Business Tax Registration Mn

Search by Business Name. Answer the questions about non-profit status and.

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Cigarette and Tobacco Taxes.

Business tax registration mn. To 4 pm MN Relay Service. A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. The Internal Revenue Service has determined that for each passenger vehicle cars and pickups registered in the appropriate tax year the registration tax minus 3500 can be deducted on itemized federal taxes.

Cookies are required to use this site. Monday through Friday Minnesota Department of Revenue Website. You should close tax accounts at the end of your filing cycles annually quarterly or monthly.

You can also email businessregistrationstatemnus or call 651-282-5225 or 1-800-657-3605 toll-free. You will be taxed at the standard rates for Minnesota state taxes and you will also get to apply regular allowances and deductions. Registration Tax Refer to.

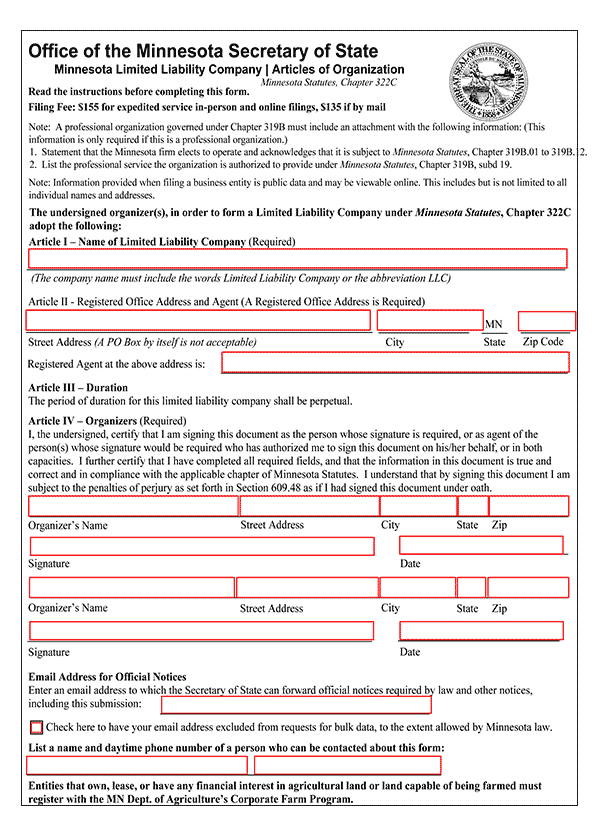

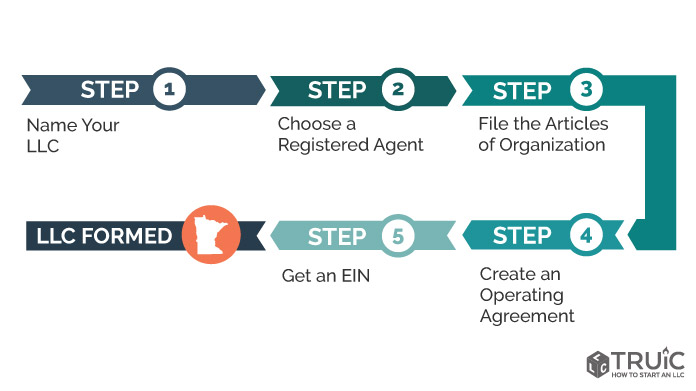

Go to the Business Filings Online page to get started. To close your business and all of your tax accounts through e-Services you must be an e-Services Master for. Minnesota Tax ID Requirements Minnesota Department of Revenue.

