Units Development and Refinance Agency MUDRA has envisioned the idea of funding the unfunded and put it into action with a funding scheme. GovLoansgov directs you to information on loans for agriculture business disaster relief education housing and for veterans.

57 rows Search more than 6 million loans approved by lenders and disclosed by the Small Business Administration. Use the federal governments free official website GovLoansgov rather than commercial sites that may charge a fee for information or application forms. From the Account Type drop-down menu select Long-Term Liabilities.

The most common program is the SBA loan program that offers small businesses long-term and low-interest financing than commercial. Launched on April 9 2020 CEBA provided a 40000 zero-interest partially forgivable loan to small businesses that experienced diminished revenues due to COVID-19 and faced ongoing non-deferrable costs such as rent utilities insurance taxes and. Small business entities and start-ups are.

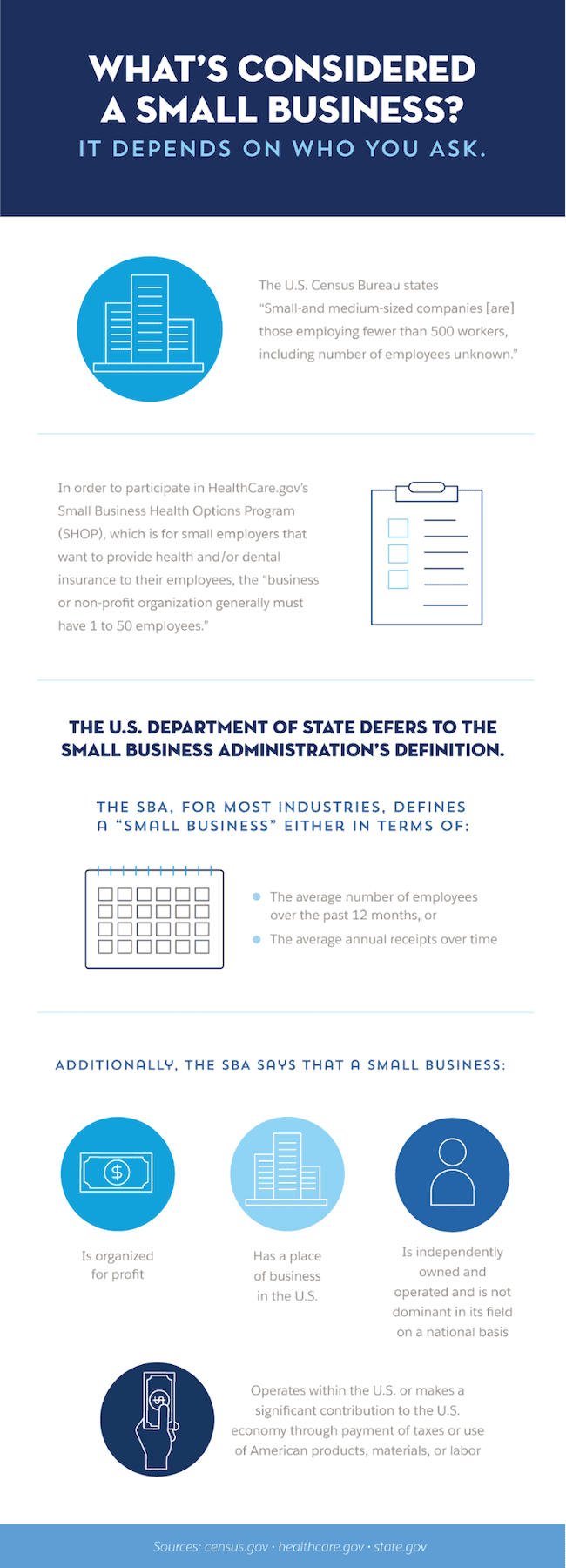

The second round of PPP expressly seeks to prevent publicly traded companies from applying after a number of large chains qualified the first time around. ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employeesThis gave lenders and community partners more time to work with the smallest businesses. So to track your loan application you just need to provide some basic information such as your full name registered mobile number PAN details date of birth loan reference number or application ID number.

