How To Calculate Value Of Company Based On Revenue

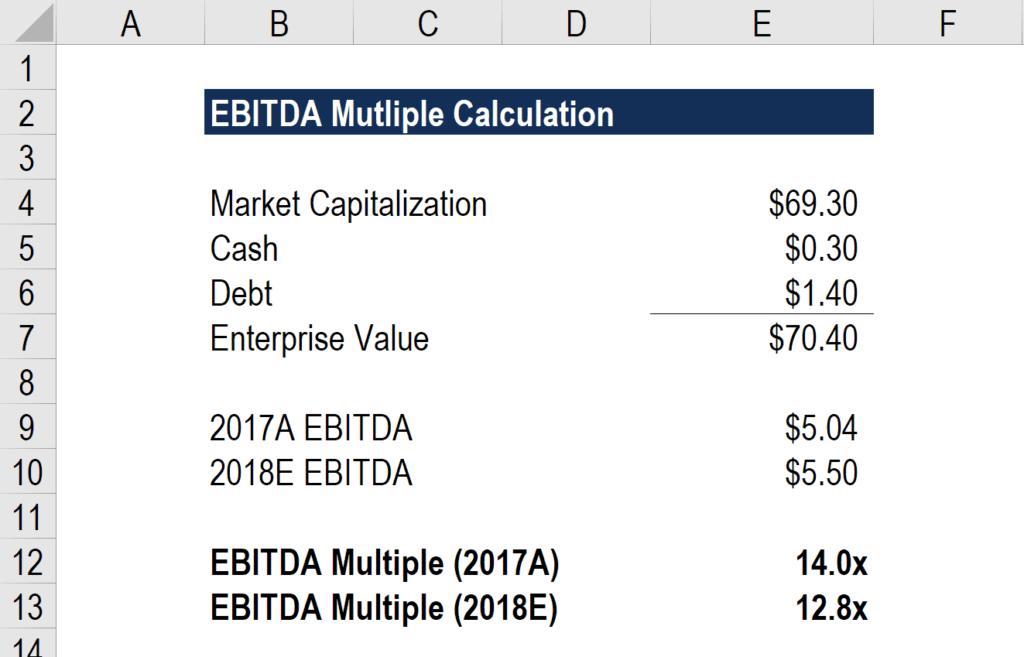

Total Sales Cost of Goods Sold Expenses Owners Wage TSDE your profit So when we say that a business was sold for a multiple of 244X for example it means that the amount paid for the business is a value of 244 times the profit. The enterprise value based on revenue is significantly lower than the enterprise value based on the EBITDA multiple.

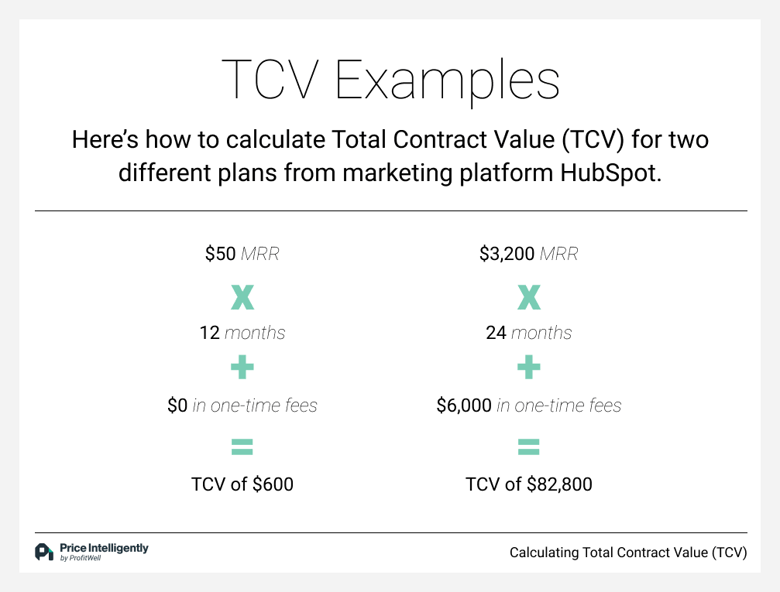

Total Contract Value Tcv Definition Importance How To Calculate

Total Contract Value Tcv Definition Importance How To Calculate

This is usually done with the EBITDA formula which calculates the value of the company based on its earnings before interest taxes depreciation and amortization.

How to calculate value of company based on revenue. EBITDA Net Profit Interest Taxes Depreciation Amortization. You will have to find out what the multiplier for that specific industry is and multiply the companys annual profit by that number to determine the value of the business. The times-revenue method is a valuation method used to determine the maximum value of a company.

Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for. For example a competitor has sales of 3000000 and is acquired for 1500000. This is a 05x sales multiple.

To value a company based on profit first you gather the profit multiple of similar public companies. Essentially a companys costs are subtracted from gross revenue to calculate net revenue. Revenue is the crudest approximation of a businesss worth.

Second calculate the average and the median profit multiple from the data you gathered. If you want to understand how to value a technology business the first question is whether to look at a multiple of SDE EBITDA or Revenue. This is the industry average youre going to use.

The Ultimate Guide for 2020. The pricesales ratio takes the current market capitalization of a. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings.

They value a business by trying to come up with a value for that stream of cash. Find Out Your SDE Multiplier. Stories of wildly high revenue multiples for unicorn SaaS businesses can seem at odds with the modest earnings multiples for smaller SaaS businesses which serves to confuse the information in the marketplace.

Compare the companys revenue to the sale prices of other similar companies that have sold recently. Calculate Sellers Discretionary Earnings SDE Most experts agree that the starting point for valuing a small business is to normalize or recast. Like EBITDA business owners calculate SDE to determine the true value of their business for a new owner so your SDE will include expenses like the income you report to the IRS non-cash expenseswhatever revenue your business actually generates.

The times-revenue method uses a multiple of current revenues to determine the ceiling or maximum. A steady stream of revenue and financial records make it easier to calculate the value of the business. In the example if a revenue multiple is used the value of the low margin business will be overstated and the value of the high margin business will be understated.

Add Business Assets Subtract Business Liabilities. You can also use the industry-based multiplier method based annual profits to determine the value of the business. It essentially separates sales from the cost of goods sold.

Using findings from a private companys closest public competitors you can determine its value by using the EBIDTA or enterprise value multiple. Use Profit Multiplier Method. How to Value a Business.

Revenue-based valuations are assessed using the pricesales ratio or PSR. Gross revenue is all income generated from sales without consideration for expenditures from any source.

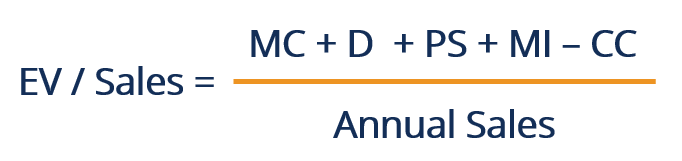

Enterprise Value To Sales Ev Sales Overview Calculation Example

Enterprise Value To Sales Ev Sales Overview Calculation Example

Calculate Website Traffic Worth Revenue And Page Views Website Traffic Website Value Website

Calculate Website Traffic Worth Revenue And Page Views Website Traffic Website Value Website

Monte Carlo Simulation Calculator For Startups Plan Projections Start Up Monte Carlo Business Planning

Monte Carlo Simulation Calculator For Startups Plan Projections Start Up Monte Carlo Business Planning