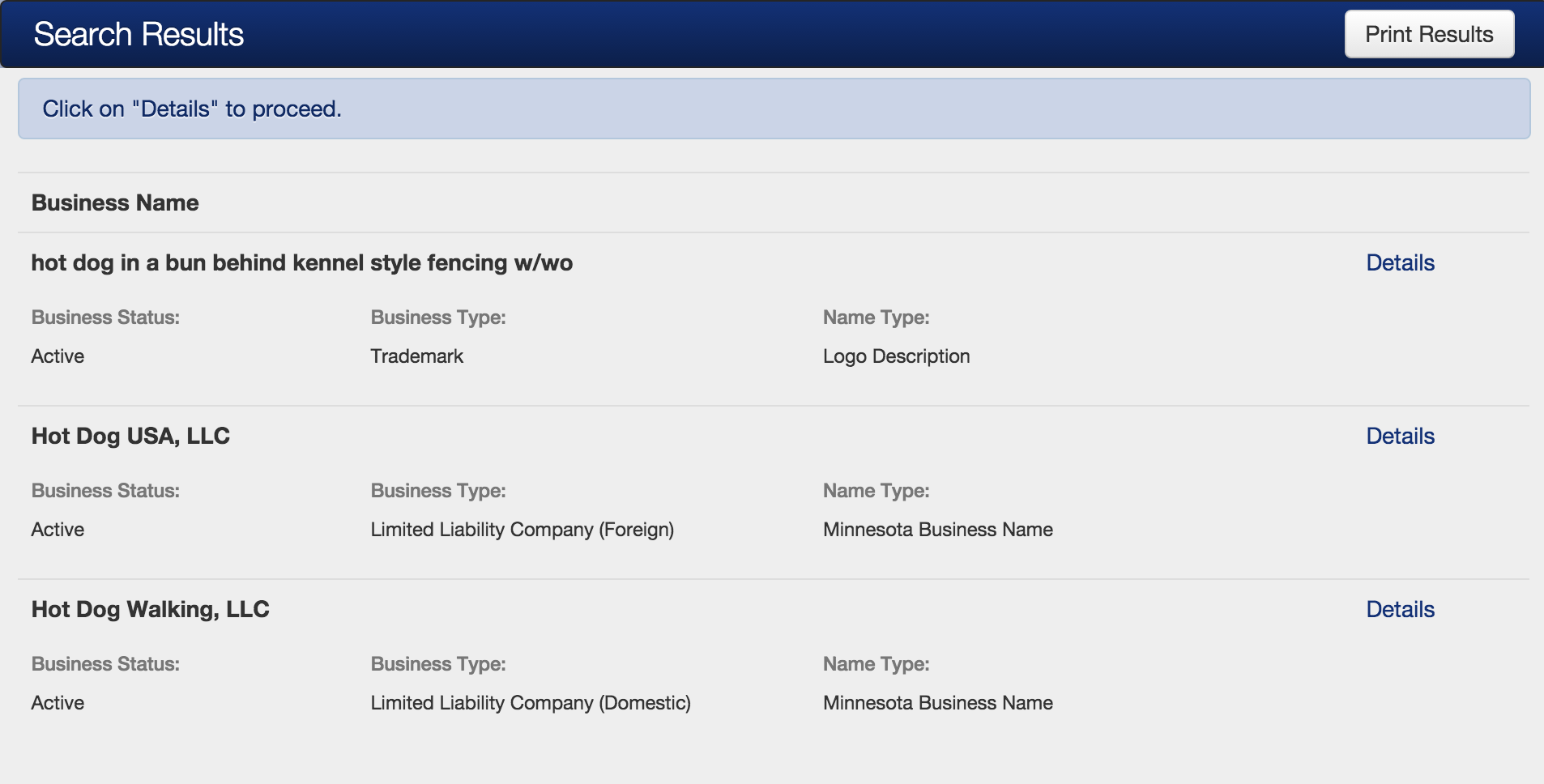

Tax Education for Businesses. The registration tax for passenger class vehicles cars vans and pickups rated at less than one-ton and one-ton passenger vans is determined by the vehicles base value and age. If you filed a Certificate of Assumed Name Minnesota Business Corporation Foreign Business or Non-Profit Corporation or a Cooperative Limited Liability Company Limited Liability Partnership or Limited Partnership you must file an annual renewal once every calendar year beginning in the calendar year following your original filing with the Secretary of State.

651-282-5225 or 1-800-657-3605 800 am. Registration should be done as soon as possible after the first wages are paid for covered employment in Minnesota. Your browser appears to have cookies disabled.

Get Directions Retirement Systems of Minnesota Building 60 Empire Dr Suite 100 Saint Paul MN 55103. Search by File Number. Create an online account with us and login.

Registering Your Business Minnesota Department of Revenue COVID-19 Penalty Relief. Registration must occur prior to the due date of the first quarterly wage detail report the employer is required to submit. Go to the Business Filings Online page and click on the business structure you would like for your business.

Business Taxes and Fees. Business Filing Certification Fee Schedule Business filings can be submitted by mail at our customer counter or in many cases online. Wwwrevenuestatemnus Business Education.

You may apply for a state tax ID number online with the Minnesota Department of Revenue at Business Registration by phone at 651-282-5225 or 800-657-3605 or by filing a paper form Application for Business Registration ABR. How do I close a business. Filings received by mail are processed non-expedited first infirst out and in most cases mailed back to the submitter.

As a Minnesota business owner you will need to pay MN state tax on any money you pay to yourself. Before you make any taxable sales in Minnesota you must register for a Minnesota Tax ID Number and a Sales and Use Tax account. If you need one you can apply through Business Tax Registration.

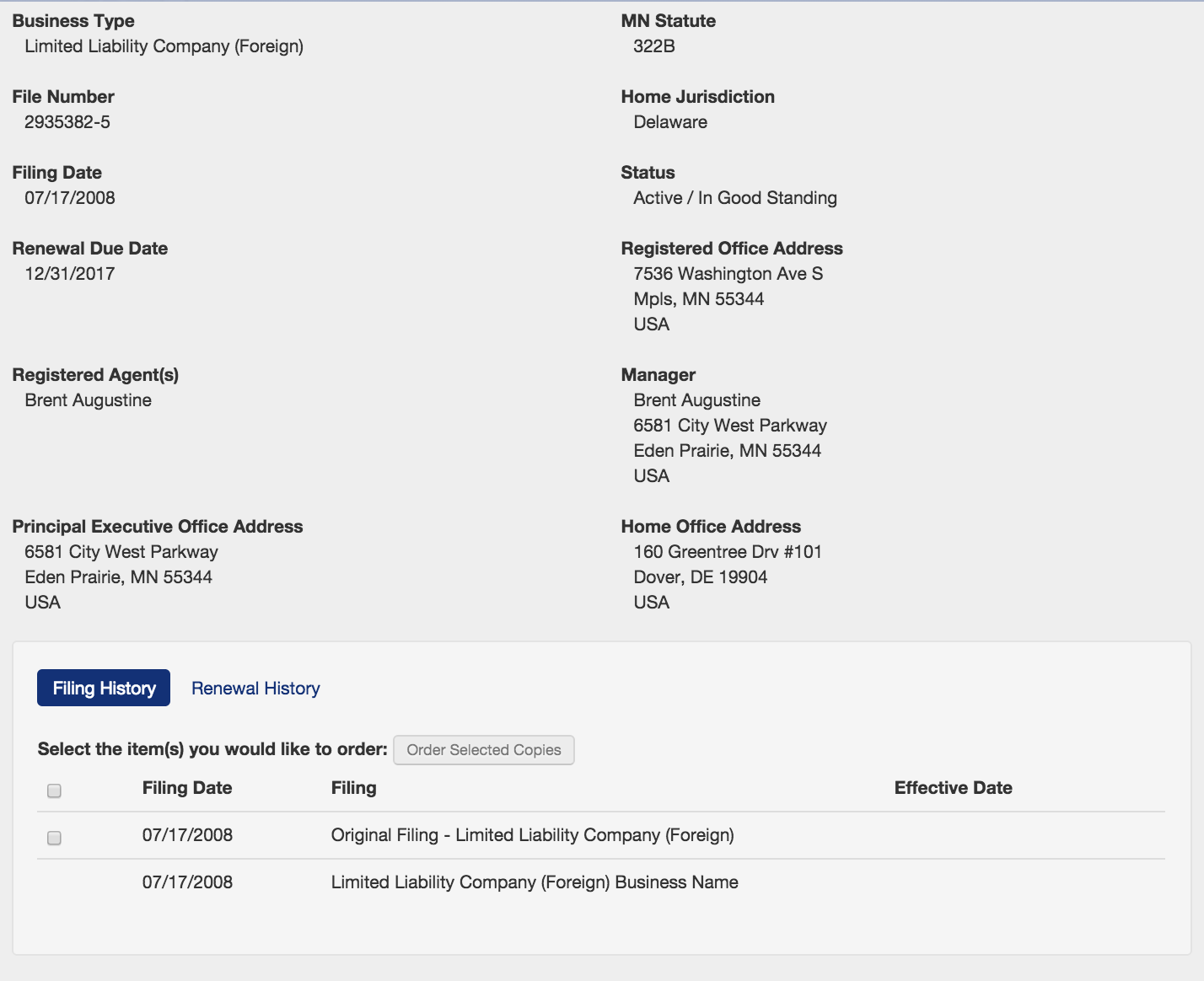

To search for a Business Filing. The Business Name should display under Search Results below the search box. Register for a Minnesota Tax ID Number.

Calculate Sales Tax Rate. These earnings flow through to your personal tax return which is where you will pay Minnesota income tax. This is commonly referred to as a sellers permit sales tax license sales tax number or sales tax registration.

If you have questions on other vehicles not shown or other general motor vehicleregistration questions please Contact. Minimum tax for vehicles 10 years old and older is 35. Here you can find more information about creating an online account.

How to Register for a Sales Tax Permit in Minnesota. Click File Number above the search box enter the file number and click Search. You may ask us to cancel or reduce filing or payment penalties if you have a reasonable cause or are negatively affected by the COVID-19 pandemic.

Tax is determined by registration class of vehicle. Most businesses starting in Minnesota selling a product or offering certain services will need to register for a sales tax permit. 651-297-4213 mdormbestatemnus Alcohol taxes.

Business Tax Account Management. Type the Business Name in the search box click Search. 651-556-3036 alctaxesstatemnus Cigarette and S.

You may download a copy of the Minnesota Motor Vehicle Tax Manual or you may purchase the Minnesota Motor Vehicle Tax Manual and Base Value Guides through the Minnesota.

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Incorporate In Minnesota Do Business The Right Way

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Llc Minnesota How To Form An Llc In Minnesota Truic Guides

Llc Minnesota How To Form An Llc In Minnesota Truic Guides

Https Www Revenue State Mn Us Sites Default Files 2020 01 Wholesale 20drug 20distributor 20tax 19 Pdf

Minnesota Business Entity Search Corporation Llc Partnerships Start Your Small Business Today

Minnesota Business Entity Search Corporation Llc Partnerships Start Your Small Business Today

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Https Www Revenue State Mn Us Sites Default Files 2019 09 Wh Inst 19 0 Pdf

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Stumped How To Form A Minnesota Llc The Easy Way

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Mn Dor St3 2019 2021 Fill Out Tax Template Online Us Legal Forms

Mn Dor St3 2019 2021 Fill Out Tax Template Online Us Legal Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Minnesota Business Entity Search Corporation Llc Partnerships Start Your Small Business Today

Minnesota Business Entity Search Corporation Llc Partnerships Start Your Small Business Today

How To Get A Certificate Of Exemption In Minnesota Startingyourbusiness Com

How To Get A Certificate Of Exemption In Minnesota Startingyourbusiness Com

Llc Minnesota How To Form An Llc In Minnesota Truic Guides

Llc Minnesota How To Form An Llc In Minnesota Truic Guides

Minnesota Llc Registered Agent Truic Guide

Minnesota Llc Registered Agent Truic Guide