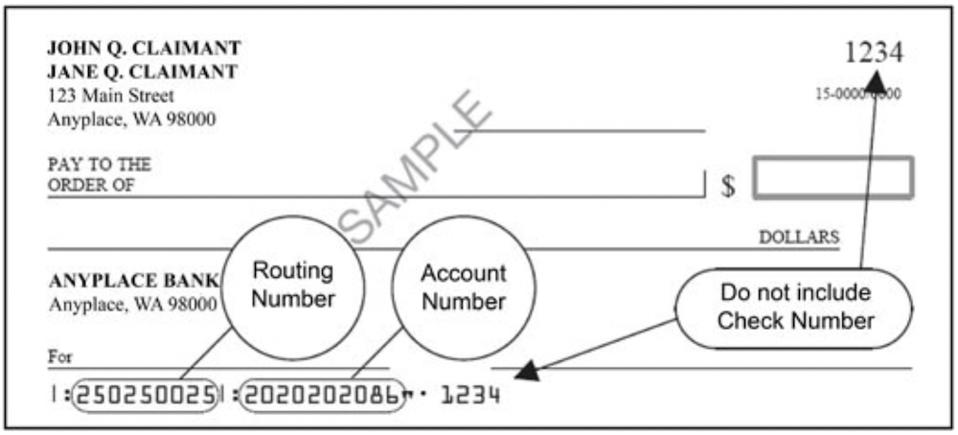

A Tracking application status via Net Banking If not yet registered with Net banking then it is advised to do it at the earliest. The 3508EZ and the. Contact your PPP lender and complete the correct form.

An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis. Your lender can provide you with either the SBA Form 3508 SBA Form 3508EZ SBA Form 3508S or a lender equivalent. Frequently Asked Questions As part of the Paycheck Protection Program the federal government has provided hundreds of billions in financial support to banks to make low-interest loans to companies and nonprofit organizations in.

Set up a liability account to record what you owe. Although the PPP has been the most popular loan program for small businesses it may not be the right solution for every business. Start or expand your business with loans guaranteed by the Small Business Administration.

The SBA connects entrepreneurs with lenders and funding to help them plan start and grow their business. Small businesses will benefit from a new fast-track finance scheme providing loans with a 100 government-backed guarantee for lenders the Chancellor announced today Monday 27 April. You can apply through myIR.

Select New to create a new account. As of December 1 2020 more than 793000 CEBA loans have been approved representing over 31 billion in funds. Small business loans.

If you try before the. Government doesnt do much direct lending but various government-supported programs are designed to offer small businesses access to affordable financing solutions.

Https Www Sba Gov Sites Default Files Resource Files Disaster Loan Overview Eidl Ppp Carl As Of August 10 2020 Pdf

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

The 57 People The Justice Department Charged With Trying To Steal Millions In Ppp Loans The Washington Post

The 57 People The Justice Department Charged With Trying To Steal Millions In Ppp Loans The Washington Post

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Sba Loan Phishing Abnormal Security

Https Www Sba Gov Sites Default Files Files Resourceguide 2822 Pdf

Sba Loan Phishing Abnormal Security

Small Business Definition What Is A Small Business Salesforce Com

Small Business Definition What Is A Small Business Salesforce Com

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

![]() Covid 19 Resources Harvard Square

Covid 19 Resources Harvard Square

Https Www Sba Gov Sites Default Files Files Resourceguide 3118 Pdf

Https Www Sba Gov Sites Default Files Files Resourceguide 2822 Pdf

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

Sba Opens Up New Grants And Loans For Small Businesses And Independent Contractors The Eidl Program

Sba Opens Up New Grants And Loans For Small Businesses And Independent Contractors The Eidl Program