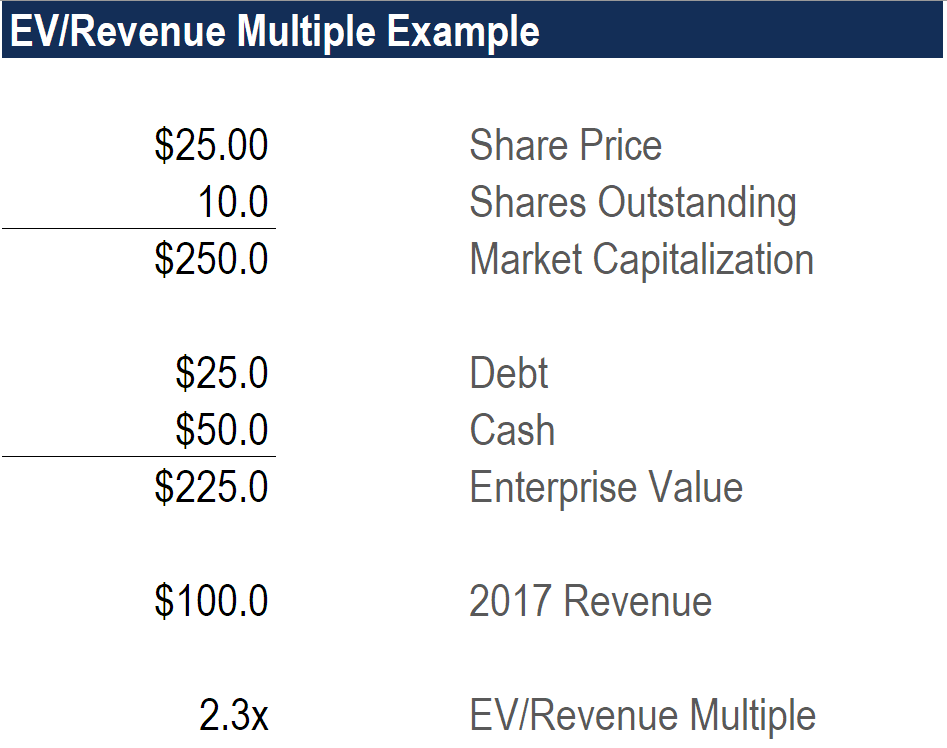

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

8 Online Revenue Model Options For Internet Businesses Smartinsights Com Revenue Model Online Business Marketing Internet Business

8 Online Revenue Model Options For Internet Businesses Smartinsights Com Revenue Model Online Business Marketing Internet Business

What Is Asset Turnover Ratio Asset Turnovers Make More Money

What Is Asset Turnover Ratio Asset Turnovers Make More Money

Working Capital Needs Calculator Plan Projections Business Planner Business Planning Finance Planner

Working Capital Needs Calculator Plan Projections Business Planner Business Planning Finance Planner

Saas Financial Model Template Efinancialmodels Unternehmensbewertung Finanzplanung Projektmanagement

Saas Financial Model Template Efinancialmodels Unternehmensbewertung Finanzplanung Projektmanagement

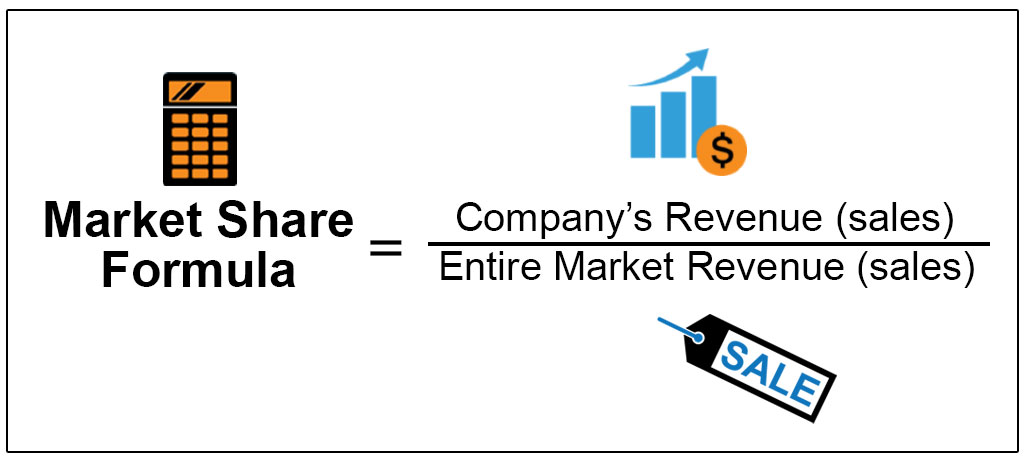

Market Share Formula Step By Step Calculation With Examples

Market Share Formula Step By Step Calculation With Examples

Revenue Definition Formula Example Role In Financial Statements

Revenue Definition Formula Example Role In Financial Statements

How Paas Companies Calculate Churn Ltv Examples From Uber Airbnb Plivo Growth Marketing Revenue Model How To Apply

How Paas Companies Calculate Churn Ltv Examples From Uber Airbnb Plivo Growth Marketing Revenue Model How To Apply

Website Value Calculator Website Value I Site Website

Website Value Calculator Website Value I Site Website

What Is A Business Model 54 Successful Types Of Business Models You Need To Know Fourweekmba In 2021 One Page Business Plan Revenue Model Business

What Is A Business Model 54 Successful Types Of Business Models You Need To Know Fourweekmba In 2021 One Page Business Plan Revenue Model Business

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Calculate Your Turnover Based On Ecommerce Sales Equation Use This Formula To Make Predictions To Your Onl Infographic Marketing Ecommerce Marketing Ecommerce

Calculate Your Turnover Based On Ecommerce Sales Equation Use This Formula To Make Predictions To Your Onl Infographic Marketing Ecommerce Marketing Ecommerce

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation

Hotel Valuation Financial Model Template Efinancialmodels Business Valuation Financial Modeling Cash Flow Statement

Hotel Valuation Financial Model Template Efinancialmodels Business Valuation Financial Modeling Cash Flow Statement

Pin On Business Plan Entrepreneurship

Pin On Business Plan Entrepreneurship

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation